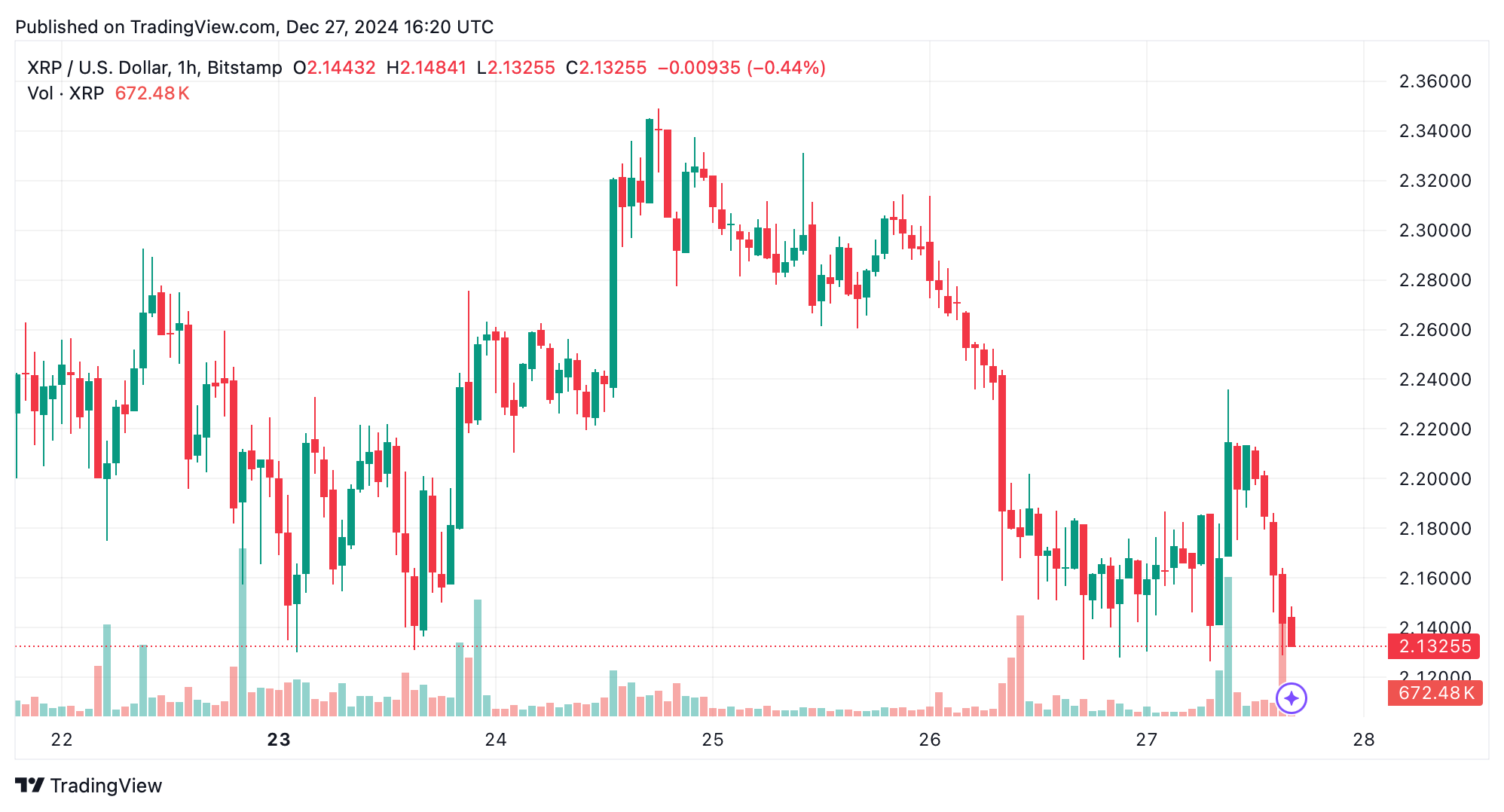

XRP’s price is currently chilling at $2.14, having dipped 1.1% in the last 24 hours. With a market cap of $123 billion, it ranks fourth behind tether (USDT), boasts a global trade volume of $5 billion, and has been bouncing between $2.13 and $2.23 today.

XRP

The daily chart reveals XRP is taking a breather after sprinting to $2.90 earlier this month. The relative strength index (RSI) is playing it cool at 48.99, showing neither buyers nor sellers are dominating. Both Momentum and the moving average convergence divergence (MACD) are waving red flags with bearish trends; Momentum gives a sell signal at -0.42651, and MACD at 0.08410. With trading volume on the decline, it’s clear the market’s taking a nap, with support hanging around $2.10 and resistance partying between $2.40 to $2.50.

On the 4-hour chart, XRP’s got the short-term blues, tracing lower highs and lows after not making it past $2.35. The exponential moving average (EMA-10) and simple moving average (SMA-10) are both showing bearish signals at $2.25029 and $2.24311. Keep an eye on support from $2.12 to $2.15 and resistance dancing at $2.25 to $2.30. Scalpers might spot a chance near $2.15, aiming for $2.25, but tread carefully; the market’s got some weight on it.

The 1-hour chart shows XRP’s stuck in a bit of a rut, with resistance at $2.18 to $2.20 and support at $2.12. Low volume whispers of a cautious mood. The awesome oscillator is just hanging out at 0.05520, while both the EMA (20) at $2.23286 and SMA (20) at $2.33407 are leaning toward the bears. A jump above $2.20 could set sights on $2.30, but only if volume decides to join the party.

Oscillators are mostly singing a neutral to bearish tune, with the commodity channel index (CCI) at -107.40505 and Stochastic at 30.90697. But, the simple moving average (SMA-50) and exponential moving average (EMA-50), at $1.79919 and $1.87019 respectively, are still cheering for the bulls. Even with short-term hiccups, the EMA (200) at $1.07240 suggests the long-term vibe is still upbeat.

Overall, XRP’s price action signals a market that’s playing it safe, with traders on the lookout for the next big move. Tight risk management is the name of the game here, as we navigate through this period of calm before the storm, or perhaps, the storm before the calm.

Bull Verdict:

XRP’s long-term moving averages, such as the exponential moving average (EMA) (200) at $1.07240, remain bullish, indicating broader upward momentum. If the price successfully breaks resistance at $2.20 with strong volume, it could target $2.30 and potentially retest $2.40, signaling a continuation of the recovery trend from earlier this month.

Bear Verdict:

Short-term indicators, including the moving average convergence divergence (MACD) at 0.08410 and the momentum (10) at -0.42651, suggest bearish pressure, while muted trading volume and repeated failures to break above $2.20 highlight selling dominance. If XRP breaks below $2.12, it may test the critical support at $2.10, potentially opening the door to further declines.

news.bitcoin.com

news.bitcoin.com