Jim Cramer advises investors to buy into the fear amid a broader market pullback that has impacted the stock market and Bitcoin.

Notably, Bitcoin’s price has recently declined to $94,000, reflecting a broader market downturn following the Federal Reserve’s latest policy decisions. The Fed reduced interest rates by 0.25%, bringing them to a range of 4.25% to 4.5%.

Stock and Crypto Markets Down

However, Chairman Jerome Powell hinted at a slower pace of easing in 2025, indicating plans for fewer rate cuts than previously anticipated. This hawkish stance has unsettled both stock and cryptocurrency markets.

Major indices like the S&P 500 and Nasdaq experienced significant declines, with the S&P 500 dropping nearly 3% in the past five days. Within the same timeframe, the Dow Jone has slumped by 3.43%, while the Nasdaq Composite has dropped by a more substantial 4.12%.

Notably, crypto mirrored this trend, as Bitcoin led the charge, collapsing below the $100,000 mark. The crypto market has so far seen over $1.3 billion in liquidations over the last 24 hours.

Jim Cramer’s Advice

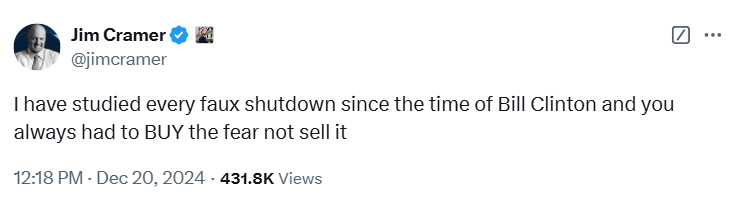

Amid this volatility, financial commentator and CNBC’s Mad Money host Jim Cramer advises investors to consider buying into the fear. He suggests that market downturns, often driven by fear and uncertainty, can present buying opportunities for those willing to take a contrarian stance.

It’s worth noting that Cramer’s recommendations often come under humorous scrutiny by the crypto community for their interesting impact. Notably, many in the community suggest that the market often moves in the opposite direction to what the Mad Money host predicts.

However, in the current scenario, Cramer’s advice to “buy the fear” appears to resonate with broader market sentiment. Mentions of “buy the dip” have surged to an eight-month high in the crypto community, indicating a collective inclination toward purchasing BTC during the downturn.

Supporting this accumulation trend, notable figures in the crypto space have made significant purchases. Justin Sun, founder of TRON, announced that he has acquired additional assets.

Similarly, El Salvador has expanded its Strategic Bitcoin Reserve by purchasing 11 Bitcoin worth over $1 million, shortly after the International Monetary Fund agreed to a $3.3 billion loan.

🇸🇻We just transferred over a million dollars worth of Bitcoin to our Strategic Bitcoin Reserve. pic.twitter.com/4ZrxGw9Od0

— The Bitcoin Office (@bitcoinofficesv) December 20, 2024

Bitcoin Pullback Could Continue

Meanwhile, market analysts expect the downtrend to continue in the short-term but remain bullish in the long-term. Rekt Capital observed that in previous cycles, Bitcoin experienced major corrections after six to seven weeks of price discovery. In the current cycle, it’s the seventh week, suggesting a potential correction phase.

Also, as BTC dropped to $96,500, Ali Martinez noted that if the asset falls below $96,000, the next support levels could be $90,000 and $85,000. With Bitcoin currently now below $95,000, this analysis indicates possible further declines.

Keeping it simple, just based on the Fib, if #Bitcoin $BTC loses $96,000, the next point of focus becomes $90,000 and $85,000. pic.twitter.com/yJ1Hq2PNe2

— Ali (@ali_charts) December 19, 2024

Another analyst, Wick, noted that Bitcoin is in a downtrend on the 4-hour chart. Drawing parallels to the 2017 bull market, he recalls multiple corrections ranging from 30% to 40%, each causing concern among investors.

$BTC (4hr)

Bitcoin in a stage 4 downtrend channel on the 4hr chart

🔴🔴In 2017 once of the most memorable bull markets in crypto history we had 5 corrections along the way that were all between 30% to 40% retraces. Each time making everyone feel like the bull market is over… pic.twitter.com/gTrepFbcB2

— Wick (@ZeroHedge_) December 20, 2024

In the current market, a 15% retracement has occurred, suggesting that more corrections could be part of the natural market cycle. Despite these short-term bearish calls, the general consensus is that the bull run is far from over. Currently, Bitcoin is down 7% in the last 24 hours, trading for $94,730.

thecryptobasic.com

thecryptobasic.com