XRP is still at the top of the cryptocurrency market, up 20% in just one day, reaching $2.44. As of right now, its market capitalization is $132 billion, making it the fourth-largest cryptocurrency in terms of market value. Along with increasing investor optimism, this spike has spurred discussions about whether XRP will soon hit $3.

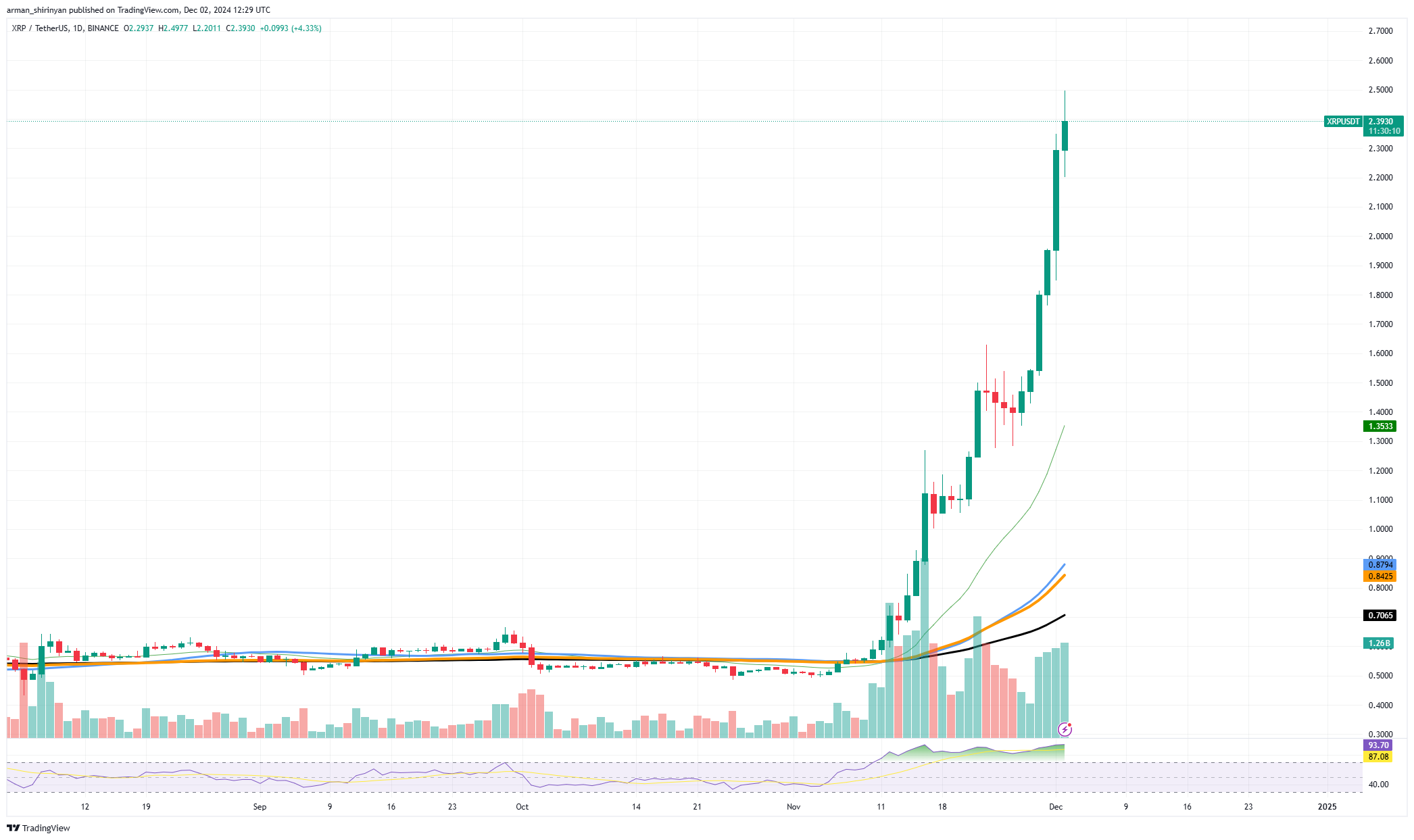

According to the price chart, XRP has experienced a parabolic rise, decisively surpassing several resistance levels, including the noteworthy $2 milestone. Strong trading volume backs this upward trend, especially on South Korea's Upbit exchange, where it hit $3.69 billion. XRP's distinct position in the current market cycle was highlighted by the noticeably lower trading volumes of Ethereum and Bitcoin. Now the question is whether XRP can continue on this path and reach $3.

Given the current momentum, it seems likely. Around $2.75 is the next important resistance level which, if broken, could open the door to a $3 breakout. With a price above $3, XRP will reach new heights for this rally, possibly reaching $3.50, contingent on market circumstances and sustained interest from institutional and retail investors. But it is important to remember that XRP's RSI is at 87, which indicates that the market is overbought.

This increases the possibility that there will be a consolidation or pullback period prior to another leg up. The levels of $1.70 and $2.20 are important support levels to keep an eye on since they serve as buffers in case of a correction. The ascent of XRP to $3 is now a reality. With record-breaking trading volumes and strong fundamentals, this ambitious goal has a strong basis.

Shiba Inu gains attention

With an outstanding breakout, Shiba Inu has drawn market attention and strengthened its position above the critical $0.00003 level. This movement demonstrates fresh momentum as SHIB has effectively surmounted significant resistance levels, driven by robust buying interest and increasing trading volumes.

According to a chart analysis, the recent rally indicates that SHIB is emerging from a period of consolidation, propelled by an increase in market activity. A positive indication is the price's continuous upward momentum, even though it briefly touched $0.000031 before retracing slightly. The 21 EMA has served as reliable support, and the strength of this move was further supported by the breakout and a spike in trading volume.

Staying above $0.00003 is not assured though, particularly in light of the larger market dynamics. The overall state of the cryptocurrency market is still unstable, and SHIB's RSI is overbought at 70, indicating that there may be a brief correction or consolidation. The amount of $0.000027 might provide instant support in the event of such a pullback, with $0.0000249 being the next crucial level to keep an eye on.

On the plus side, additional gains might be possible if SHIB can maintain its position above $0.00003. Based on market sentiment and ongoing bullish momentum, a successful move past $0.000032 could lead to $0.000035, or even $0.00004. SHIB will require sustained support from the larger market, especially from Bitcoin and Ethereum, which frequently drive altcoin movements in order to continue on its upward trajectory.

Bitcoin not ready?

Bitcoin appears to be stalling as it approaches the much-awaited $100,000 milestone. The cryptocurrency seems to be consolidating below $98,000 after a notable rally in recent weeks, which begs the question of whether the bullish momentum is waning or merely stalling for a larger market move.

According to the chart analysis, Bitcoin is presently trading close to $96,000, which is just below the psychological resistance level of $100,000. A break above this level, which serves as a significant barrier, might start the subsequent surge of bullish momentum. As market sentiment cools and profit-taking quickens, a pullback is more likely the longer Bitcoin struggles to recover $100,000.

The recent breakout zone and the 21 EMA are in line with $90,400, which is key support. Bitcoin may move toward the $80,400 support, which is in line with the 50 EMA and acts as a robust safety net for the current bullish trend if it breaks below this level, which could indicate additional bearish pressure.

With a current Relative Strength Index of 71, the market is overbought. Although this is not necessarily a sign of bearishness, it does imply that the market may go through a period of consolidation or a brief correction before attempting to rise again. Strong buying pressure is necessary to break through the current resistance levels in order for Bitcoin to regain its upward momentum and move toward $100,000. Bulls may be able to reopen the path toward $100,000 and possibly $105,000 if they can push the price above $98,000 with significant trading volume.

u.today

u.today