Cardano (ADA), the ninth-largest cryptocurrency by market capitalization, has recorded significant profit margins in its holding addresses. Despite ADA’s price dipping below the $1 mark, this positive development is occurring.

Key Cardano metrics amid market volatility

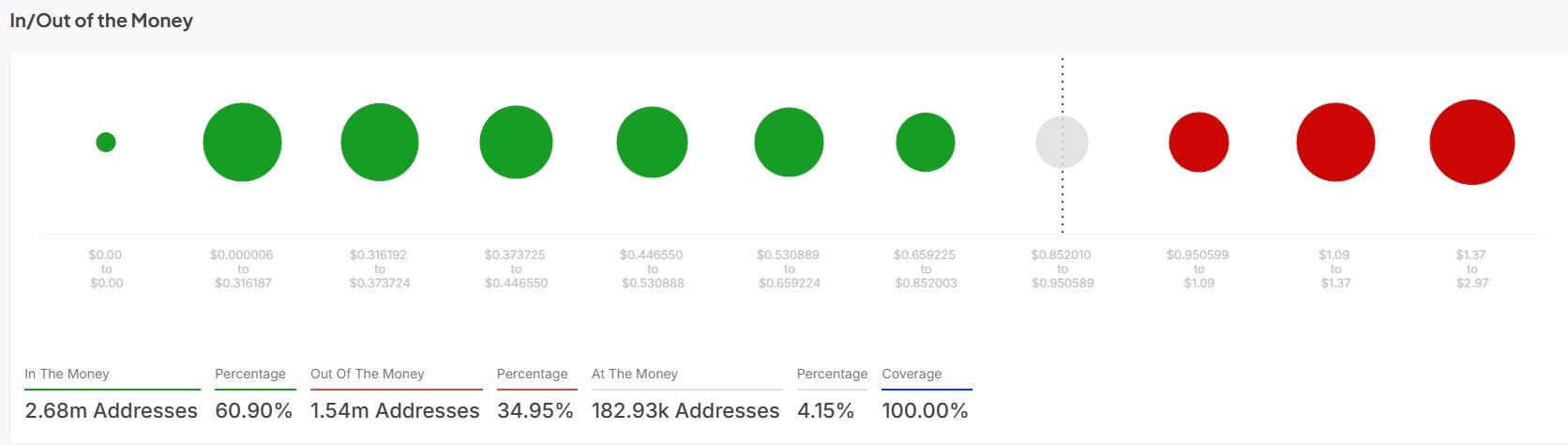

According to data from IntoTheBlock, Cardano’s In/Out of the Money chart reveals interesting developments in the performance of the asset.

A total of 2.68 million Cardano addresses are in profit, representing 60.9%. This refers to addresses currently making significant gains. Meanwhile, 1.54 million addresses are experiencing losses, or are "Out of the Money." This covers 34.95% of total addresses.

Notably, the cumulative Cardano addresses stand at 182,930. That covers 4.15% of the total wallets registered on the Cardano network.

The positive metrics were recorded despite ADA being down by about 70% from its all-time high (ATH). It marks a significant development for Cardano, which has struggled to regain $1 in the last four days.

ADA trades at $0.8984 as of this writing, representing a 0.49% increase in the last 24 hours.

Analysts give diverging price predictions

The Cardano community, however, remains bullish on the asset's potential to regain higher price levels.

According to an earlier U.Today report, on-chain analyst Ali Martinez has also given investors and traders hope for a possible bullish run. Martinez noted that historical precedence shows the ongoing price correction could lead to a price surge of up to $6. Investors will have to hope for history to repeat itself.

However, Peter Brandt, a veteran trader, differs in his prediction. Brandt suggests that ADA’s price could drop significantly. He referred to the anticipated drop as a "potential CAR crash," which could see ADA drop by over 40%.

The differing viewpoints emphasize the need for investors and traders to conduct their research. This could prevent significant losses on the part of investors.

u.today

u.today