$PENDLE crypto showed a promising ascending triangle pattern over the past year, indicating sustained buying interest.

Each attempt to push higher met resistance at $6.50, defining a crucial barrier for the crypto. Notably, the repeated tests of this resistance level often precede a significant breakout.

In late November, $PENDLE crypto price approached the upper boundary of the triangle, with increasing trading volume suggesting a buildup of pressure.

The pivotal moment could arrive when it successfully breaches the $6.50 level, marking a potential turning point. The subsequent price action could create anticipation of further uptrend.

If $PENDLE breaks above the ascending triangle, the potential for reaching even higher levels seems plausible. This suggested that the next major price target could be set around $20.

Adding to the bullish outlook was the reported increase in activity from both institutional funds and prominent whale accounts.

Their significant acquisitions and positioning within the market could provide the necessary capital influx to drive $PENDLE’s price toward the projected $20 mark, aligning with their broader strategic investments in the crypto space.

Pendle Finance Ecosystem Fund Makes Deposit

The financial trajectory of the Pendle ecosystem over the past year as per the balance over time showed an overall ascending trend, highlighting increases in fund deposits to major exchanges, particularly in strategic price zones.

The deposit of 562,500 $PENDLE worth over $3.47M to Binance, marked a crucial point. The activity mostly occurs at market junctures—whether at potential bottoms, tops, or before price pushes.

The yellow columns, signified the deposit to centralized exchanges (CEX), served as a telltale sign of pivotal activities that had historically influenced the price trajectory of Pendle.

Historically, this preceded either major rallies or profit-taking scenarios, and the current trend suggested another potential rally could be underway.

The timing of this deposit coincided with a notable uplift in the general crypto market sentiment, indicating bullish prospects.

However, it also raised the possibility of nearing a peak, where strategic profit-taking might commence.

The balance showed a rise from approximately $2 million in early February to over $20 million by December, aligning with a steady increase in the price, which mirrored the broader market.

$PENDLE Whales Increase Their Activities

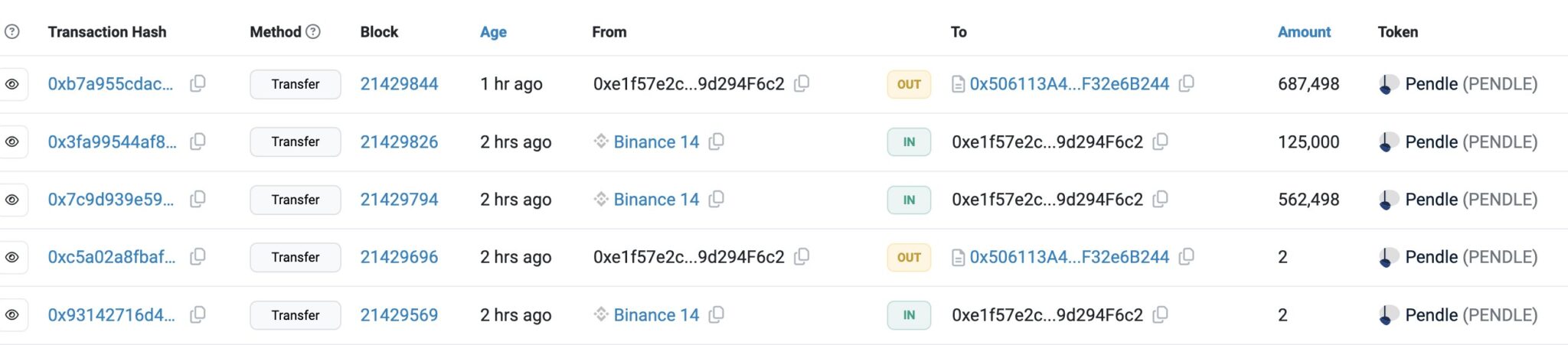

A tracked $PENDLE whale initiated a significant transaction by withdrawing 687,498 $PENDLE tokens, valued at approximately $4.26 million, from Binance. Subsequently, this entire amount was staked.

This move aligned with increasing trends of staking among $PENDLE token holders, likely influenced by whales’ actions. This growing trend among other users was clear in the recent staking outcome.

Another user deposited $54,000 worth of $PENDLE and WETH into a Uniswap pool, experiencing substantial financial results in just over a day.

The market gain was 7.08%, earning them $2,074.10, which represented an annual percentage yield of 904.31%. Despite a divergence loss of $870.18, the net result was a profit of $1,203.92.

💸 $2,074 income in just 2 days!

— Archive Protocol (@ArchiveWeb3Data) December 16, 2024

This user deposited $54K worth of $PENDLE and $WETH into a pool on @Uniswap. They've been in the pool for 1 day and 12 hours. Here's how it's performing:

📈 Market gains: +7.08%

💰 Earnings: +$2,074.10 (904.31% APY)

🧮 Divergence loss:… pic.twitter.com/6M76dzYMeo

This profitability suggests that the whale’s staking strategy is not only viable but also increasingly being adopted by the broader community, aiming to replicate such gains.

This activity indicated a strategic shift towards staking within the $PENDLE ecosystem, reflecting a robust sentiment and a proactive approach to capitalizing on available DeFi opportunities.

thecoinrepublic.com

thecoinrepublic.com