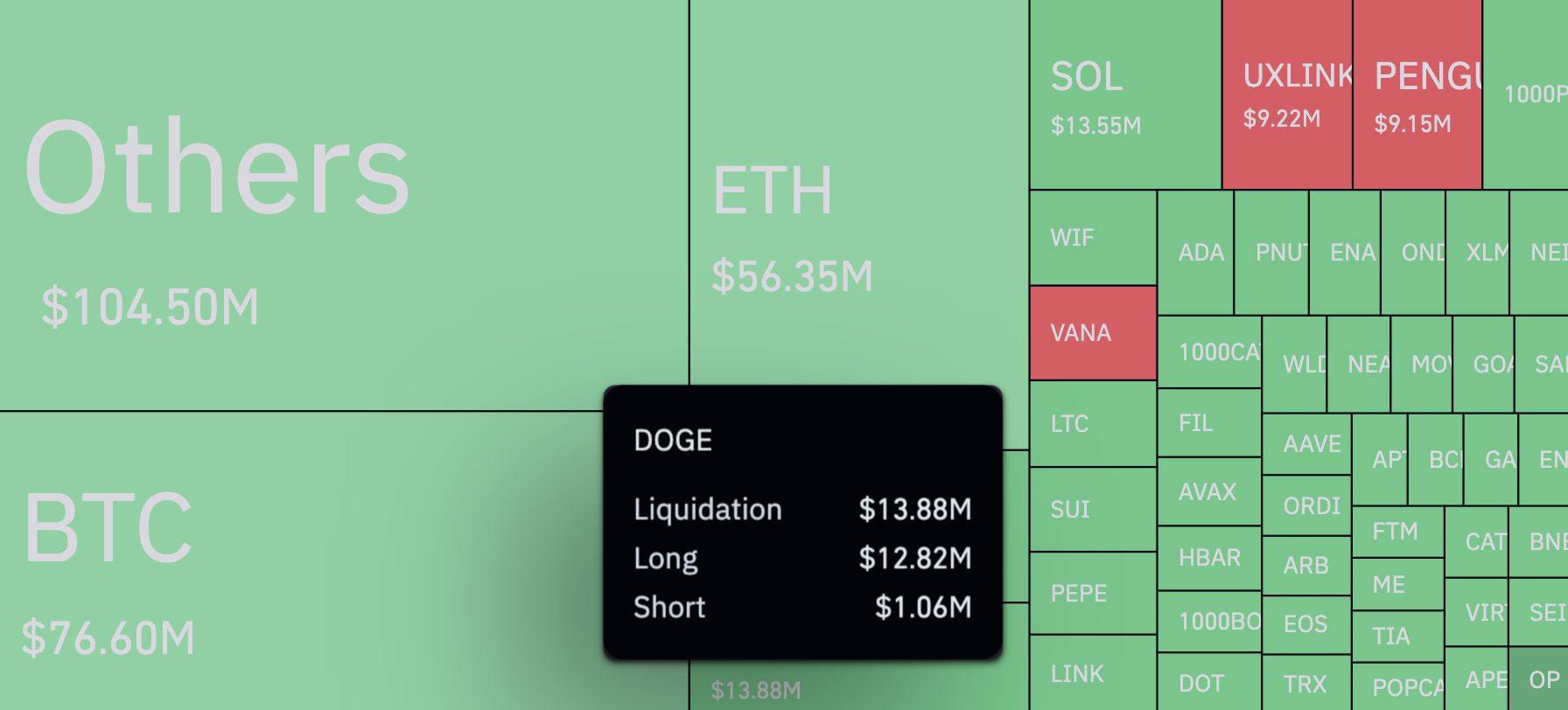

Anomalous activity has been detected in Dogecoin (DOGE) trading. As became known thanks to data from CoinGlass, derivatives trading with the popular meme cryptocurrency witnessed an abnormal imbalance in the last 24 hours. The total liquidated Dogecoin positions amounted to $13.88 million which, considering a total number for the cryptocurrency market at $402.63 million is not much, still makes DOGE one of the largest assets by this parameter.

However, the issue is not the size of Dogecoin liquidations, but their nature, as 92.36% of them are long positions. If we try to formulate an even wilder figure, the amount of liquidated longs is 1,209% more than the total of liquidated shorts. The reason is, as always, simple: latecomers or overleveraged traders fail to assess risk properly and, as a result, receive margin call notices from the exchanges.

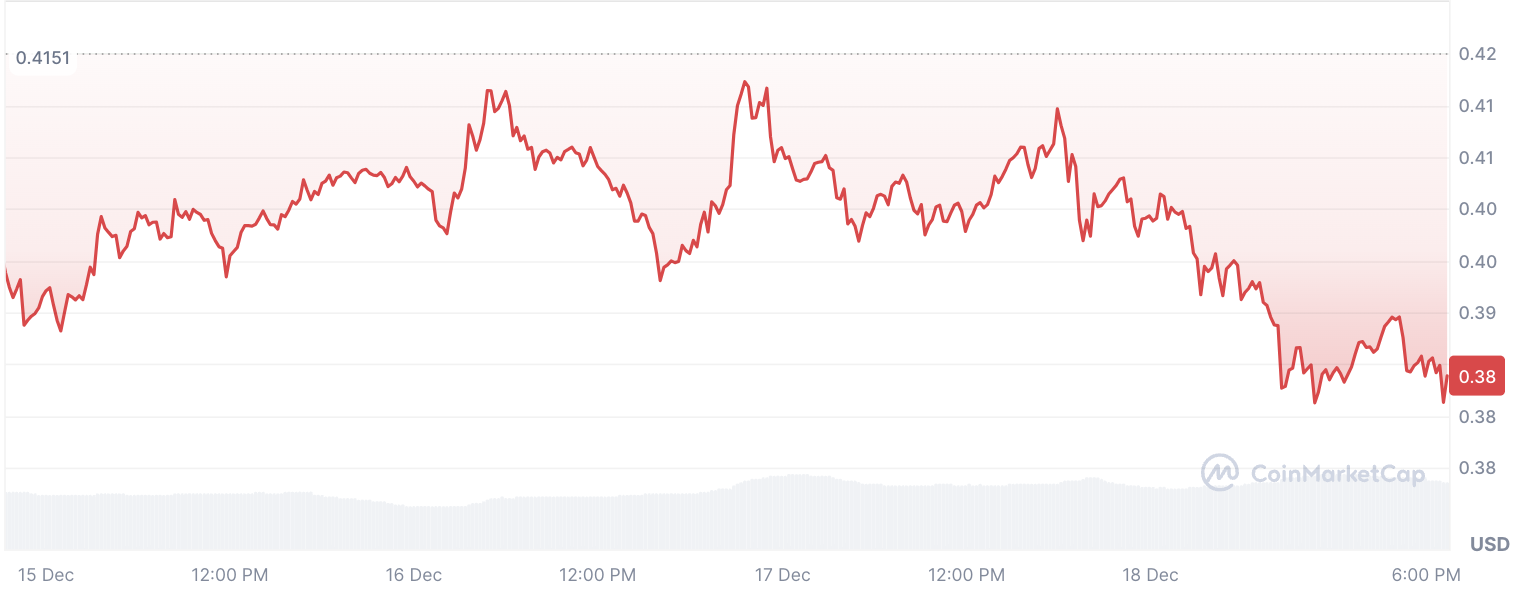

But what makes them do it? In the last 24 hours, the price of Dogecoin has been trading like it is about to perform a major pump, with a series of lower highs and higher lows. Considering the fact that Bitcoin was marking its all-time high at the same time, and that DOGE often follows the major cryptocurrency, the picture on the price chart looked promising.

However, the big sell-off at the start of today's trading brought the hopes of a DOGE breakout to zero and liquidated a large portion of long positions. After that, we saw another bounce today as the price of Dogecoin spiked up 1.5%. However, this was not successful and led to more bullish liquidation.

Bulls punished, bears celebrating — how long this trend will last remains an open question.

u.today

u.today