Chainlink price continued its strong uptrend as it rose for three consecutive weeks, reaching its highest level since January 2022.

Chainlink ($LINK), the biggest oracle network in the blockchain industry, rose to a high of $26.40, pushing its market cap to over $16 billion.

The rally coincided with the ongoing accumulation by whales.

In an X post, Lookonchain identified one whale who moved $LINK coins worth over $9.6 million from Binance and moved them to $AAVE ($AAVE). The investor then borrowed 4 million and deposited to Binance, possibly to buy more $LINK.

According to Etherscan, another whale moved Chainlink coins worth $7.16 million from Coinbase to a self-custody wallet. Another whale moved $LINK tokens worth over $2 million to OKX.

Whale accumulation is often seen as a good catalyst for cryptocurrency because of the volume of their transactions. Altogether, Nansen data shows that the number of Chainlink coins on exchanges stood at over 253.4 million, a few points lower than last week.

Meanwhile, according to Santiment, the ongoing $LINK surge happened with very little fear of missing out. As such, the crypto analytics firm expects that the coin will continue rising.

🔗📈 Chainlink has enjoyed a late-week rally, and now needs to climb just +10.8% to match its 3-year high from January, 2022. It is encouraging that there is very little retail FOMO toward $LINK. Markets move the opposite direction of the crowd's expectations, so the crowd's… pic.twitter.com/UuKdmMMXWA

— Santiment (@santimentfeed) December 6, 2024

Chainlink price flips key resistance level

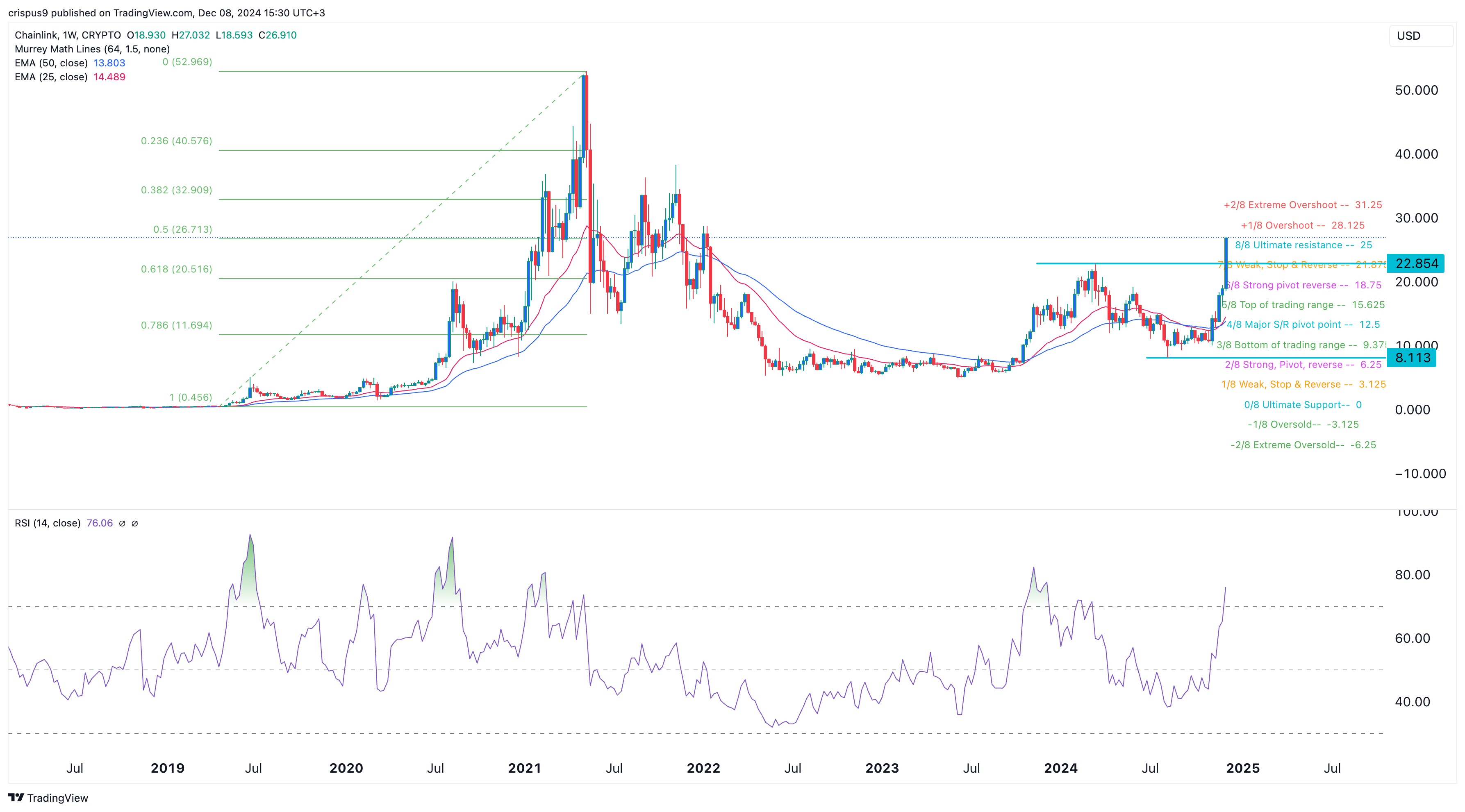

The weekly chart shows that the $LINK price made a strong recovery in the past few weeks. It has now flipped the key resistance level at $22.85 into support as this rally accelerated. That was an important price because it was the highest swing on March 11.

Chainlink price has moved to the 50% Fibonacci Retracement level and also flipped the ultimate resistance of the Murrey Math Lines tool. It remains above the 50-week and 100-week moving averages.

Therefore, the immediate short-term target for the $LINK price will be at $31.25, the extreme overshoot of the Murrey Math Lines. In the long term, the coin may double and retest the all-time high of $52.

The bullish view will become invalid if the price drops below the key support at $22.85. A drop below that level could see it fall below $20.