Ondo Finance (ONDO) price action approached a significant resistance level at $1.75. ONDO crypto price chart indicated a recent uptick in price as it neared this resistance.

This resistance level previously acted as a ceiling for ONDO price movements, making it a focal point for potential breakout analysis.

The volume profile showed the Point of Control (PoC) was near the $1.75 level, affirming that it was not only a price resistance but also a zone of substantial trading activity.

This PoC highlighted where the most trading volume had occurred recently, indicating the area’s significance.

The analysis anticipate a strong “flip” off this $1.75 level—if it can be breached and converted into support, there could be potential for a 30%-40% bullish rally.

This expected rally above the $1.75 mark, suggested a target region around $3.00 if the breakout sustains.

The increasing volume accompanying the price’s approach to the resistance suggested rising momentum and trader interest, potentially fueling the breakout.

If ONDO successfully establishes support above $1.75, the volume and price stability above this level could catalyze and sustain the upward movement towards $3.00, aligning with the projected percentage increase.

This scenario hinges on maintaining the current momentum and the market’s response to breaking past the $1.75 resistance.

Whale Accumulation Continues for ONDO Crypto

Another metric to consider is the transaction record for ONDO that highlighted substantial acquisition activities by large investors, “whales.”

Recently, Onchain Lens reported transactions of ONDO token receipts from Coinbase to a single address, which in aggregate represented a whale accumulating 1,085,120 ONDO tokens, valued at approximately $1.83 million.

The record showed two large transactions each of 335,900 ONDO, valued at $571,536, occurring just 6 minutes ago.

Following these, a sequence of smaller but still considerable transactions took place, with amounts ranging from 60,816 to 121,966 ONDO. The significant dollar values, indicated hefty purchases.

In the past 10 hours, a whale has accumulated 1,085,120 $ONDO, worth $1.83M, from #Coinbase.

— Onchain Lens (@OnchainLens) December 11, 2024

0x15482c9b3Ec697E8eEA5b48BD1a8BF7b3cBa42D5 pic.twitter.com/8MQa7kigVW

The accumulation pattern could be critical as it reflects ongoing interest and investment from whales in the broader market.

Whale activity like this, often serve as a catalyst in crypto markets, influencing price movements due to the substantial capital and market share these entities control.

The recent purchases suggested confidence from high-net-worth investors in ONDO crypto’s potential growth, aligning with market speculations that such accumulation could drive price towards $3.

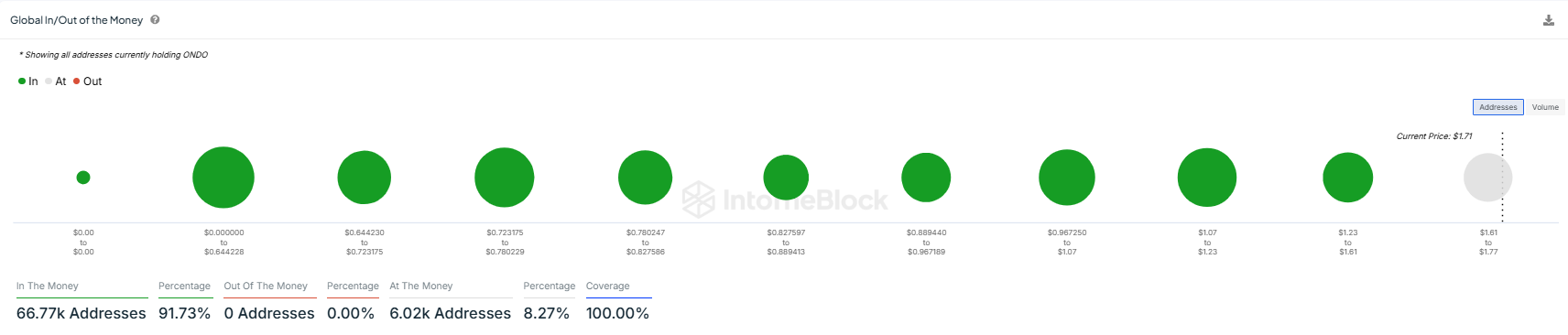

ONDO’s Global In/Out of The Money

The Global In/Out of the Money for ONDO relative to the current price of $1.71, as of press time, indicated 91.73% of the addresses holding ONDO were ‘In the Money’. This meant majority of investors currently enjoy profits on their holdings.

Conversely, 0.00% are ‘Out of the Money’, denoting no current holders were at a loss, reflecting strong past price performance or buying patterns below price.

Additionally, 8.27% were ‘At the Money’, indicating these holders purchased around the current price level. The dominance of profitable holders sets a potentially optimistic sentiment in the market.

Considering the substantial portion of holders profiting, there could be potential for ONDO crypto to reach $3, as profitable investors could be incentivized to hold or buy more, anticipating further gains, thus potentially driving the price upward.

This positive sentiment, coupled with ongoing profitability among holders, supports the possibility of ONDO achieving higher price in the near term.

thecoinrepublic.com

thecoinrepublic.com