- Ripple’s $RLUSD stablecoin debuts with backing from U.S. bonds.

- $XRP surges 122% in 30 days, reaching a 7-year high.

- The NY Financial Services Dept regulates Ripple USD.

Ripple, a major player in blockchain and cryptocurrencies, plans to release its stablecoin – Ripple USD ($RLUSD). It is linked to the US Dollar and launched on December 17. The dollar-backed stablecoin will be launched on the MoonPay, Uphold, Bitso, Archax, and CoinMENA platforms.

Additionally, It is backed by U.S. dollars, government bonds, and cash equivalents. Ripple introduced $RLUSD, and its price surge was seen recently, reaching a high of $2.82, 122% up from the previous month.

Regulatory Compliance and Market Expansion

Operational under the New York Department of Financial Services regulation, $RLUSD meets various banking rules for enhanced compliance and security. Transparency will be improved as Ripple intends to share monthly third-party attestations from the independent auditing firm. This may help strengthen confidence among users and investors in digital currency.

Concurrently, this could help expand the scope of its application in remittances and decentralized finance (DeFi). With the total market capitalization of stablecoins exceeding $200 billion this year, $RLUSD has a strong opportunity to seize a promising percentage of this growing market.

Potential Market Dynamics and Risks

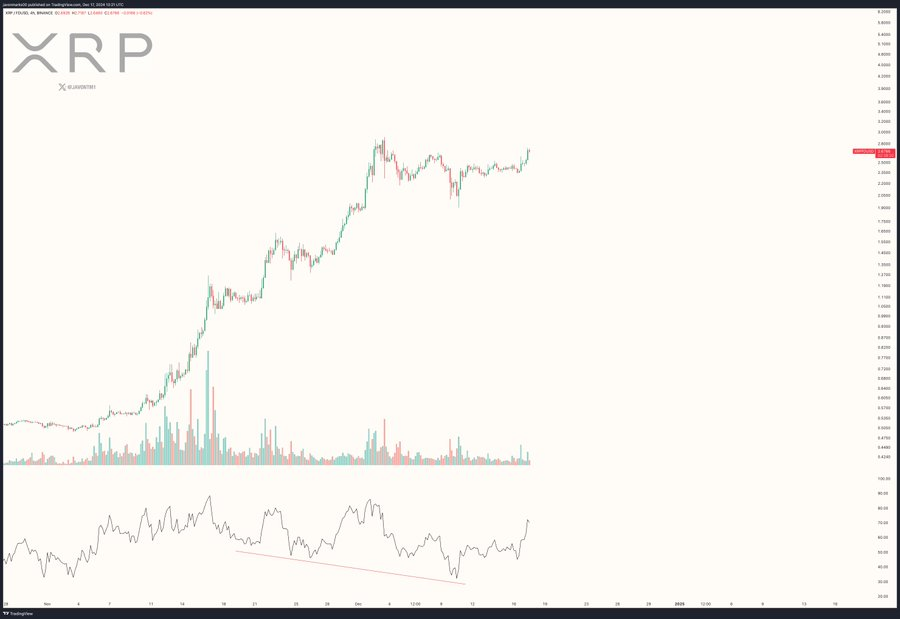

Javon Marks, an analyst, noted that the $XRP 4-hour chart shows a bullish trend line. The consolidation and smaller price range that the price bar has registered recently. Moreover, coupled with the bullish divergence registered in the RSI, signifies that a breakout is expected in $XRP.

Marks highlights high trading volume during price action in critical times, in which a combination of investor interest can push the price to high levels. He opines that if the current support hold and buying pressure are extended, $XRP might break and eclipse the previous levels to trade above $11, signaling a strong bullish run for the coin.

Concurrently, with the $RLUSD launch, Ripple expects it will add value to $XRP, especially in cross-border transactions. However, new stablecoins have some difficulty getting users’ acceptance. For instance, similar initiatives by some of the key players in the industry, such as PayPal, have relatively low adoption.

$RLUSD of Ripple has advantages over its predecessors due to the firm’s presence and the regulator’s approval, which can improve its market position. Nevertheless, the possibility of a ‘sell the news’ sentiment may affect $XRP’s price after launch, and the technical indicators show bearish signals if the coin reaches the $2.90 level.