-

Aptos [APT] has recently surged beyond the $14 threshold, prompting analysts to set their sights on the potential for $20 amidst bullish trends.

-

Market indicators show a healthy trading environment, with significant buyer interest pushing APT prices upward following recent technical breakthroughs.

-

According to analyst Michaël van de Poppe, “As long as key support levels hold, we might see APT aiming for $20.”

Aptos [APT] continues its bullish run beyond $14, signaling potential growth to $20 as buyer interest remains strong. Key support levels are crucial.

Momentum Builds as Aptos Surpasses Key Resistance

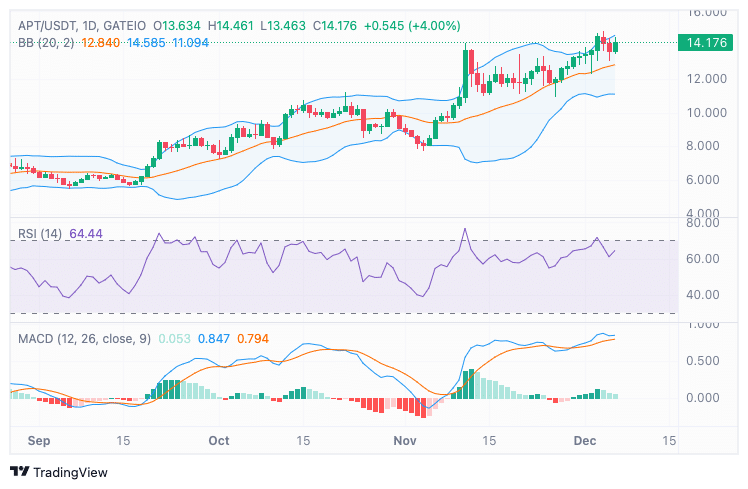

In a remarkable display of market strength, Aptos has not only crossed the $14 mark but is also demonstrating significant bullish momentum. Analysts observe that the recent breakout from the $11.30–$11.50 range, which previously posed resistance, has established a new support area, fueling hopes for further upward price action. This resilience in price suggests that if APT successfully retests these support levels, it could embolden more buyers to enter the market.

Analyzing Resistance Levels and Market Sentiment

Currently trading at approximately $14.24, APT has witnessed a 0.99% price increase in the last 24 hours and a 12.85% surge over the past week. Market analysts are keeping a close watch on two pivotal resistance levels: the first at $13.80–$14.00, which aligns with a previous swing high, and the second near $17.00, marking a historical resistance zone. A break beyond these levels could catalyze a rapid ascent towards the $20 target, although traders are advised to be wary of potential profit-taking activity, as shown by increased APT deposits on exchanges.

Technical Indicators Suggest Upward Potential

Recent technical analysis provides encouraging signs for APT. The Relative Strength Index (RSI) is currently at 64.44, indicating strong bullish momentum while avoiding overbought conditions. This suggests the price may have further room to grow without experiencing a significant downturn. Additionally, the Moving Average Convergence Divergence (MACD) confirms positive market sentiment, with the MACD line positioned above the signal line, and histogram bars reflecting sustained buying pressure.