The Q4 2024 crypto valuation surge saw the digital asset market cap surpass that of the global inflation-linked bond market.

Crypto Market Cap Dwarfs U.S. High-Yield Bond Market

The crypto market capitalization surged from $1 trillion to over $3 trillion in the last quarter of 2024, surpassing that of the global inflation-linked bond market, according to a Grayscale Research report. At one point, the crypto market cap was even twice the total market capitalization of the U.S. high-yield bond market.

However, according to report data, the crypto market capitalization was still significantly smaller than the global hedge fund industry or Japan’s approximately $4.5 trillion equity market. At the time of writing (Dec. 31, 2024), the crypto market cap stood at approximately $3.3 trillion.

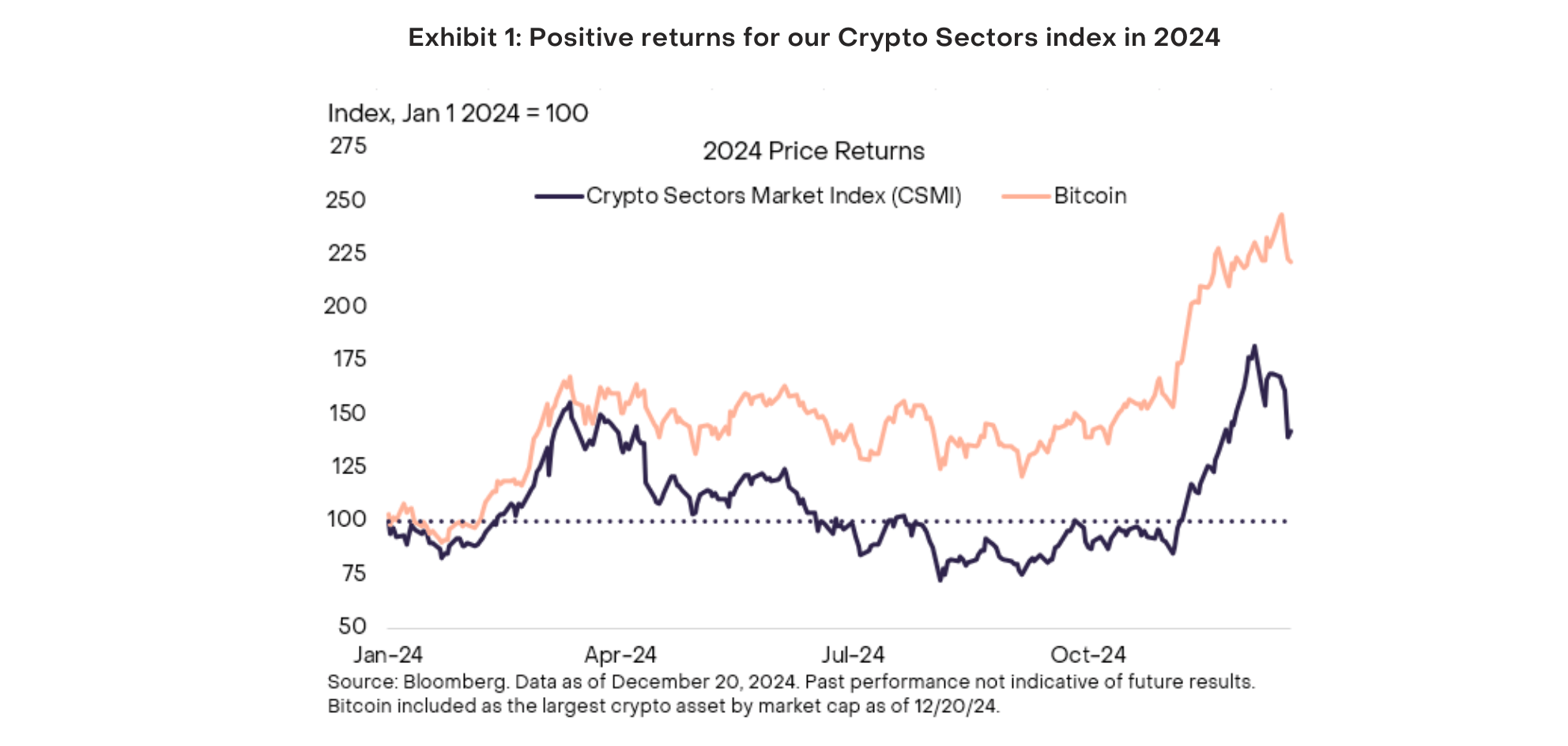

The fourth-quarter surge in crypto valuations is largely attributed to Donald Trump‘s election victory in November. As has been reported by Bitcoin.com News and other media platforms, bitcoin (BTC) surged more than 35% since Nov. 5, and some industry proponents predict the top crypto asset will rise to over $150,000 by the end of 2025.

Competition in the smart contract platform sector was particularly fierce during the quarter, with Ethereum and Solana emerging as dominant players. So-called high-performance blockchains also drew significant attention in this category.

“Investors also directed attention to other Layer 1 networks, including high-performance blockchains like Sui as well as TON, a blockchain integrated with the Telegram messaging platform,” the Grayscale Research report explained.

Despite increased competition, smart contract platforms face various design choices that impact network scalability, security, and decentralization. In turn, these specific design choices result in different block times, transaction throughput, and average transaction fees.

Meanwhile, the Grayscale report asserts that a statistical relationship exists between the smart contract platform’s fee revenue and market capitalization. In other words, the greater a network’s ability to generate fee revenue, the greater its ability to pass on value to the network in the form of token burns or staking rewards.

news.bitcoin.com

news.bitcoin.com