The cryptocurrency world is buzzing, and $XRP is right in the middle of it! Some believe it could crash to zero, while others think it might soar to a new all-time high. With so much uncertainty, it’s hard to tell what’s next for $XRP. In this $XRP price prediction article, we’ll break down the key factors driving $XRP’s price, the challenges it faces, and what the future might hold for this popular cryptocurrency.

How has the $XRP Price Moved Recently?

$XRP Price Prediction">

$XRP Price Prediction">

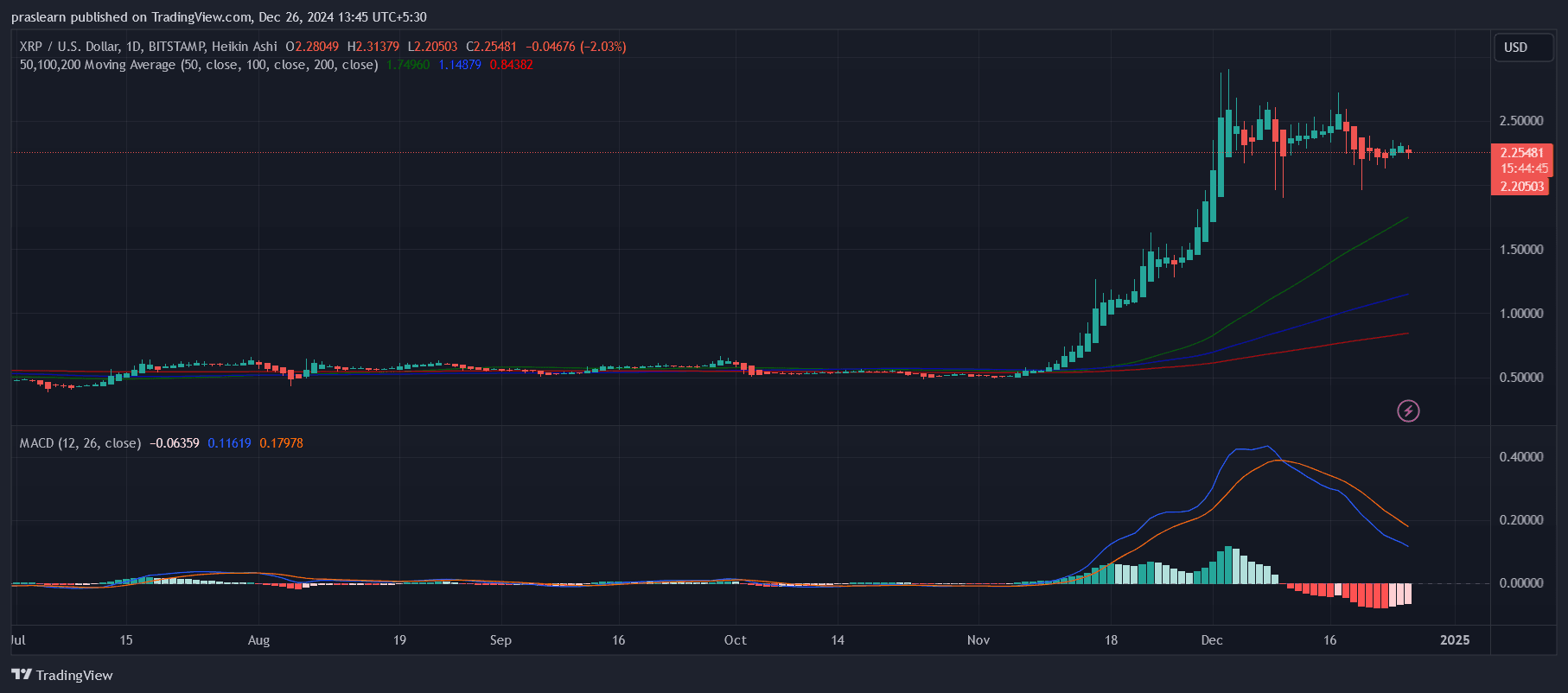

$XRP is currently priced at $2.24, with a 24-hour trading volume of $6.19 billion, a market capitalization of $128.48 billion, and a market dominance of 3.76%. Over the past 24 hours, its price has dropped by 2.19%.

$XRP reached its all-time high of $3.92 on January 4, 2018, while its lowest-ever price of $0.002802 was recorded on July 7, 2014. Since its $ATH, the lowest price $XRP hit was $0.113268, known as the cycle low, and its highest recovery since then was $2.89, the cycle high. The current market sentiment for $XRP is neutral, with the Fear & Greed Index showing a high score of 79, indicating Extreme Greed.

$XRP's circulating supply stands at 57.25 billion out of a maximum supply of 100 billion. The yearly supply inflation rate is 5.90%, meaning 3.19 billion $XRP were added to circulation over the past year.

$XRP Price Prediction: Will $XRP crash to 0 or a NEW $ATH Soon?

The $XRP market is at a crossroads, exhibiting a triangle pattern—a sign of consolidation that often precedes significant price movements. However, this pattern is still in its formative stages and may not offer conclusive insights just yet. While $XRP has demonstrated remarkable strength in the past year, surging 263% and outperforming 87% of the top 100 crypto assets, including Bitcoin and Ethereum, its future trajectory is still uncertain.

Analytical Insights

Positive Indicators: $XRP's above-average performance over the past year, its position above the 200-day SMA, and its 18 green days in the last 30 days reflect bullish undertones. These metrics, combined with its high liquidity and strong market cap, suggest a level of resilience in the face of broader market volatility.

While the triangle pattern hints at a potential breakout, its incomplete structure and the possibility of further evolution necessitate caution. A breakout above the critical resistance level at $2.59 could confirm a bullish trend, potentially paving the way for $XRP to challenge higher price zones.

Conversely, if $XRP fails to hold the $1.94-$1.95 support level, it risks entering a deeper correction, with downside targets at $1.80, $1.63, and possibly $1.40, the latter aligning with key retracement levels for corrective phases.

$XRP’s yearly inflation rate of 5.90%, while relatively high, has been absorbed well by its robust market performance. However, any significant increase in circulating supply without proportional demand growth could weigh on its price in the medium to long term.

Predictive Outlook

- Bullish Scenario: If $XRP maintains support above $1.94-$1.95 and breaks past $2.59, it could reignite bullish momentum, possibly targeting new highs. This scenario hinges on sustained market confidence, favorable macroeconomic conditions, and broader crypto market stability.

- Bearish Scenario: A failure to sustain above critical support levels could lead to further declines, with $1.40 serving as a pivotal point. Breaking below this level might erode investor confidence, increasing the likelihood of extended bearish pressure.

The possibility of $XRP crashing to $0 or reaching a new all-time high ($ATH) hinges on various technical and market factors. A crash to zero is highly unlikely given $XRP’s strong fundamentals, including its widespread adoption, integration in payment systems, and robust market performance, which has seen a 263% increase over the past year.

$XRP has also outperformed 87% of the top 100 crypto assets, trading above its 200-day simple moving average (SMA) with high liquidity. While its current triangle pattern suggests a period of consolidation before a potential breakout, the pattern remains incomplete, and the next move could go either way.

Critical support levels at $1.94-$1.95 need to hold to avoid deeper corrections toward $1.80, $1.63, or $1.40, while breaking past the $2.59 resistance level would signal a bullish trend and open the path to a potential $ATH.

Reaching a new $ATH of $3.92 will require sustained bullish momentum, favorable market conditions, and possibly positive developments in $XRP’s regulatory outlook. With 18 green days in the last 30 and its impressive year-over-year performance, $XRP shows promise, but achieving new highs depends on overcoming resistance at $2.59 and beyond.

Conversely, while bearish corrections are possible if support levels fail, a crash to zero remains an unlikely scenario due to $XRP’s established market position and institutional backing. Investors should closely monitor key support and resistance levels as $XRP’s next move will likely define whether it trends toward a breakout or faces further consolidation.

cryptoticker.io

cryptoticker.io