A concerning trend has emerged among young UK investors who are making crucial financial decisions at an alarming speed, with two-thirds finalizing important investment choices in less than 24 hours.

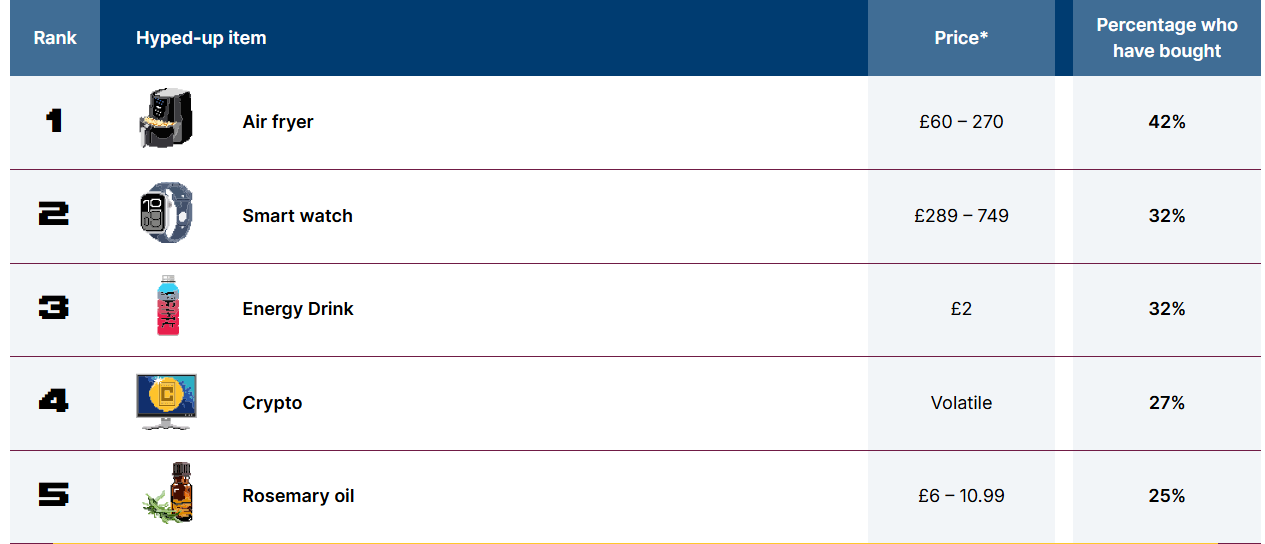

Moreover, according to the country’s market watchdog, they fail to see the difference between purchasing a hyped air fryer or smartwatch and buying Bitcoin or another trading product.

Young Investors Rush Investment Decisions, FCA Study Warns

The Financial Conduct Authority's (FCA’s) survey of 2,000 UK investors aged 18-40 reveals a striking pattern of rapid-fire investment decisions. A significant 14% of respondents make investment choices in under an hour, while only 11% take more than a week to evaluate opportunities.

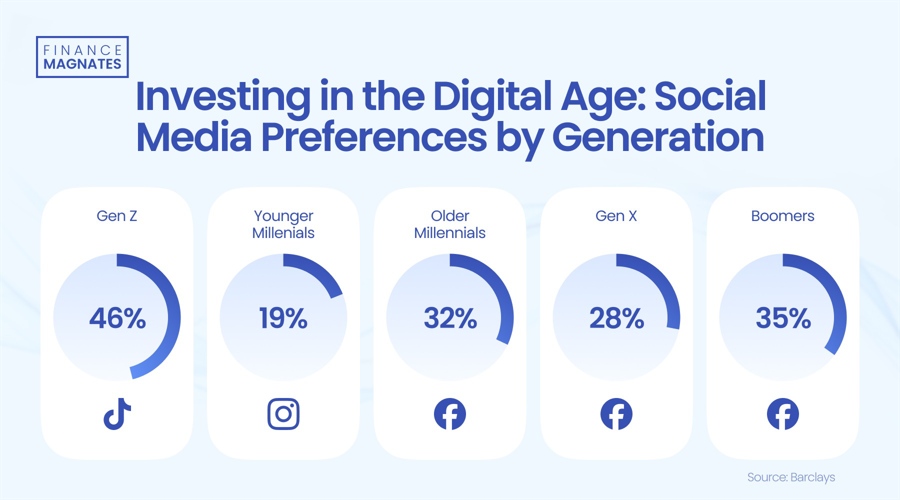

The digital landscape heavily influences modern investment behavior. An overwhelming 85% of young investors acknowledge the significant impact of platforms like Instagram, TikTok, and YouTube on their investment decisions. More notably, 43% rely on these platforms as their primary research tool.

“If you’re considering investing, the very first investment you should make is some of your own time,” Lucy Castledine, Director of Consumer Investments at the FCA, commented. “It's important to look beyond the hype, especially on social media, and do your research to make sure what you're investing in fits with your financial goals. Check out our 5 tips to InvestSmart.”

Finfluencers Became New Investment Advisers

A recent study by Barclays confirms the FCA findings that almost 50% of UK investors relying on social media for financial guidance. However, they may be exposing themselves to risk by neglecting to verify the credibility of financial influencers, often referred to as "finfluencers."

“As more people turn to social media for investment guidance, there is a clear demand for platforms to improve transparency around finfluencers' credentials,” commented Sasha Wiggins, CEO at Barclays Private Bank and Wealth Management. “This is crucial in tackling the threat of investment scams and preventing people from acting on unsuitable advice.”

These findings align with previous reports on the growing reliance on social media for investment decisions. In April, CMC Markets reported that one in three retail traders trust financial influencers more than their own family or friends.

Similarly, a study in Germany revealed that over half of young investors purchased trading products through influencer links, prioritizing social media personas over professional financial advisors.

Consumer Psychology

The fear of missing out drives 51% of young investors to invest more than initially planned. The average spend on hyped investment products reaches £550, with 40% of investors later expressing regret over their decisions.

“This important and timely research illustrates the worrying influence that hype and online trends are having on people’s decision making,” added Steve Martin, a behavioral scientist at Columbia Business School and the CEO of Influence At Work, added.

“Playing to people’s fear of missing out (FOMO) is a deliberate ploy designed to increase the attractiveness of a product. Less of an issue if the item is a low-cost consumer product. But spontaneous and hasty decisions about financial investments are concerning due to the risk of potentially regrettable and long-term implications.”

Investment patterns mirror viral consumer behavior, with cryptocurrency ranking fourth among trending purchases at 27%, following air fryers (42%), smart watches (32%), and energy drinks (32%).

financemagnates.com

financemagnates.com