Ethena price retreated for three consecutive days as exchange balances continued rising and as whales sold their tokens.

Ethena ($ENA) token dropped to $0.95, moving below the psychologically important level of $1 for the first time since Dec. 20.

The ongoing crash is caused by the risk-off sentiment in the crypto industry, which has caused Bitcoin (BTC) and other prices to be lower.

It also happened as on-chain data showed that whales were selling their tokens. The biggest transaction occurred when a whale sent 11.6 million $ENA tokens worth $11 million to Binance, the biggest crypto exchange. In another transaction, one trader moved $ENA tokens valued at $10.7 million to the Binance.

Ethena whales dumped tokens worth $30 million on Thursday, Dec. 26. These sales happened a week after Arthur Hayes, Bitmex founder and earlier investor, sold some of his $ENA tokens. According to Nansen, Hayes now owns 18,616 coins valued at $17,458.

Ethena price also fell as tokens on exchanges continued rising, a popular bearish view. These tokens increased by 5.82% in the last seven days to over 730.27 million. Total supply on exchanges moved to 4.87%, up by 0.27% a week ago.

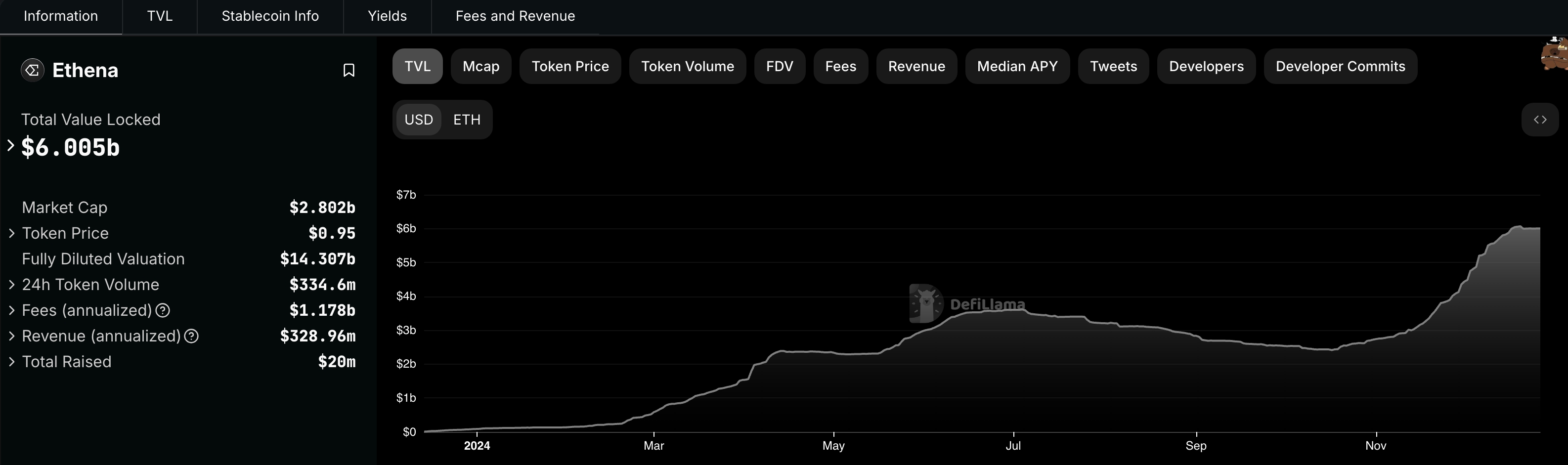

Meanwhile, inflows into Ethena’s $USDe stablecoin have stalled. The coin has a market cap of $6 billion, where it has been in the past few days, a sign of sluggish demand.

Ethena price analysis

Technicals suggest that Ethena may have more downward to go as it has formed a head and shoulders pattern on the four-hour chart. This pattern comprises a neckline, which is at $0.8552, two shoulders, and a head. In most periods, the pattern leads to a strong downward momentum when it moves below the neckline.

Ethena has also moved to the 38.2% Fibonacci Retracement level and slipped below the 50-period moving average. It also fell below the strong pivot reverse level of the Murrey Math Lines.

Therefore, the token will likely continue falling, with the immediate target being the H&S’s neckline at $0.8552. A drop below that level will point to more downside, potentially to the extremely oversold level of $0.5860.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.