2025 will be the year of Altcoins. Altcoin season will make a HUGE comeback!

invezz.com

31 December 2024 16:49, UTC

invezz.com

31 December 2024 16:49, UTC

Arbitrum ($ARB) displays significant bearishness amid prolonged declines.

Faded profitability, dwindled market sentiments, and weak engagements position $ARB for more dips.

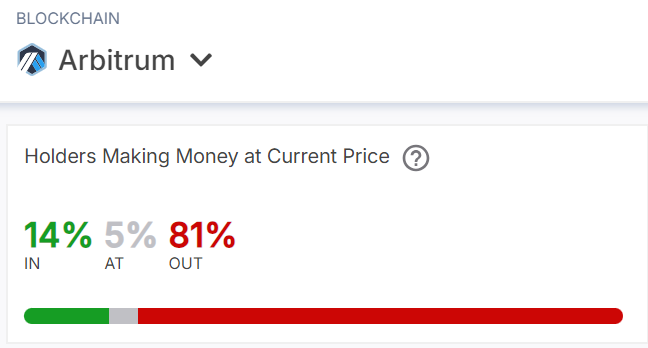

According to IntoTheBlock data, around 1.06 million $ARB addresses, representing 80.96% of holders, are “out of the Money.”

Meanwhile, 14.24% enjoy returns, while 4.8% (62.6K addresses) remain break-even.

That signals significant selling pressure, suggesting continued struggles for the altcoin.

Arbitrum’s prevailing outlook suggests a worrying scenario.

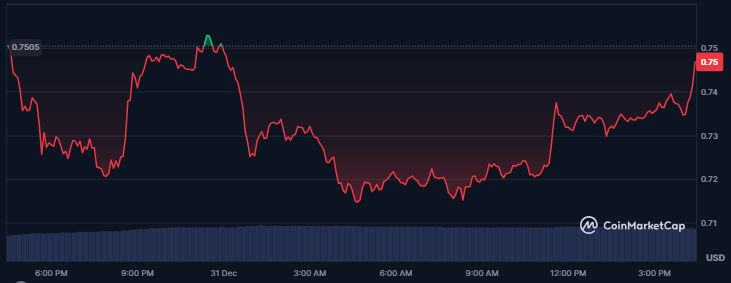

$ARB trades at $0.7486 after losing 2% and 6.55% in the past day and week.

On-chain data and technical indicators highlight further declines if bulls fail to reverse the trajectory quickly.

The daily chart shows $ARB’s latest underperformance breached a crucial demand territory.

That confirms magnified bearish activities, aligning with downtrends that began in November.

Continued dips will likely call for the support barrier at $0.65.

Such a slide will indicate faded buyer activity, which might accelerate Arbitrum’s declines.

Technical indicators support $ARB’s near-term downtrends.

The Relative Strength Index maintains visible downtrends, reading 39.68 at press time.

That leaves room for additional price declines before the RSI hits oversold territories below 30.

The Moving Average Convergence Divergence sways beneath the signal line on the 4H chart.

That highlights seller dominance in the marketplace.

Moreover, $ARB prices hover well beneath the vital 50-day and 200-day Exponential Moving Averages.

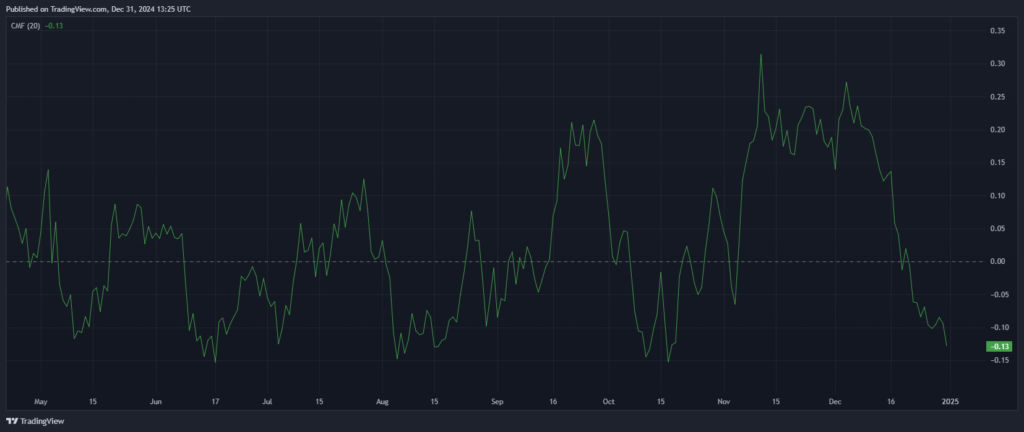

The Chaikin Money Flow, which measures capital flowing out and into an asset, has plunged from 0.27 on 4 December to -0.13 at press time.

Dwindled cash flow into the Arbitrum ecosystem signals distrust in the asset’s future potential.

Investors are likely to refrain from the project due to its extended struggles.

These indicators suggest $ARB could suffer persistent plunges until a massive buying volume resurgence.

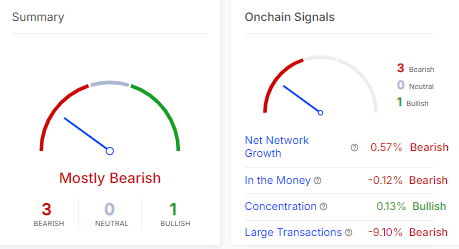

Furthermore, Arbitrum’s on-chain metrics reflect declined interest and activity.

A 0.57% dip in Net Network Growth highlights reduced adoptions within the blockchain.

A 9.10% plunge in large transactions confirms faded engagements despite concentration’s 0.13% increase.

Moreover, the “In the Money” indicator dipped by 0.12% amid struggling profitability.

Market sentiments affirm $ARB’s dire conditions. Its open interest plunged by over 3% to $166 million at press time (Coinglass stats).

The decline reflects reduced trader activity, with limited new positions executed.

In summary, Arbitrum’s prevailing outlook highlights seller dominance, translating to extended dips for the alt.

Factors such as dwindled profitability, faded user engagement, and massive bearish indicators confirm bearishness.

$ARB needs a colossal buyer comeback to offset its prevailing downtrends.

Meanwhile, the altcoin has mimicked broad market performance in the past sessions.

Thus, enthusiasts should follow crypto trends to determine $ARB’s trajectory in the coming times.

Analysts believe altcoins will skyrocket to record highs in 2025.

2025 will be the year of Altcoins. Altcoin season will make a HUGE comeback!

Broad-based recoveries will rescue Arbitrum from its bearish struggles.

The post Weak market sentiment leaves 80% of Arbitrum ($ARB) holders at a loss appeared first on Invezz