Bitcoin (BTC) surged to a record high above $106,000, driven by President-elect Donald Trump’s plans for a strategic Bitcoin reserve and a surge in institutional demand.

The global cryptocurrency market has rebounded sharply from its sluggish start to the month, as hotter-than-expected consumer inflation data fueled optimism for a third consecutive U.S. Fed rate cut.

With the FOMC’s next decision scheduled for December 18, uncertainty lingers over inflationary pressures and the Federal Reserve’s path forward.

Yet, amid this economic volatility, certain digital assets are showing strong momentum and positioning themselves to achieve the coveted $25 billion market cap milestone.

Sui Network (SUI)

Sui Network (SUI) currently holds a market cap of $13.9 billion, and to reach a $25 billion market cap, it would need an additional $11.1 billion in value, a target that appears increasingly achievable given its rapid growth and market momentum.

The token has surged 521% year-to-date and 175% in Q4, consistently outperforming most altcoins.

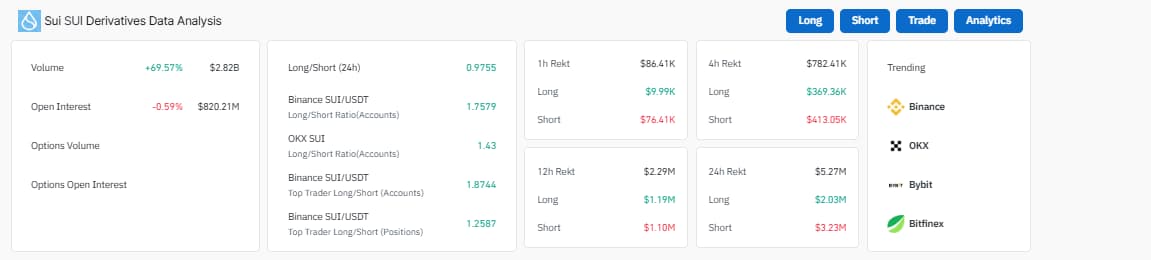

On-chain and derivatives data from CoinGlassfurther reinforce this bullish outlook. Sui’s derivatives trading volume soared 69.57% to $2.83 billion, while long/short ratios exceeding 1.4 on platforms like Binance and OKX reflect a strong bias toward long positions among traders.

Additionally, open interest remains robust at $820 million, signaling sustained confidence from both retail and institutional investors.

Ecosystem growth and partnerships

Sui’s ecosystem expansion has been another critical driver of its performance. Recent partnerships with Franklin Templeton and Babylon Labs have unlocked Bitcoin liquidity and enhanced its DeFi and Web3 capabilities, attracting new participants to its network.

Wallet integrations with Phantom and Backpack have further boosted accessibility and adoption, strengthening Sui’s position in the broader market.

Analysts have pointed to Sui’s price action as mirroring Solana’s (SOL) 2021 breakout when SOL rallied from single digits to an all-time high of $259.

Sui’s current consolidation after surpassing its March high resembles Solana’s pre-surge pattern, suggesting Sui could be on the verge of a similar parabolic move.

Adding to the optimism, Bitcoin’s historic surge to $106,000 has lifted sentiment across the crypto market, funneling capital into high-performing assets like Su

With strong technical momentum, increasing adoption, and Bitcoin’s rally providing a favorable market backdrop, Sui appears well-positioned to reach a $25 billion market cap by 2025.

Stellar Lumens (XLM)

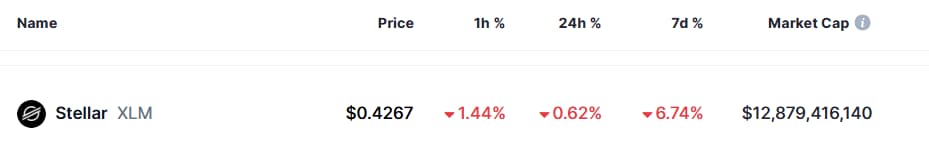

Currently holding a market cap of $12.87 billion, Stellar Lumens (XLM) would need to add approximately $12 billion to hit the $25 billion mark, a target that appears increasingly achievable based on its strong technical outlook and rising market confidence.

The weekly chart analysis reveals that XLM is nearing a critical breakout from its long-term downtrend that dates back to 2017.

Historically, such breakouts have led to significant price surges, and with XLM already delivering a substantial gain from its low of $0.12, momentum is clearly shifting in favor of bulls.

Stellar (1W)

— @CryptoELlTES (@CryptooELITES) December 16, 2024

When I shared it at $0.12, we’ve now achieved 300% profit.

📈 Targets:

1️⃣ $1.20

2️⃣ $3

The technical outlook is completely positive. The real rally will start once the long-term downtrend from 2017 is broken.#XLM $XLM #Stellar #Ripple pic.twitter.com/w7qC31NPI5

A confirmed breakout above this resistance could propel the price to $1.20 in the short term and as high as $3 in the longer term, following patterns seen in prior cycles.

Derivatives data indicates a bullish dominance

Further reinforcing this bullish trajectory, XLM’s derivatives data shows rising market interest. Trading volume surged 68.92% to $643.21M, and open interest climbed 3.52% to $219.44M, signaling growing commitments from traders.

Long positions dominate across platforms like Binance and OKX, with long/short ratios of 2.11 and 1.41, respectively, indicating a strong market bias toward upward movement.

Another critical factor for XLM’s growth is its correlation with Ripple (XRP), which has historically influenced Stellar’s performance. As Ripple gains traction with key developments like the RLUSD launch, a potential surge to $5 or beyond for XRP could serve as a major catalyst for XLM.

With strong technical indicators and market catalysts aligning, Stellar has the potential to rebound above $1 and push toward a $25 billion market cap by 2025.

That said, both Sui and Stellar are well-positioned to potentially achieve the $25 billion market cap milestone, fueled by robust ecosystem growth, strategic partnerships, and rising adoption across their respective networks.

However, given the inherent volatility of the cryptocurrency market, traders and investors must exercise caution, keeping a close eye on evolving trends, technical indicators, and key developments to navigate potential risks effectively.

Featured image via Shutterstock

finbold.com

finbold.com