$XRP’s price action has been under pressure in recent weeks as it struggles to break through the key resistance level of $2.73. Investors had been hoping for a breakout above this level to push the altcoin to new all-time highs ($ATH), but the delay has led to rising profit-taking activity.

This hesitation and subsequent selling have shaken investor confidence, with many choosing to secure gains at the current price levels rather than holding out for further upside.

$XRP Investors Are Pessimistic

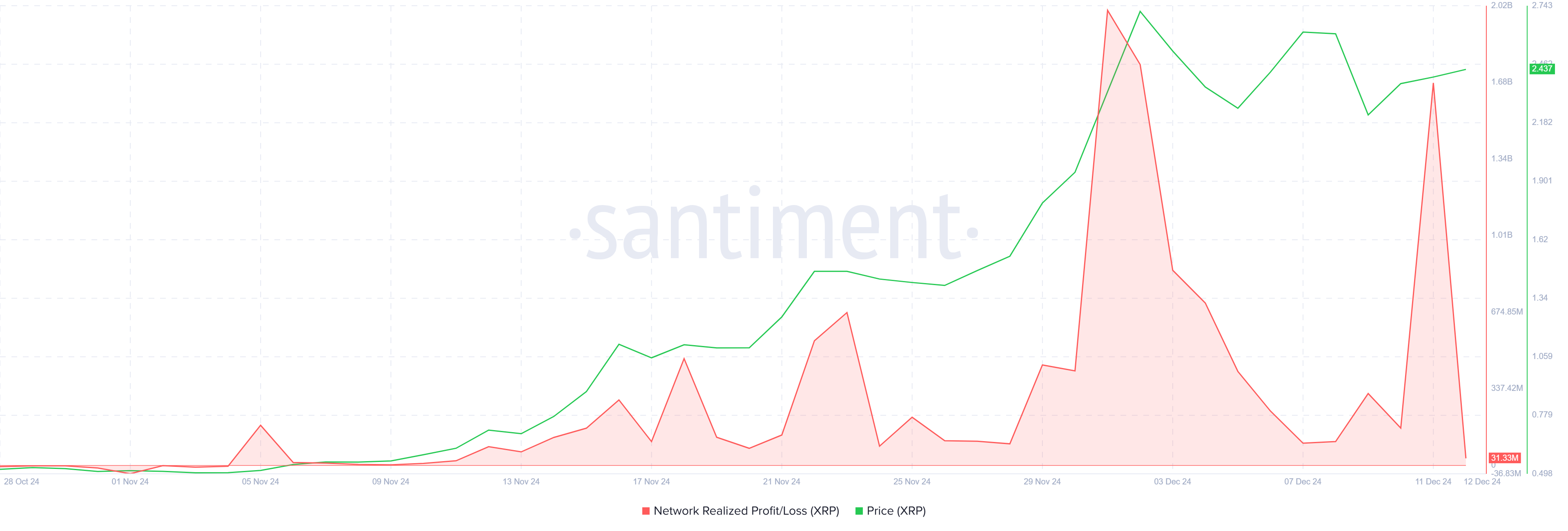

Profit-taking has intensified as $XRP’s price fails to break past the resistance at $2.73, with many investors opting to cash in on recent gains. This behavior is evident in the spike in realized profits, a key indicator of selling pressure.

Realized profits measure the gains taken when coins are moved to new addresses, and their rise shows that $XRP holders are choosing to lock in profits rather than wait for further price increases. This trend is a concerning signal for $XRP’s short-term price outlook.

As more investors take profits, it creates a negative feedback loop that erodes the altcoin’s momentum. While profit-taking is a normal market reaction, the high levels of selling indicate that investor sentiment is beginning to wane.

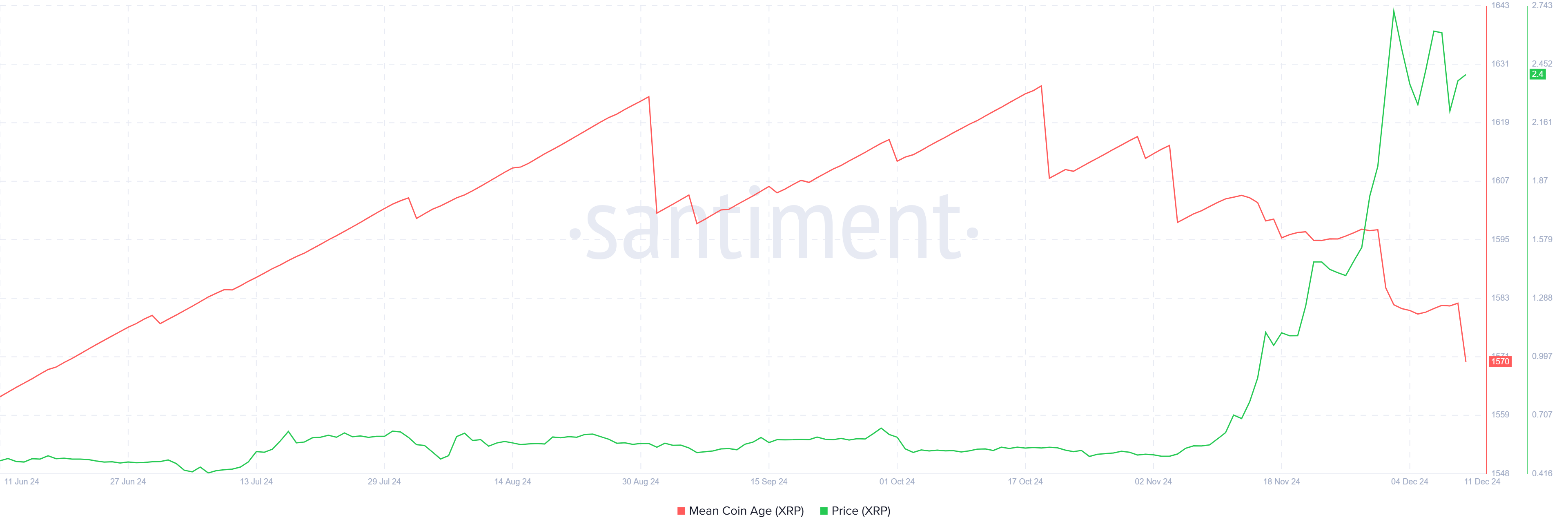

The broader macro momentum for $XRP has been less than ideal. One of the key indicators of investor confidence, the Mean Coin Age (MCA), has been steadily declining over the last few weeks. This measure tracks the average age of coins in circulation, and its decline suggests that long-term holders are losing interest in holding $XRP.

Despite the bullish momentum in the broader cryptocurrency market, $XRP has failed to capture significant gains, which is impacting overall market sentiment. Even with the market experiencing strong rallies, $XRP’s inability to rally in a similar manner is causing many to reconsider their positions. This weak macro momentum is further affecting the asset’s price stability and investor conviction.

$XRP Price Prediction: Looking For A Breakout

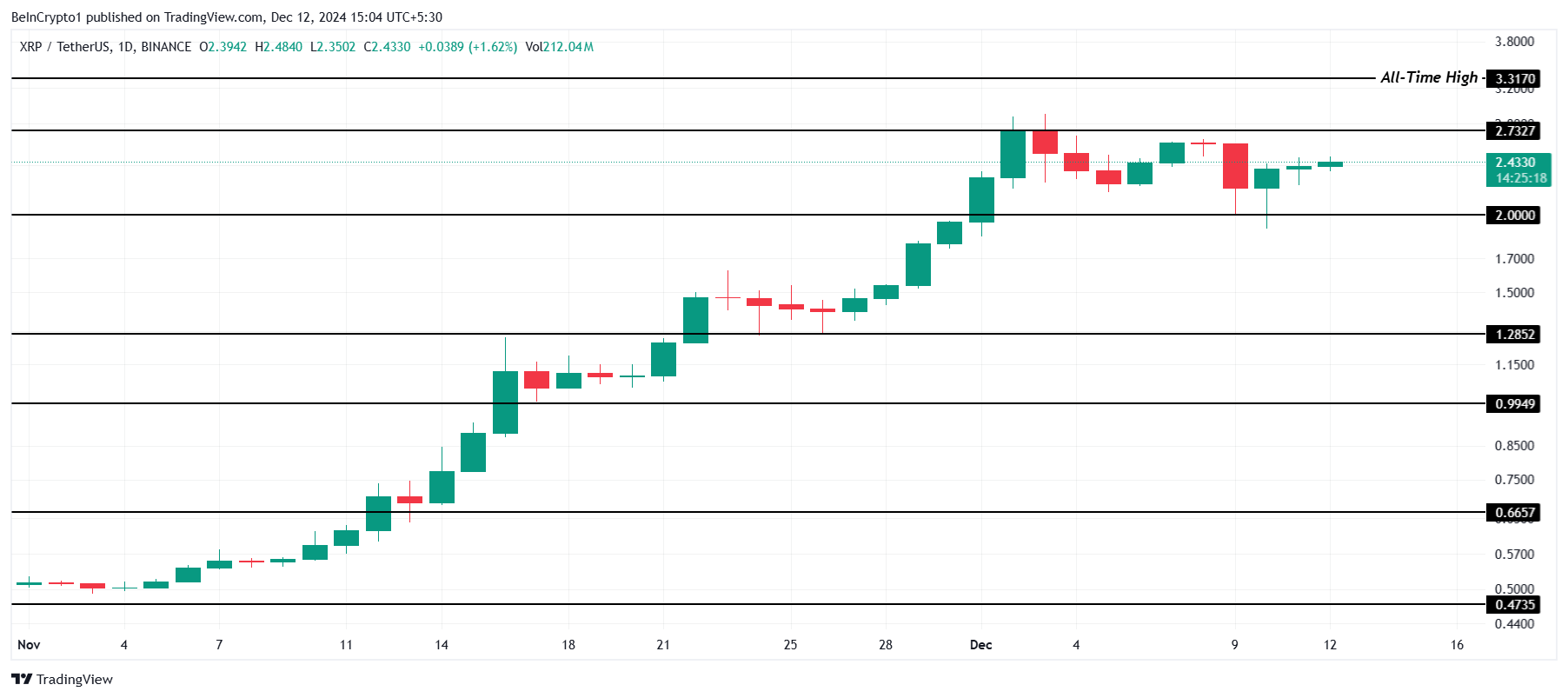

$XRP’s current price of $2.43 is facing resistance at the $2.73 mark, a critical level that stands between the altcoin and a new all-time high ($ATH) above $3.31. The proximity to this barrier creates both an opportunity and risk for investors as the token approaches a pivotal point in its price action.

Despite the potential for upside, bearish factors suggest that $XRP may remain consolidated within the range of $2.73 and $2.00. Macroeconomic conditions have tempered the market sentiment around $XRP, leading to cautious movement. Investors should keep an eye on this range for further price direction.

For the bearish outlook to be invalidated, $XRP must break above $2.73 and flip this resistance level into support. Such a move would open the path for a retest of the $ATH at $3.31, signaling renewed bullish momentum. Until then, $XRP’s price action remains in a holding pattern with limited upward momentum.

beincrypto.com

beincrypto.com