XRP took a sharp nosedive, slipping below the crucial $2 mark and sending shockwaves through the crypto community.

Currently trading at $1.97, XRP fell from $2.41 in less than 24 hours, marking a staggering 18% drop for the day.

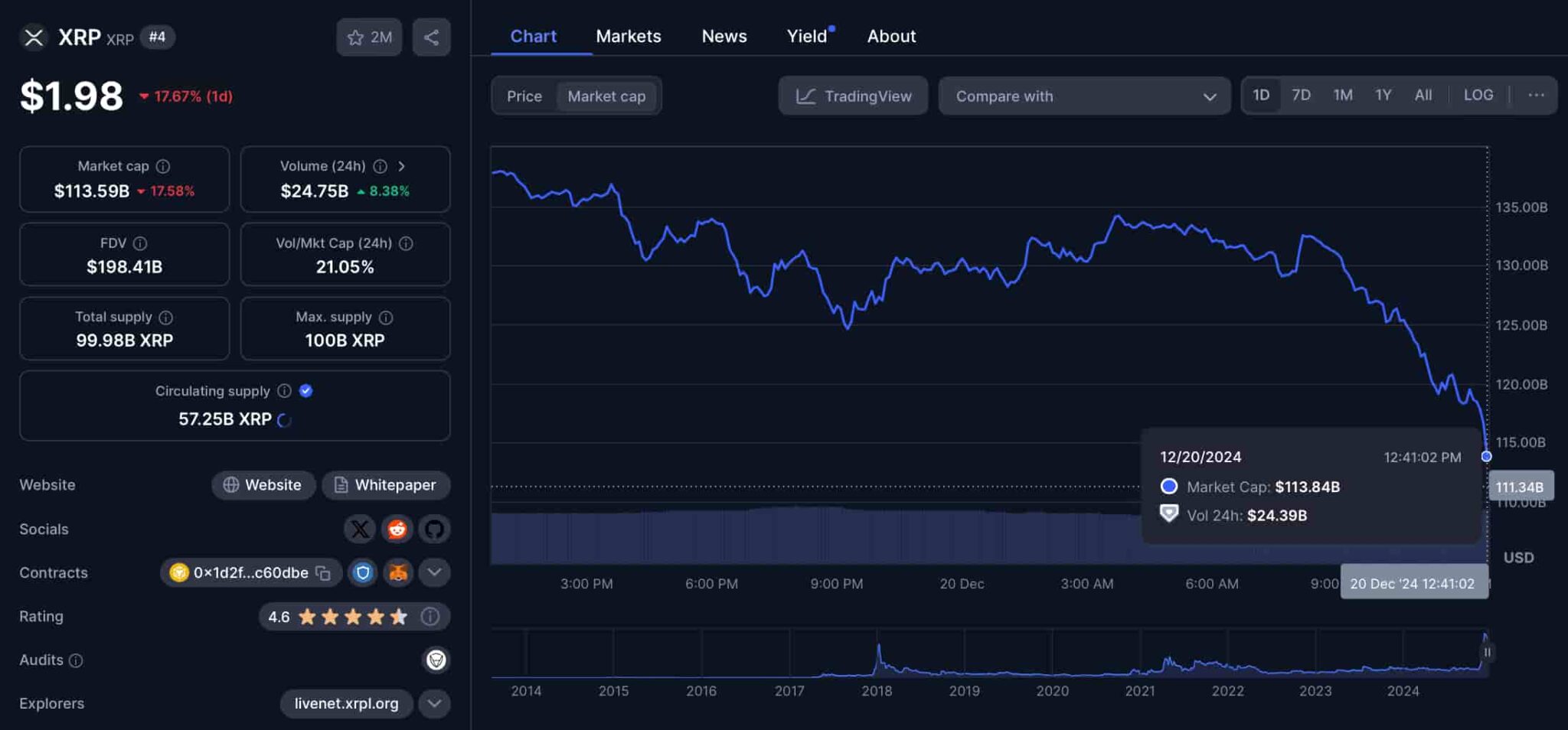

The market cap tumbled from $137.8 billion to $113.8 billion, resulting in a loss of $24 billion in value within a day.

Trading volume surged to $24.75 billion, an 8.38% increase over the last 24 hours, signaling intense market activity as traders scrambled to reposition.

XRP is still trading above its 200-day simple moving average, suggesting that the broader trend remains positive despite the correction, as the token remains up 76.35% in the past month

Over the past 30 days, XRP has seen 17 green days out of 30, reflecting a 57% positive trading streak.

Key XRP levels to watch

In the short term, traders are eyeing the $2 psychological level as a critical marker for recovery. The immediate support level lies at $1.92, and if this holds, XRP could stabilize and attempt to reclaim higher ground. On the upside, the resistance level at $2.55 will be the next challenge for the bulls.

While the sudden crash has rattled investors, the overall outlook remains cautiously optimistic. Traders and analysts will closely monitor whether XRP can quickly bounce back above $2, a move that could restore confidence and set the stage for renewed upward momentum.

Interestingly, a lot of chart analysts on X (formerly Twitter), such as Crypto Tony, had suggested that XRP was holding up relatively well compared to other altcoins before the price continued to cascade downward. This false sense of resilience was quickly shattered as selling pressure mounted.

Renowned on-chain analyst Ali Martinez added to the discussion, noting that if XRP rebounds to $2.62, a significant 20.50 million in short positions could face liquidation.

$20.50 million in short positions will be liquidated if $XRP rebounds to $2.62! pic.twitter.com/IKMCIolaiV

— Ali (@ali_charts) December 20, 2024

This potential squeeze could serve as a catalyst for a swift recovery if the market sentiment flips bullish.

Featured image via Shutterstock

finbold.com

finbold.com