Dogecoin’s trading activity on the daily chart indicated DOGE could have found a potential local bottom.

A Dragonfly Doji candlestick appeared at the Fibonacci retracement level of 0.618, positioned at $0.27295, suggested a DOGE price rejection at this level.

This pattern often signals a reversal, hinting that Dogecoin might have established a solid support point after a downward trend.

The market sentiment appeared to shift as the candle formed, with the tail dipping to a low of $0.14223 before closing near its opening price, reflecting strong buying pressure at lower levels.

The presence of the Doji pattern at a key Fibonacci level typically suggested that sellers were exhausted, leading to a balance between buyers and sellers.

If the support holds, DOGE could see a rally, with potential targets upwards of the $0.50 mark, especially if the broader market sentiment remains favorable.

This could affirm the reversal signal, possibly triggering a sustained upward movement, given the historical price reactions to such patterns.

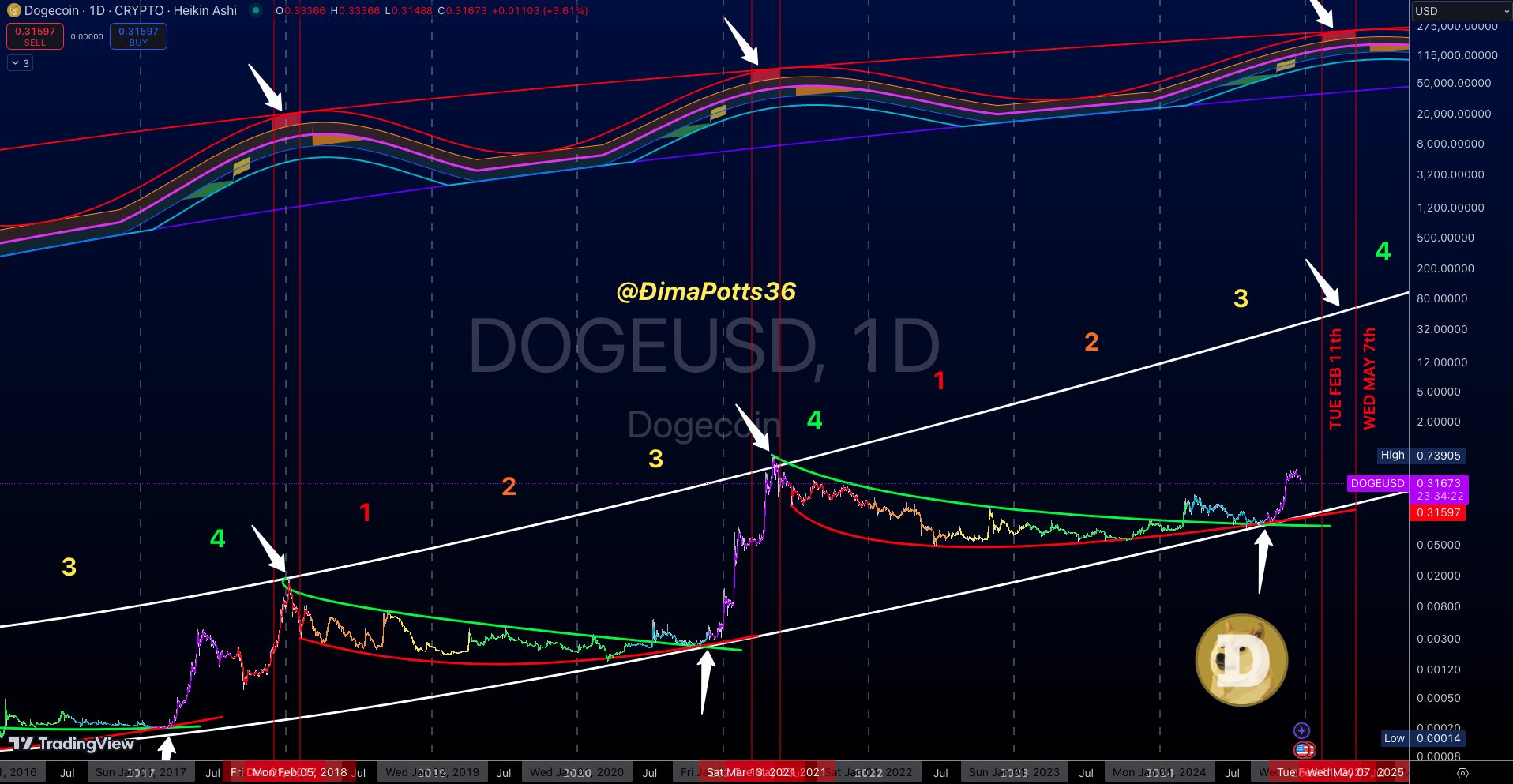

DOGE Price Correlation with Bitcoin Halving Cycles

Further analysis showed that Dogecoin closely followed a cyclical pattern aligned with Bitcoin’s, particularly post the third BTC halving.

Previous cycles in 2016 and 2020 indicated that DOGE reaches its peak within three to four weeks following Bitcoin’s top.

This highlighted several crucial periods at the top, which has accurately predicted every Bitcoin peak. These peaks signified key events that influenced DOGE’s price trajectory.

For the upcoming cycle, predictions suggested a peak between February and May, contingent on Bitcoin’s first top within this period.

Given DOGE’s strong performance at the end of 2024, surpassing its previous third-year highs, anticipations for 2025 heightened.

As of press time, DOGE valued at $0.31, marked an improvement and setting of a solid foundation for the subsequent year.

The expectations were for DOGE to excel beyond its historical fourth-year peaks, indicating a potentially monumental year for the memecoin.

This pattern pointed at the cyclicality and interconnectedness of crypto performances, especially in relation to Bitcoin’s market movements.

Whales Accumulated DOGE During the Dip

Again, large holders accumulated over 250 Million DOGE tokens during the recent market downturn.

The holdings between 1,000,000 and 10,000,000 coins alongside price of DOGE which dipped in early December, caused a surge in whale transactions suggesting strategic buying during lower price.

Post-acquisition, the price trend of Dogecoin displayed a mild recovery, hinting at the potential impact of large-scale purchases on market dynamics.

The pattern suggested that whales possibly perceived the dip as an optimal entry point, anticipating a rebound or stabilization of prices.

These often signaled a shift in market sentiment, which could lead to a more bullish outlook if these holders maintain or increase their positions.

If similar buying patterns occur for DOGE, it could suggest an impending price increase. Conversely, a sell-off by these whales could lead to downward pressure on prices.

thecoinrepublic.com

thecoinrepublic.com