XRP is among cryptocurrencies with concentrated ownership in a few top addresses, raising concerns about the impact of centralization.

A breakdown of ownership indicates that Ripple-controlled addresses account for most of the asset, primarily locked in escrow. Major exchanges also rank among the top holders.

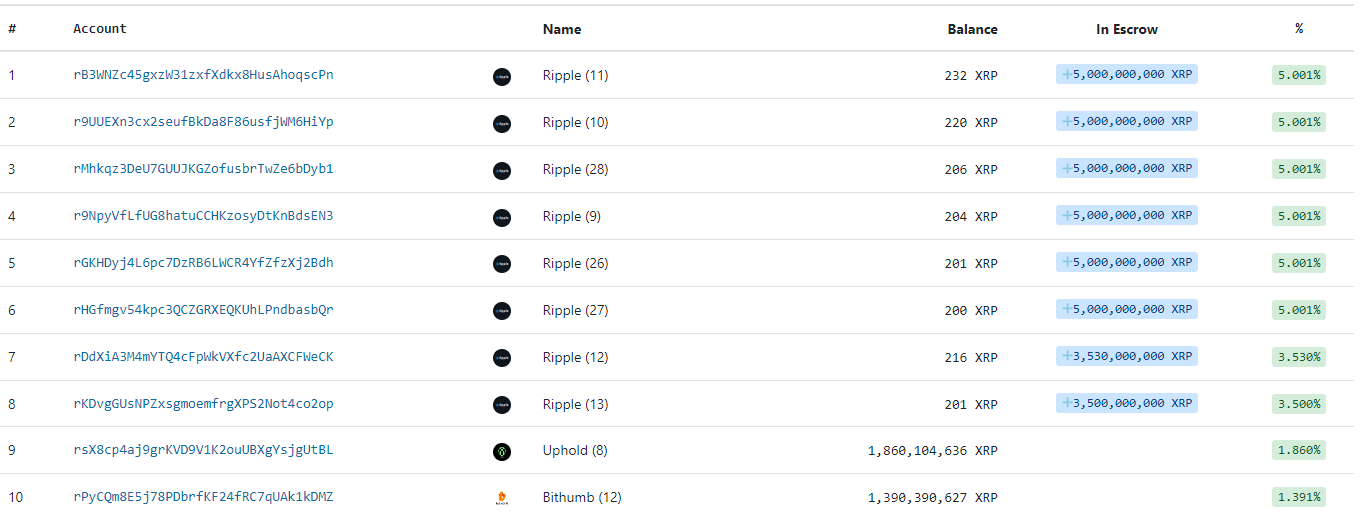

The top 10 XRP holders collectively own 35.39% of the total supply, amounting to 27.53 billion tokens. Ripple dominates this list, with its seven accounts holding 24.53 billion XRP, including tokens in escrow, representing 31.57% of the total supply, according to data retrieved by Finbold from XRP Scan on December 23.

Additionally, Uphold and Bithumb features are available among the top owners. Uphold holds 1.86 billion XRP (1.86%), and Bithumb accounts for 1.39 billion XRP (1.39%).

XRP centralization concerns

Although Ripple has implemented a clear XRP management plan, the concentration of assets in a few company-affiliated addresses raises concerns about centralization. Critics argue this goes against the principles of blockchain decentralization and trustlessness.

For instance, cryptocurrency researcher Justin Bons challenged Ripple’s decentralization claims earlier in December, highlighting possible flaws in XRP’s design.

In an X post on December 3, Bons asserted that XRP relies on a centralized Unique Node List (UNL) and uses Proof of Authority (PoA), allowing the XRP Foundation to control validators and enforce compliance.

Bons further criticized XRP’s lack of validator incentives, a 99.8% pre-mine, and reliance on founder-held token sales, which he believes compromise fairness and transparency.

He recommended Ripple adopt a Proof of Stake (PoS) model to decentralize validator selection and promote transparency.

XRP previously broke out of prolonged consolidation below $1, driven by post-election optimism following Donald Trump’s election and the upcoming departure of Securities Exchnage Commission (SEC) Chair Gary Gensler, which has boosted investor confidence.

Regarding the next price movement, crypto analyst Dark Defender noted in a December 22 post that XRP is consolidating within a descending triangle and testing a key support line around $1.80.

The daily chart highlighted resistance above $2.90. However, the Relative Strength Index (RSI) remains below the golden cross threshold, indicating weak bullish momentum. A breakout above resistance could trigger a rally, while a breakdown below support may lead to further declines.

Featured image via Shutterstock

finbold.com

finbold.com