The $AMP token experienced a robust rally, reaching $0.0144, its highest level since March 11.

Ampere ($AMP) has surged by about 300% from its yearly low, pushing its market capitalization to over $910 million.

The surge coincides with a broader shift into older cryptocurrencies that outperformed in 2021, following notable surges in names like Stellar Lumens (XLM) and Ripple (XRP).

$AMP’s utility in the payment industry, particularly for its fast transaction speeds and low costs, has supported its price growth. Recently, $AMP technology was integrated into Flexa, a growing payment network for e-commerce.

$AMP’s price also rose as crypto analysts expressed bullish sentiments about the coin. In a statement, CJ Bennet, a popular crypto analyst, noted that the coin was poised for more gains, potentially reaching a record high.

$amp

— CJ Bennett (@the_real_CJ) December 4, 2024

Patience prevails, my friends. Trust in the winning tech, and you'll be just fine. We have not only tapped the next zone that captured the measured expansion from the previous pennant, but it's also blown right through it and started to move up towards the major milestone… pic.twitter.com/oyENTiyqGE

Amp’s all-time high was $0.037, meaning that it still needs to gain 235% from its current level to reach that milestone.

The coin is also gaining as investors celebrate the arrival of altcoin season. Data from CoinMarketCapshows the altcoin season index has climbed to over 80, while the fear and greed index has risen to 88. Most altcoins tend to perform well during periods of high market greed.

Meanwhile, there are signs that $AMP whales are accumulating the coin. According to Etherscan, one whale moved tokens worth over $2 million from Coinbase, which is seen as a bullish signal.

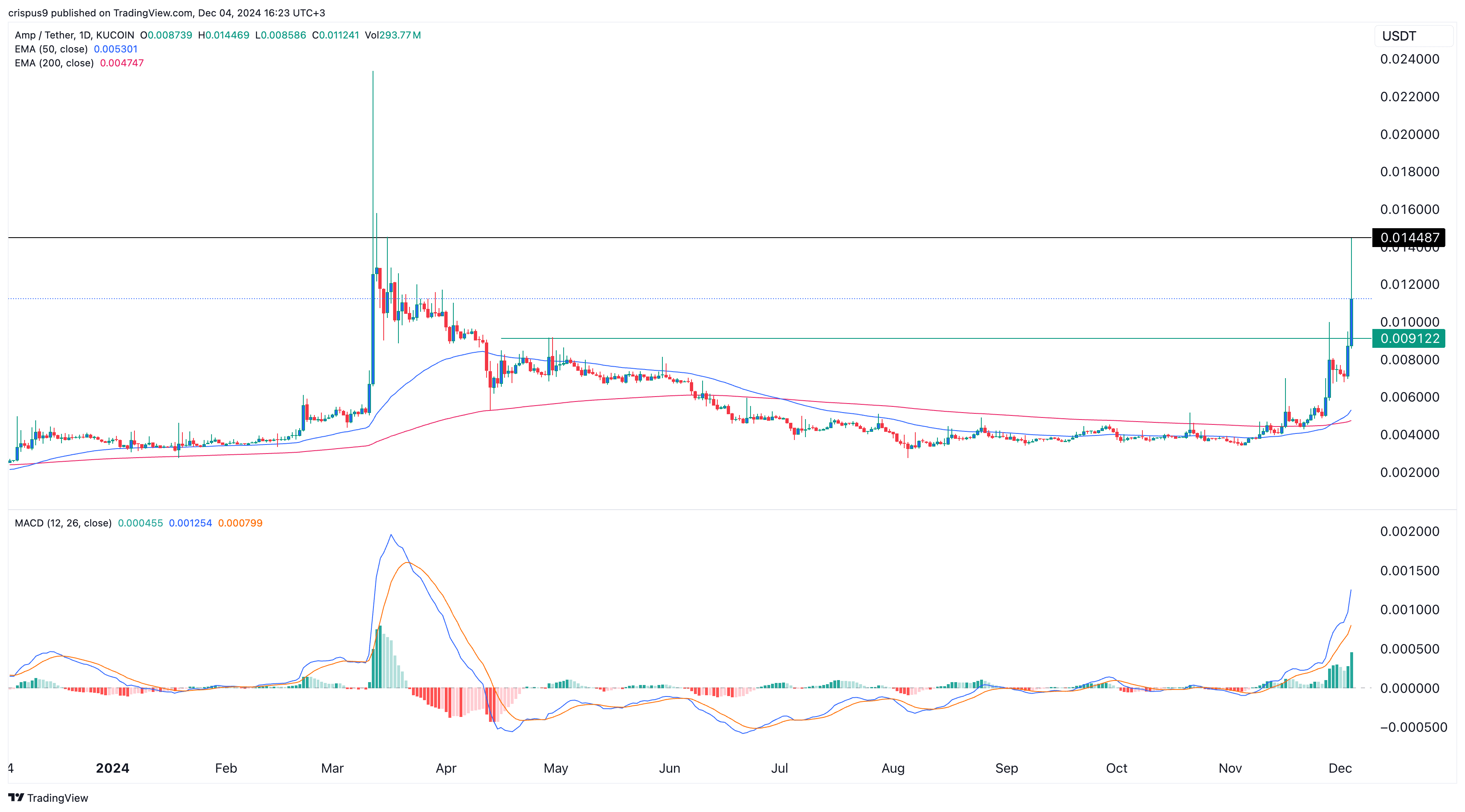

$AMP price analysis

The daily chart shows that the $AMP token price experienced a strong bullish breakout, reaching a high of $0.01450. It surpassed the crucial resistance level at $0.0091, its highest point on April 29.

The coin has formed a golden cross pattern as the 200-day and 50-day moving averages crossed each other.

The MACD and the Relative Strength Index also indicate upward momentum. Therefore, $AMP needs to close above this week’s high of $0.01450 to confirm the bullish trend. A close below this high could validate a shooting star pattern, a common bearish indicator. If that occurs, the price may drop and retest the support at $0.0091.