Analysts suggest Dogecoin is on the cusp of resuming its uptrend after an extensive consolidation period.

Shortly after Donald Trump’s election victory, the leading meme coin Dogecoin (DOGE) surged 220% from $0.15139 to $0.48434 as investors speculated that the incoming administration would support crypto.

While this rally has stalled in the past few weeks, with the doggy-themed crypto shedding some of its gains to trade around $0.38429, analysts now suggest it is ready for its next move.

Dogecoin (DOGE) Uptrend to Resume?

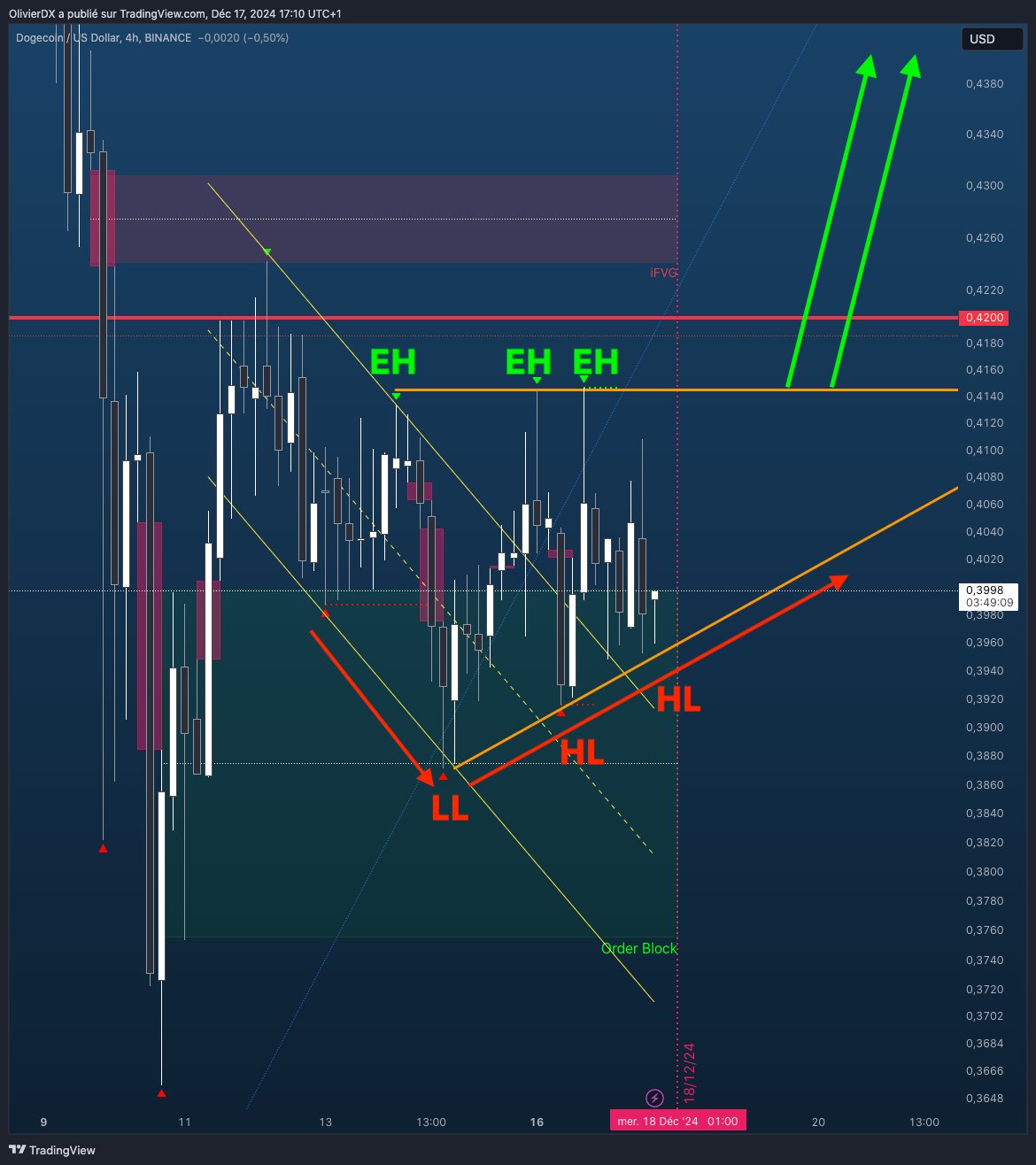

Crypto trader “Olivier Đ X” has suggested that Dogecoin’s price rally is set to resume. The analyst disclosed this in an X post on Tuesday, December 17, asserting that the meme coin was staging a price reversal to the upside on its 4-hour candle chart.

Per Olivier Ð X’s analysis, DOGE is completing a breakout of a descending channel on the 4-hour candle chart. According to the trader, the asset should resume its uptrend after breaking an emerging resistance around the $0.4140 price point. This pattern notably also has the potential to expand into an ascending triangle chart pattern.

Meanwhile, Olivier Ð X is not the only analyst who has suggested that Dogecoin’s rally is set to resume. On Tuesday, December 17, “The Cryptomist” asserted that the meme coin’s price was gearing up for a significant spike. The analyst expressed this view, citing an ascending triangle pattern on the asset’s daily candle chart.

While Olivier Ð X and The Cryptomist offer no price targets for the expected rally, analysts like Javon Marks have contended that DOGE is set to break its all-time high price of over $0.73 with conservative long-term targets of $3.

The recent views contending that the meme coin’s uptrend is set to resume come just as data suggests that investors may now be losing patience.

Dogecoin (DOGE) Sentiment Flips Negative

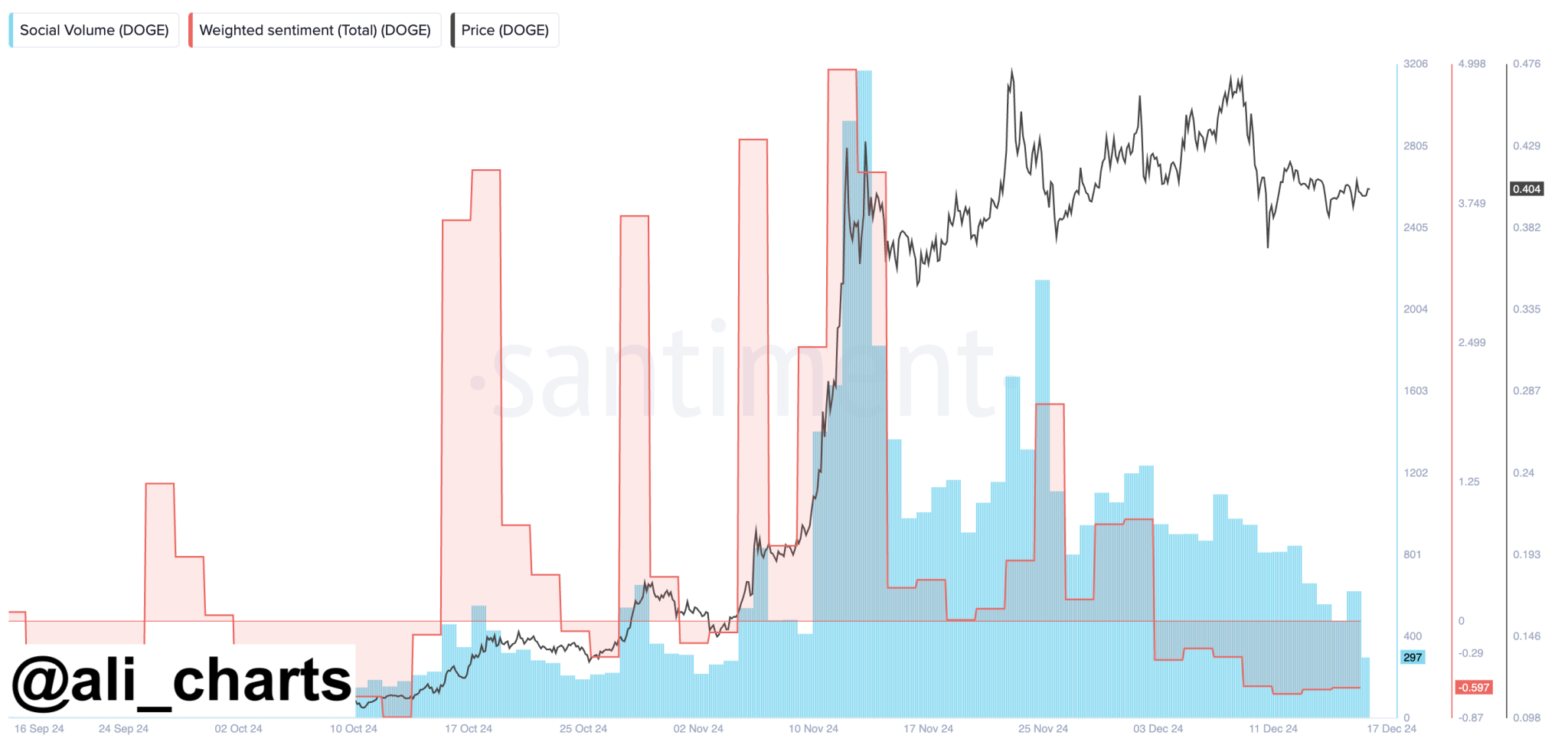

According to Sentiment Feed data shared by Ali Martinez on Tuesday, weighted sentiment around DOGE has flipped negative, dropping sharply from highs of nearly five on Santiment’s scale in mid-November 2024 to a negative 0.6.

At the same time, social mentions of the asset have also tanked from over 3,200 to below 300.

Santiment Feed has often tipped overwhelming negative sentiment as a contrarian indicator.

thecryptobasic.com

thecryptobasic.com