Prominent AI chatbot ChatGPT expects the XRP price to skyrocket to a two-digit figure if SBI allocates up to 20% of its assets to an XRP Reserve program.

Bullish sentiments have enveloped the XRP community following a proposal by GAM Investments urging SBI Holdings to implement a strategic XRP buyback plan. This proposal, disclosed in a document addressed to SBI Holdings and its CEO, Yoshitaka Kitao, suggests using a portion of SBI’s assets to bolster XRP holdings.

If SBI proceeds with this, the move could significantly impact XRP’s market price, but the extent of this impact remains unclear. As a result, we sought ChatGPT’s opinion, with the chatbot suggesting prices could soar to as high as $15.

GAM’s Proposal to SBI

As The Crypto Basic recently reported, GAM Investments, an SBI shareholder, raised concerns about the undervaluation of their stake in SBI. According to GAM, SBI has not effectively leveraged its investment in Ripple or XRP.

Notably, the lack of a clear crypto strategy, combined with confusing investor communications, has raised doubts about the company’s ability to maximize shareholder value.

SBI, which owns an 8–9% stake in Ripple, controls a substantial portion of XRP indirectly through Ripple’s holdings. GAM argues that this stake alone could surpass SBI’s current market capitalization, indicating an untapped opportunity for value creation.

GAM has proposed that SBI establish a strategic XRP reserve, suggesting that this approach could benefit shareholders more than traditional cash dividends.

Hypothetical Scenarios for XRP Price Projections

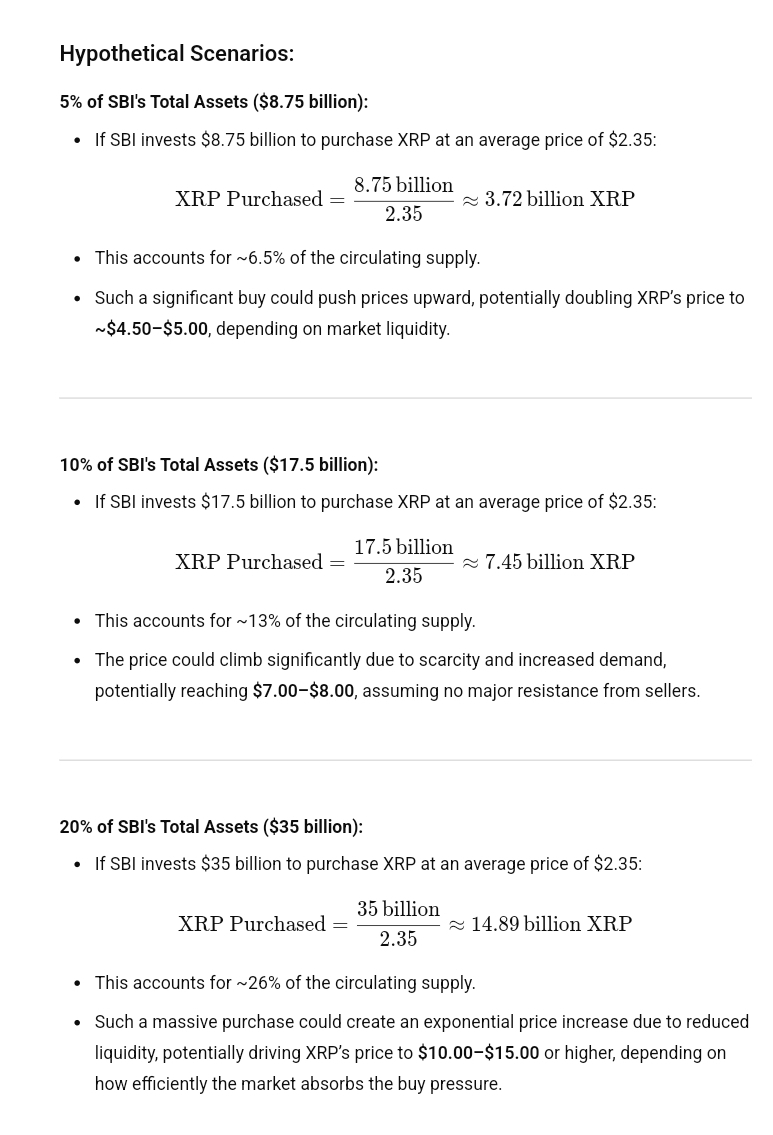

We queried ChatGPT on how such a reserve could affect XRP price. In response, the chatbot provided an analysis of the potential price impact if SBI uses 5%, 10%, or 20% of its total assets to purchase XRP.

As of March 2024, SBI held total assets valued at 27.2 trillion Japanese Yen, equivalent to $175.1 billion. The AI chatbot outlined the hypothetical scenarios under the assumption that XRP’s circulating supply is approximately 57.45 billion tokens.

If SBI allocates 5% of its assets to XRP, this would involve injecting $8.75 billion into the market. At the current average price of $2.35 per XRP, SBI could purchase around 3.72 billion tokens.

Interestingly, this acquisition would represent about 6.5% of the circulating supply. ChatGPT believes such a major buy could potentially double the XRP price to about $4.50–$5.00, depending on market liquidity and seller resistance.

With a 10% allocation, SBI would invest $17.5 billion, enabling the purchase of roughly 7.45 billion XRP tokens. This would account for 13% of the circulating supply. The AI chatbot suggests that the increased demand and reduced supply could drive prices to $7.00–$8.00.

Nonetheless, if SBI opts to dedicate 20% of its assets, this would inject $35 billion into the XRP market. This amount could secure approximately 14.89 billion XRP tokens, equivalent to 26% of the circulating supply.

The substantial reduction in available tokens could lead to an exponential price increase. ChatGPT projects XRP could reach $10.00–$15.00 in this scenario. However, this would depend on market conditions and liquidity levels.

Will This Happen?

While the proposal from GAM Investments is noteworthy, it remains unclear whether SBI will act on these recommendations.

According to XRP community figure WrathofKahneman, the influence of GAM on SBI’s decision-making depends on the extent of their holdings and their ability to sway other investors. Also, even if SBI carries out this suggestion, there is no guarantee that ChatGPT’s projections would materialize.

thecryptobasic.com

thecryptobasic.com