On January 1, 2025, Ripple will unlock more than $2 billion worth of XRP from an escrow system on the XRP Ledger blockchain. The tokens are set to hit the market in three transactions of 200 million, 300 million, and 500 million XRP.

The clock for the three escrows will tick on the first minutes of 2025, freeing 1 billion XRP tokens in addition to the 57.2 billion currently in circulation. The January release represents 2.63% of the total 38 billion of XRP that is still locked in Ripple’s escrow accounts.

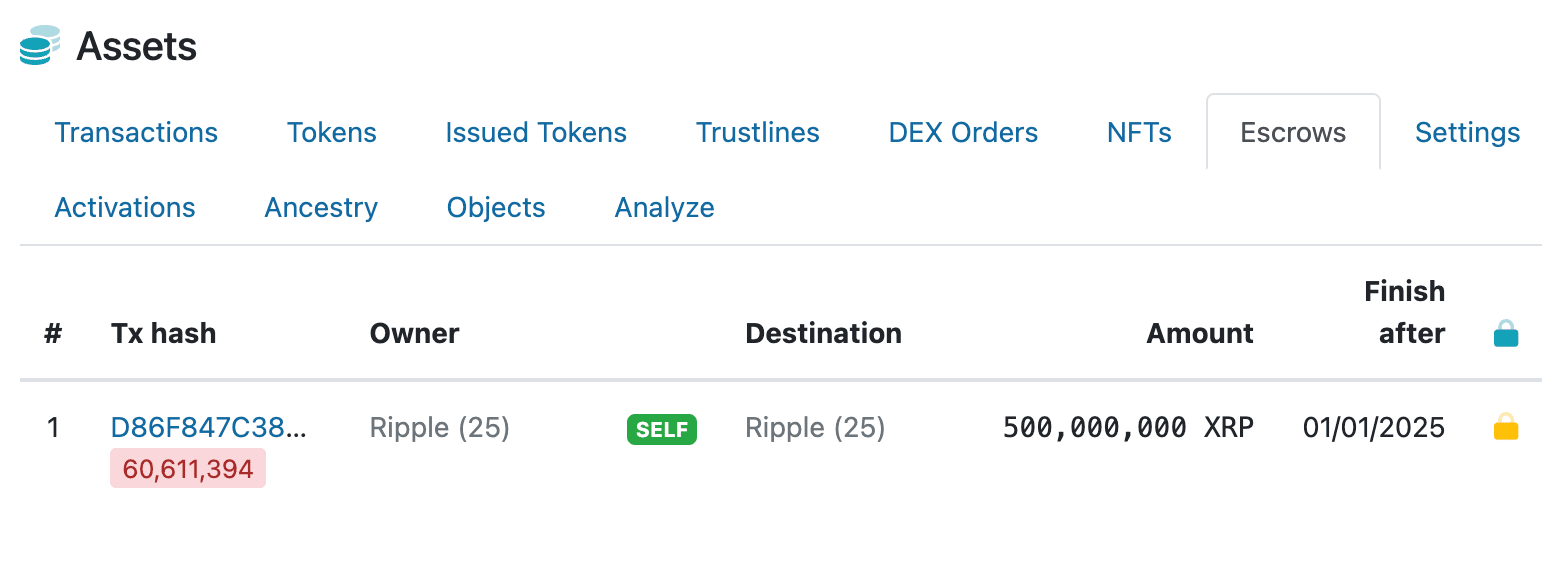

To be specific, Ripple (24) address will unlock 200 and 300 million XRP that were locked in the escrow on December 1, 2024, and January 1, 2021, respectively. Then, Ripple (25) will release 500 million XRP that were locked on January 1, 2021. These will be the last transactions from Ripple (24) and (25), although there are numerous escrows held by other Ripple-controlled addresses.

Unlike Bitcoin and Ethereum, which create new tokens “on the go” as a reward for miners/validators that keep the blockchain safe, Ripple pre-mined the entire supply of 100 billion XRP at the very inception of the network. In 2017, 55 billion XRP were locked in an escrow system hardcoded to release 1 billion XRP each month to ensure gradual and controlled distribution.

The scheduled unlocks help Ripple fund its operations, invest in ecosystem development, and provide liquidity for its payment solutions. While the real amount of XRP that actually enters circulation every month is often lower than 1 billion due to the company re-locking a portion of tokens into a new escrow, this nevertheless creates a significant amount of selling pressure. With Ripple currently trading above the coveted $2 mark, it remains an open question whether XRP will see a proportional demand increase to sustain current price levels. Nevertheless, the promise of the nearing altcoin season leaves room for cautious optimism.

VanEck experts call the start of the altcoin season

As Bitcoin struggles to stay above the psychologically important $100,000 mark, VanEck experts claim that the “altcoin season” may be already in full force. The asset manager even suggested November 27 as the start day for the rise of altcoins in this cycle.

For context, the term “altcoin season” refers to the periods when cryptocurrencies other than Bitcoin (so-called altcoins) outperform the king of crypto. The hotly anticipated altseasons historically follow after Bitcoin dominance peaks near 60%, as traders seek higher returns in alternative assets.

According to VanEck analyst Matthew Sigel, the relationship between Bitcoin dominance and altcoin performance can be explained through the cyclical nature of capital flows in cryptocurrency driven by investor psychology. When new capital enters the market during Bitcoin's rise, it encourages a "risk-on" sentiment, motivating investors to seek higher-risk, higher-reward opportunities in altcoins.

Increased appetite for risk often benefits more nascent crypto sectors, such as decentralized finance (DeFi), gaming, and non-fungible tokens (NFTs). The "altseasons" are identified when over 60% of the top 50 altcoins by market cap, excluding the stablecoins and Bitcoin-backed assets, outperform Bitcoin over a 90-day period.

Data from Artemis’s Altcoin Season Index quoted by VanEck in a report indicates that altcoins are doing reasonably well. The index tracks how the top 50 altcoins compare to Bitcoin performance, taking on the values between 0 and 1, where 0.6 is a cutoff value that signals the start of the altcoin season. The current score of 0.64 suggests a moderate altcoin performance, a sign of a major altcoin pump still ahead.

According to CoinMarketCap, the current state of the cryptocurrency market is neither altcoin season nor Bitcoin season. The platform uses a much more stringent standard for calculating the altseason index, defined as 75% of the top 100 altcoins outperforming Bitcoin. With the current score of 49 sitting firmly in the middle, the altcoin rally seems like a more distant perspective than suggested by VanEck. At the same time, the index climbed as high as 82 on December 8, indicating a strong potential for a retest.

Crypto analyst Ash Crypto recently made a prediction for the altcoin season to start in Q1 2025, drawing parallels between the Bitcoin performance in 2020 and 2024. In both cases, November saw strong gains in the cryptocurrency market, followed by a pullback in December. The subsequent reversal in Bitcoin dominance set the stage for the “mega altseason,” which analyst hopes to return in 2025.

At the time of writing, Bitcoin is hovering around the $99k mark. With the wave of pro-crypto policymakers brought by Trump into his administration, many experts expect Bitcoin to reach new highs in 2025. VanEck set its base price target for BTC at $180k by 2025, citing Bitcoin’s growing adoption as an institutional reserve asset, rising altcoin speculation, and powerful synergies between crypto and AI as potential catalysts in the upcoming year.