With bitcoin (BTC) cruising past the $100,000 mark and the crypto economy swelling dramatically in value this year, multiple sectors saw significant expansion. Stablecoins, a major player in the digital asset realm, now exceed $200 billion in total valuation, reflecting a $73 billion increase in this subset of fiat-pegged cryptocurrencies.

Stablecoins Flourish While Rankings Shift

Stablecoins are vital to the crypto world, offering users a way to trade for fiat alternatives without cashing out into traditional currencies. For example, when someone holds a stablecoin like tether ($USDT) or usd coin ($USDC), they expect its value to closely mirror the U.S. dollar, and it usually does.

At the start of 2024, the stablecoin market was valued at $131 billion. Today, data from coingecko.com and defillama.com indicates that the figure has climbed to $204 billion. Both sources are used to account for gold-backed stable assets listed by Coingecko.

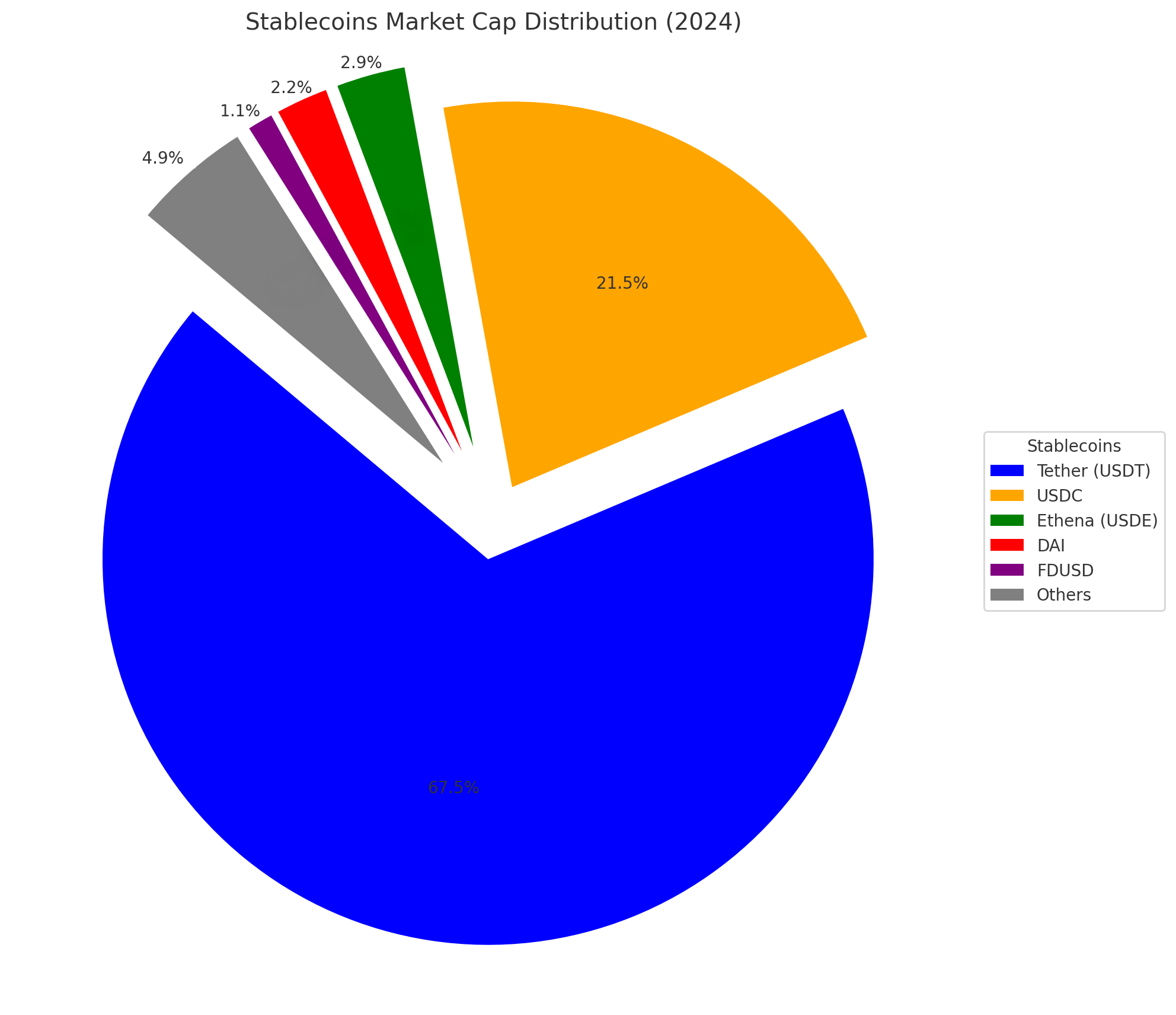

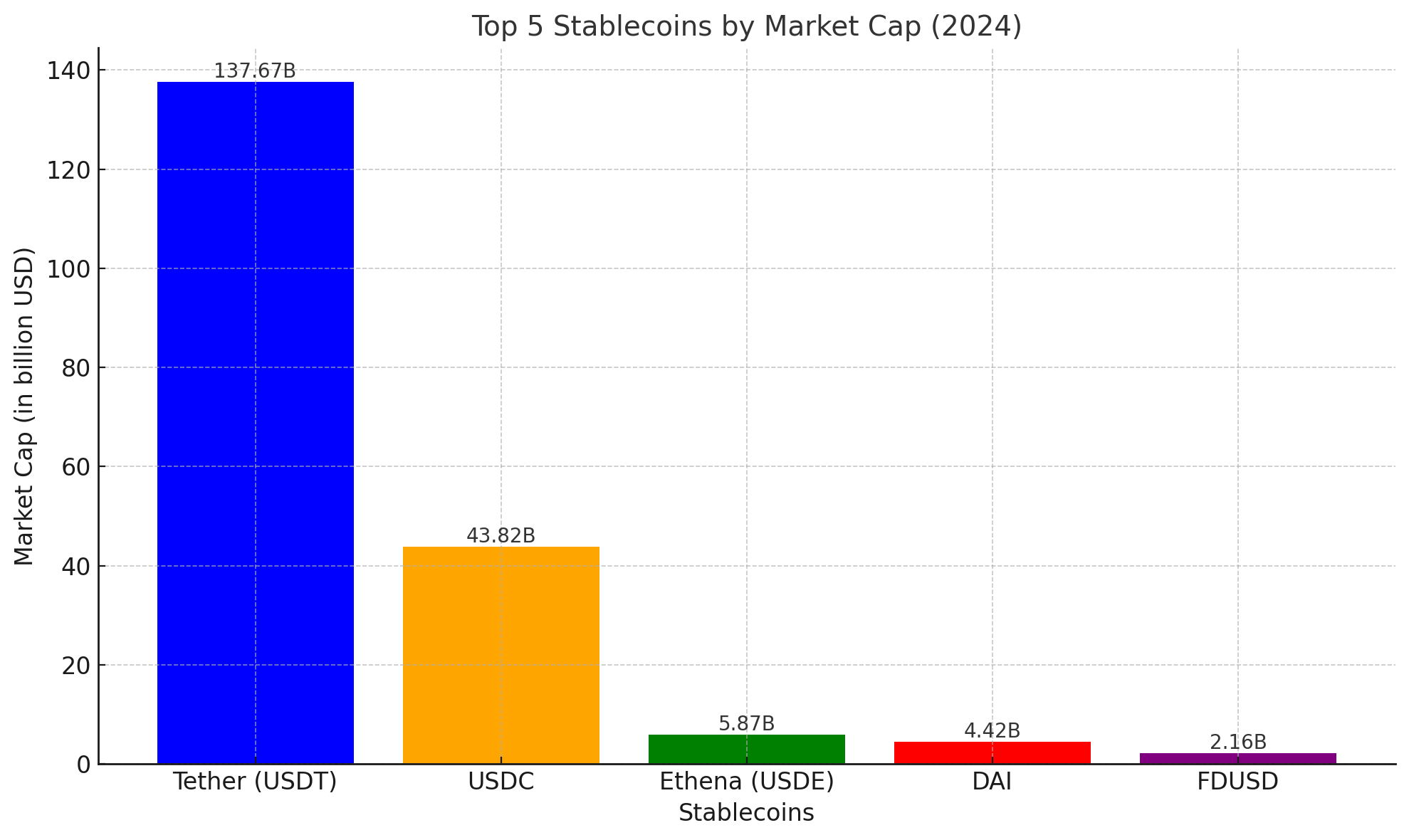

At the year’s onset, tether ($USDT) led the stablecoin pack with a market valuation of $91.78 billion. Fast forward to now, and its value has surged 50%, reaching $137.67 billion by the year’s end. Similarly, $USDC, issued by Circle, started the year at $24.71 billion and now boasts a $43.82 billion valuation.

Earlier in 2024, $DAI was the third largest stablecoin by market cap, but it has since dropped to fourth place. Back in January, $DAI held a market value of $5.24 billion, compared to today’s $4.42 billion. The dip is partly tied to Makerdao’s rebranding to Sky and the launch of USDS, which trades 1:1 for $DAI. Sky’s USDS enters 2025 as the seventh-largest stablecoin with a $1.26 billion valuation.

As we approach 2025, Ethena’s USDE takes the third spot among stablecoins, boasting a $5.867 billion market cap. This yield-bearing asset pegged to the U.S. dollar wasn’t even among the top stablecoins a year ago. Back then, trueusd (TUSD) held fourth place but has since fallen to 12th. First Digital’s FDUSD, fifth a year ago, holds steady in the same position today, with its market cap rising from $1.80 billion to $2.16 billion. Last year’s sixth-to-tenth ranking stablecoins—BUSD, $USDD, FRAX, USDP, and $PYUSD—have also shifted.

As 2025 begins, the sixth-to-tenth leaders in stablecoin market caps are now USD0, USDS, $USDD, $PYUSD, and USDX. The rapid growth of stablecoins reflects the increasing integration of digital assets into the global financial system. As adoption continues, these currencies have become an essential component for crypto users and investors seeking stability amid market fluctuations, signaling their growing influence within decentralized finance (defi) and beyond.

Looking ahead to 2025, the reshuffling among stablecoin rankings shows a dynamic market in constant evolution. With newer entrants like Ethena’s USDE gaining traction, traditional stablecoin dominance faces new challenges, making it clear that innovation remains a driving force in the sector’s expansion and future direction.

news.bitcoin.com

news.bitcoin.com