Uniswap’s price has rallied, crossing a crucial resistance level, with many crypto experts predicting further gains ahead.

Uniswap ($UNI) token surged to $19.44, its highest level since December 2021, as crypto momentum continued to strengthen.

This rally coincides with robust inflows across decentralized exchange (DEX) networks. Data indicates that DEX platforms handled over $372 billion worth of tokens in November, marking the largest monthly increase on record.

Uniswap alone processed $30.86 billion in volume over the last seven days, solidifying its position as the industry leader. Its volume significantly exceeded that of competitors like Raydium and PancakeSwap combined. Over its lifetime, Uniswap has facilitated over 465 million trades worth more than $2.36 trillion.

Uniswap’s price is also gaining momentum as traders anticipate the launch of UniChain, the platform’s independent Layer-2 chain. UniChain aims to enable seamless cross-chain trading on a single platform. Currently in the testnet phase, UniChain is set to launch early next year.

At the same time, there are rising odds that the Trump administration will abandon the case brought against Uniswap by the Securities and Exchange Commission. The SEC alleged that the company provided securities on its platform without registration.

Uniswap price analysis

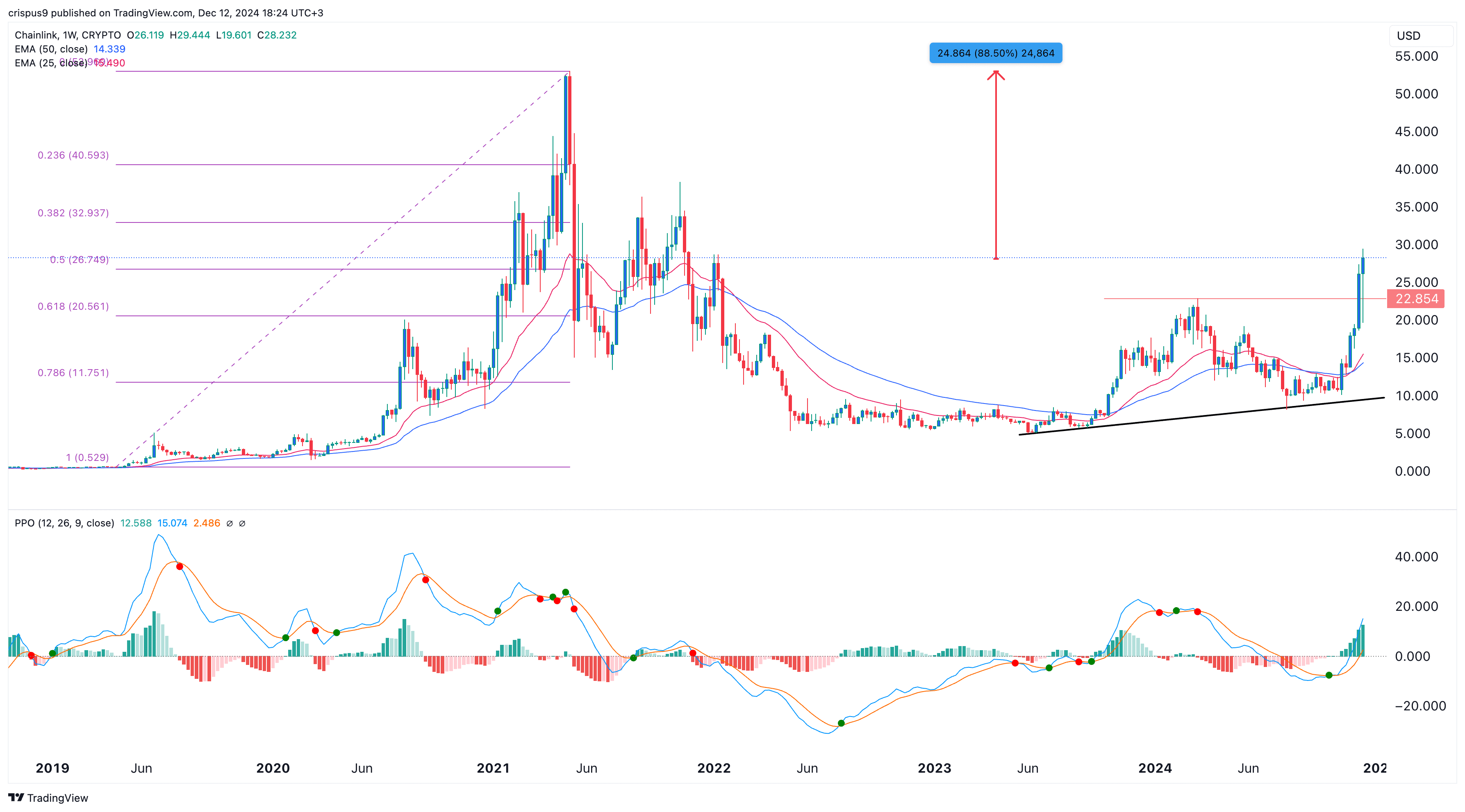

The weekly chart reveals that $UNI has formed a slanted triple-bottom pattern, a bullish reversal indicator. The price has broken above the pattern’s neckline at $17.13, suggesting that bulls are firmly in control.

$UNI is also approaching the 38.2% Fibonacci Retracement level at $19.23. Furthermore, it has moved above the 50-week moving average, while the MACD indicator and Relative Strength Index are both trending upwards.

The path of least resistance for $UNI appears bullish, with a long-term target of $50, representing approximately a 180% increase from the current level. This aligns with predictions from analysts like Crypto Tigers predict.

For this to happen, Uniswap price will need to rise above the 50% retracement point at $24 and its all-time high of $45.