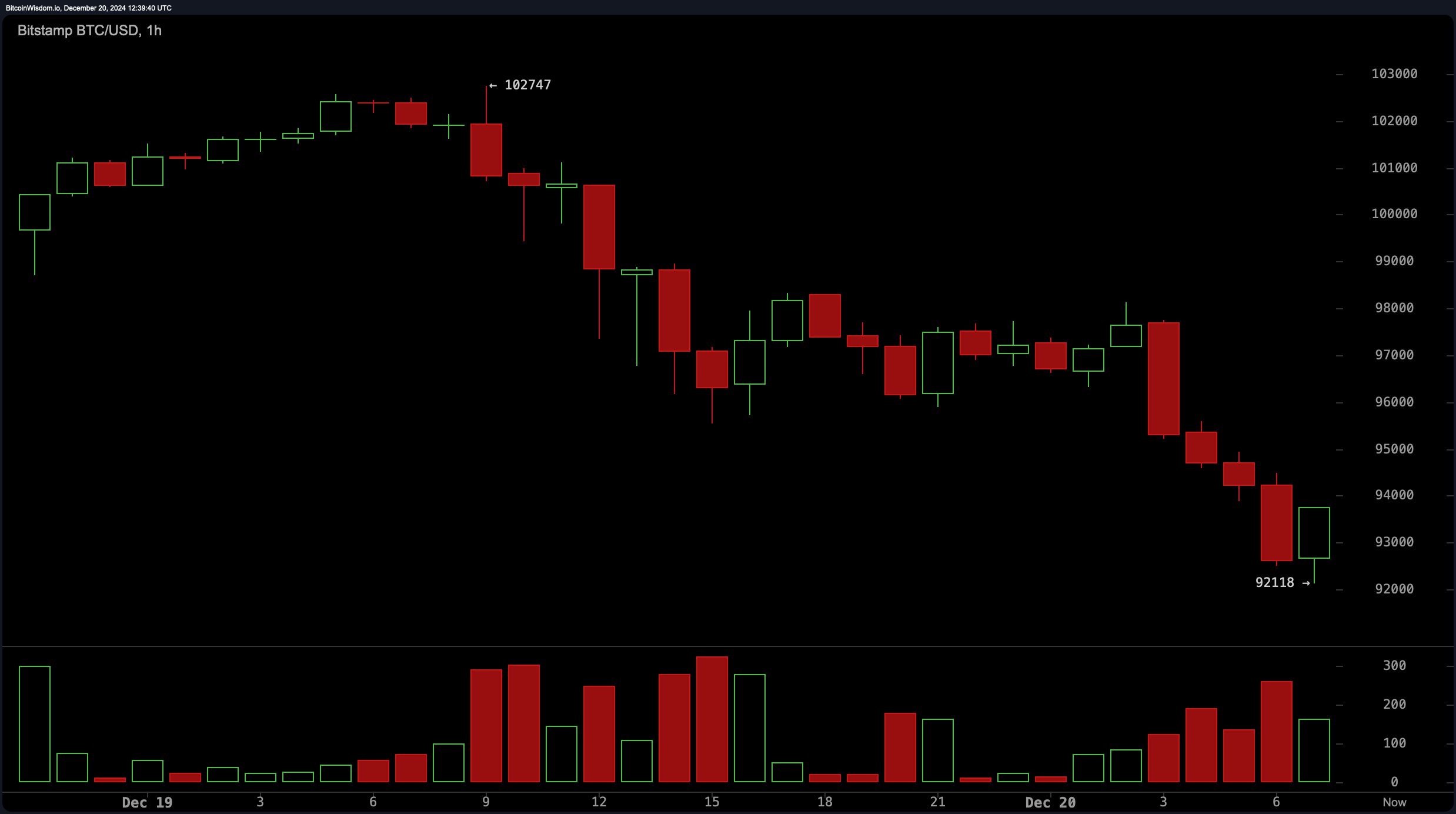

Bitcoin (BTC) plunged over 9% on Friday to a 24-hour low of $92,118 at 6:30 a.m. Eastern Time.

Bitcoin’s Sharp Decline Leads $1.4 Billion in Derivatives Liquidations

This crash marks one of the most dramatic dips for the cryptocurrency this month. The wider crypto scene didn’t fare much better, shrinking by 11.94% to a total market cap of $3.13 trillion.

The sell-off frenzy hit several altcoins hard, with GIGA, CVX, TEL, and GOAT suffering drops from 24% to 27% within the last day. This has left investors in disarray as a gloomy vibe spreads across the market.

Over in the derivatives market, the chaos led to $1.4 billion in liquidations from both long and short positions, with bitcoin longs alone losing $270 million. An eye-watering 427,928 traders had their positions wiped out, showcasing just how wild the swings can be.

Market gurus point to a mix of economic jitters and a dip in investor confidence as the culprits behind this slump. Even though bitcoin is meant to be free from central control, it’s still swayed by worldwide economic vibes, echoing the general market mood.

Altcoins have been battling their own storms, with many projects showing increased swings. The day’s biggest flops, like meme coins, highlight how risky speculative bets can be when the market gets choppy.

While the future of bitcoin and the crypto world is up for grabs, today’s losses are a stark reminder for investors to tread carefully in this unpredictable environment. The market’s quick fall is a lesson in its unpredictability during escalating bull runs and subsequent sell-offs.

news.bitcoin.com

news.bitcoin.com