XRP has faced a significant downturn in recent days, with its price dropping nearly 20% from an intraday high of $2.7255 on December 17 to $2.20 as of December 23, 2024. This decline comes amid broader struggles in the cryptocurrency market, where macroeconomic factors have driven a sharp sell-off. Despite the absence of fundamental issues specific to XRP, a combination of tightening global liquidity and a hawkish Federal Reserve stance has put pressure on the entire crypto sector.

State of the Crypto Market on December 23, 2024

The broader cryptocurrency market is showing clear signs of weakness. As of December 23, the global crypto market cap stands at $3.459 trillion, down 2.4% over the past 24 hours. Trading volumes remain robust, with $193.75 billion in activity during the same period, but selling pressure dominates across major cryptocurrencies.

- Bitcoin (BTC), the largest cryptocurrency, is priced at $95,998.96, down 8.4% over the past week and 0.9% in the past 24 hours. Its market cap stands at $1.9 trillion.

- Ethereum (ETH) is trading at $3,337.48, with steeper losses of 15.5% over the week. It has shed 1.2% in the past 24 hours, leaving its market cap at $401.98 billion.

- XRP, ranked 4th by market cap, is priced at $2.20, down 8.0% over the week and 3.2% in the past day. Its 24-hour trading volume of $11.09 billion highlights active participation but insufficient demand to counter selling pressure.

- Other top altcoins, including BNB ($673.30) and Solana (SOL) ($184.55), have also struggled, with Solana losing 15.9% over the week. The market’s synchronized downturn underscores the influence of external macroeconomic factors.

Impact of the Federal Reserve on XRP and the Crypto Market

The sharp decline in XRP, alongside other cryptocurrencies, began immediately after the Federal Reserve’s December 18 policy meeting. While the Fed reduced its benchmark rate by 0.25 percentage points to a target range of 4.25%–4.5%, the accompanying statement and press conference from Chair Jerome Powell introduced an unexpectedly hawkish tone.

The Fed’s updated projections revealed that only two additional quarter-point rate cuts are expected in 2025, down from the four cuts forecasted in September. Powell emphasized that inflation, while easing, remains above the Fed’s 2% target, and further cuts will depend on continued progress. This cautious stance signaled that liquidity conditions would remain tight into 2025, catching investors off guard.

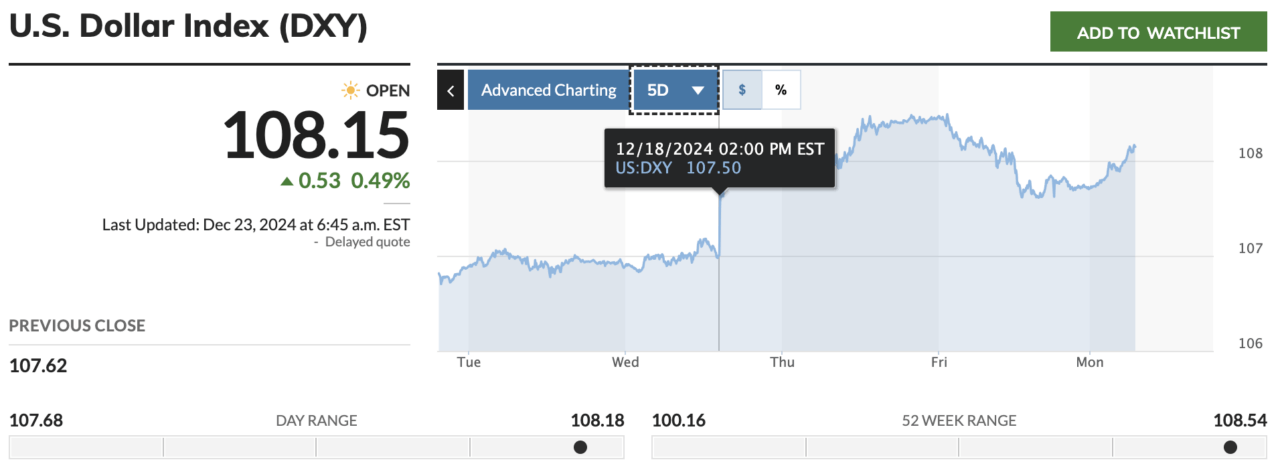

The market’s reaction was swift. At 2:00 p.m. ET on December 18, the U.S. Dollar Index (DXY) spiked from 107.50 to above 108, reflecting a stronger dollar. By December 23, the DXY reached 108.15, its highest level in months. A stronger dollar tightens global financial conditions, making speculative assets like cryptocurrencies less attractive.

XRP’s Price Action

XRP’s one-month price chart highlights its dramatic reversal since December 17, when it reached an intraday high of $2.7255. XRP began to decline sharply following the Fed’s announcements. This drop aligns with the broader crypto market’s response to tightening liquidity and rising risk aversion.

XRP’s 24-hour trading volume of $11.09 billion reflects significant market activity, but the persistent selling pressure driven by macroeconomic factors has kept the price on a downward trajectory.

Tightening Liquidity and Global Market Dynamics

Jamie Coutts, Chief Crypto Strategist at Real Vision, said last week on X that tightening liquidity is a key driver of the crypto market’s struggles. Over the past two months, global liquidity has contracted due to shrinking central bank balance sheets and rising bond market volatility. Powell’s hawkish remarks during the December 18 press conference only added to these concerns.

Coutts noted that cryptocurrencies are particularly sensitive to shifts in liquidity conditions. Historically, periods of tightening financial conditions have coincided with sharp declines in speculative assets. The recent spike in the DXY and rising Treasury yields—now at 4.54% for the 10-year note—underscore these restrictive conditions. With risk appetite shrinking, crypto assets are bearing the brunt of the fallout.

Tightening liquidity was evident for 2 months. Brace and watch the whites in the eyes of the central planners if this escalates. Buying opp incoming. https://t.co/ftgesVUq4H

— Jamie Coutts CMT (@Jamie1Coutts) December 20, 2024

Conclusion: What’s Next for XRP?

XRP’s decline appears to be driven entirely by macroeconomic factors rather than asset-specific developments. The Federal Reserve’s decision to slow the pace of rate cuts, coupled with a strong dollar and rising yields, has created a challenging environment for speculative assets. As of December 23, XRP remains at $2.20, with broader market sentiment likely to dictate its short-term trajectory.

cryptoglobe.com

cryptoglobe.com