This is a segment from the Empire newsletter. To read full editions, subscribe.

When Covid rolled across the world — bringing about lockdowns and meme stocks — we all took the news of swans and dolphins reclaiming Venice canals as a positive sign.

Perhaps the whole ordeal had a silver lining. A moment for the natural world to stretch its wings and humans to reassess their consumption habits.

Sadly, it was fake news. There were no dolphins in Venice canals and global coal output has ramped up after the pandemic. The Earth never really made it any closer to returning to its original state.

Nearly five years later, crypto is currently on the lookout for its own fake dolphin news. A signal that altcoin season will actually return at scale, and massive returns along with it.

Maybe it’s XRP flipping SOL as markets briefly rotate out of AI and memecoins.

“Altcoin season” as a concept has, however, been diluted in the waiting. The definition used here in the Empire newsletter is a conservative one, meant to reserve the label for periods in which returns are both sustained and enormous.

And we’re indeed getting closer.

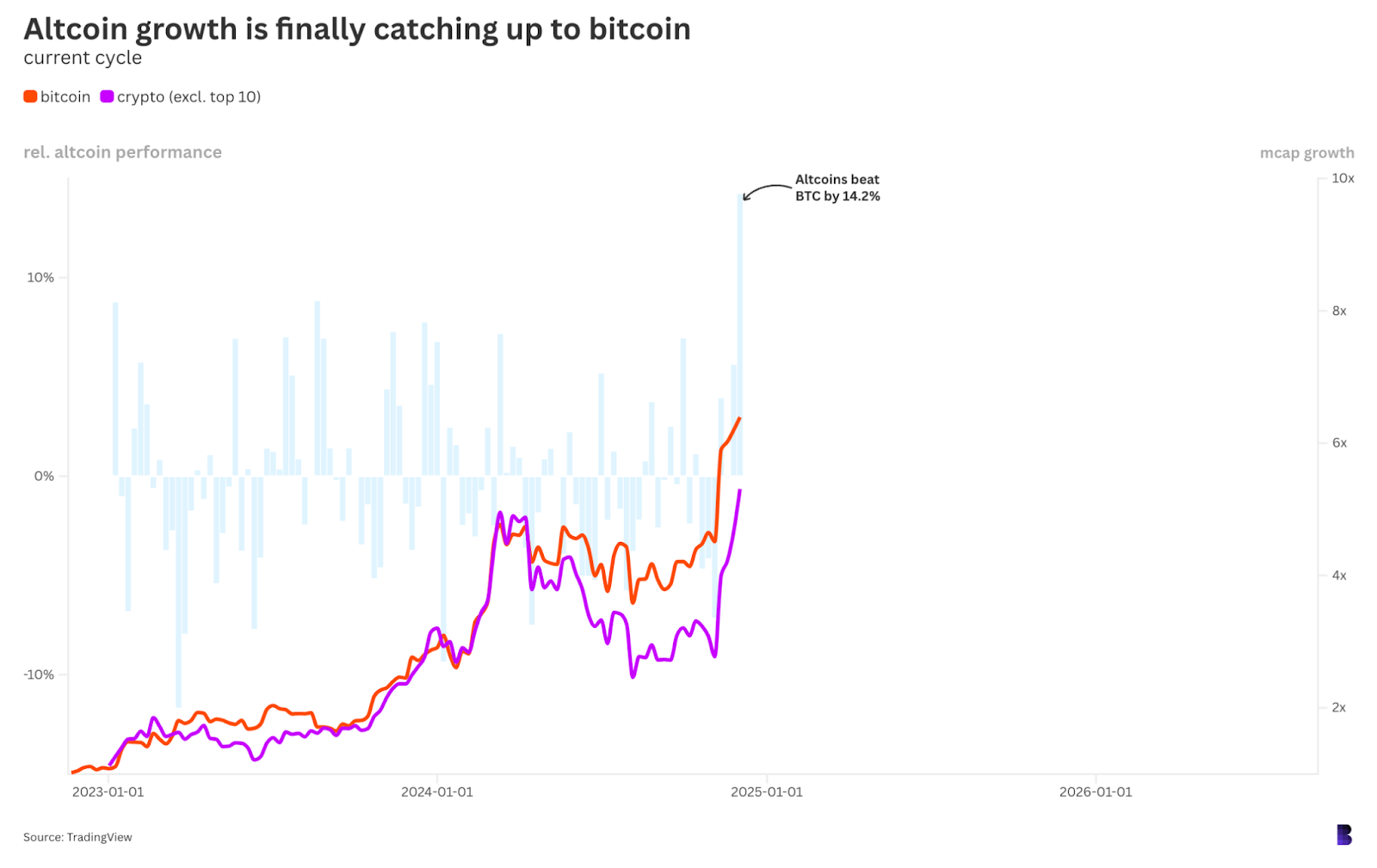

Altcoin season: When the market cap growth of altcoins — as represented by everything outside of the top 10 — eclipses bitcoin’s since the bottom of the cycle for three months or more.

So, altcoin season can potentially start when the purple line on the chart above surpasses the orange line. As that happens fairly often, altcoin season is only properly confirmed once it has beaten bitcoin for capitalization growth over an extended period — when the altcoin pumps are real enough to retain it all.

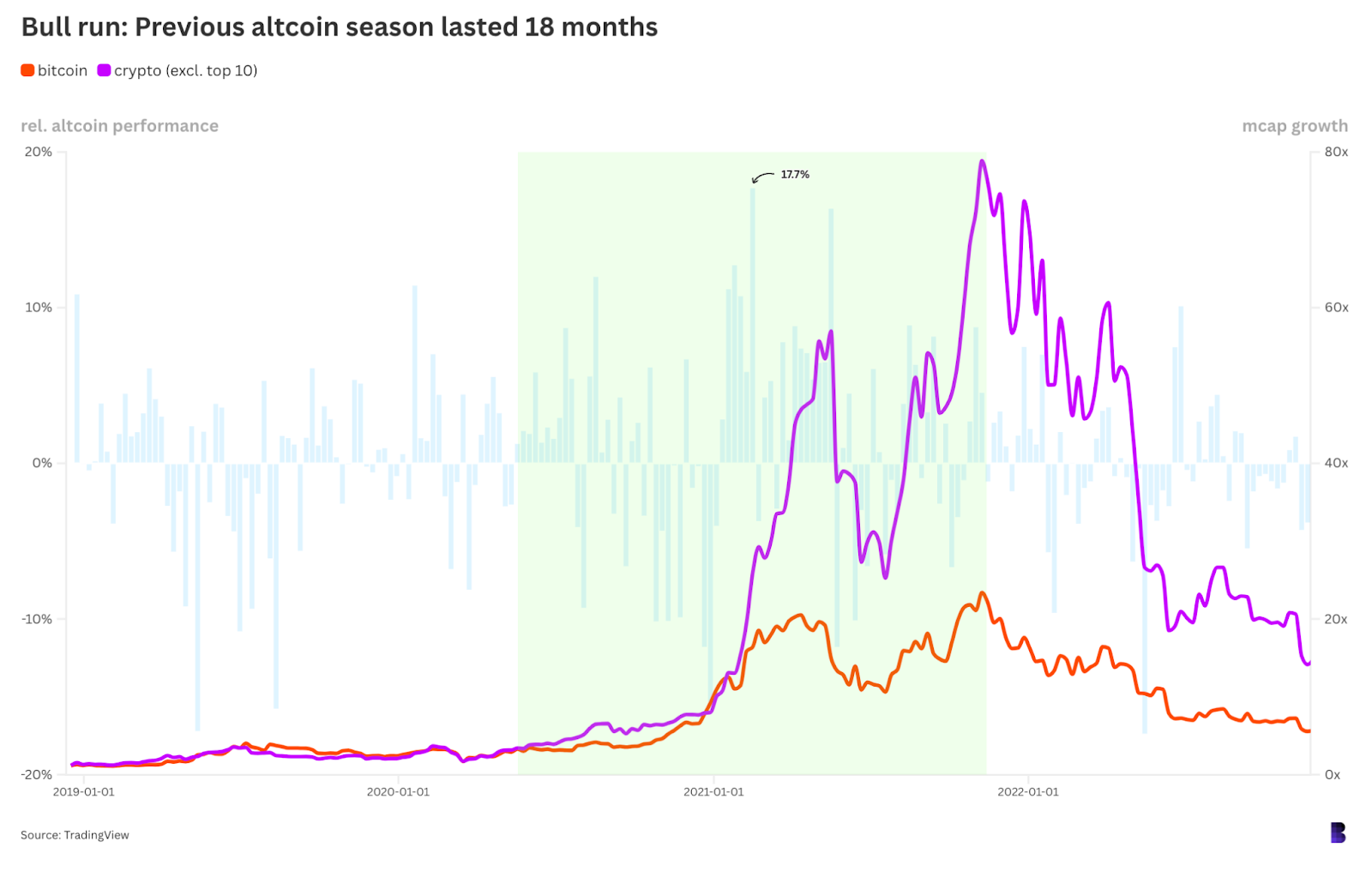

It’s a retrospective model. Running it back gives three distinct altcoin seasons since 2016, and the latest ended when the previous bull run topped out in November 2021.

That season lasted for bitcoin’s entire bull run, spanning a year and a half. That’s now 1,118 days ago, the longest gap by far.

Here’s the good news: The altcoin market just posted its best weekly performance (moving average) against bitcoin for this entire cycle, which started in November 2022.

BTC’s market cap shrunk by 0.3% while the altcoin market (minus the top 10) grew by 13.9% — a difference of 14.2%.

From here, the capitalization of altcoins would only need to rise by around 20% for our first condition to be met, with bitcoin trading sideways.

Sounds like a lot. But the altcoin market has more than doubled in the past five weeks alone.

Crypto is healing.

blockworks.co

blockworks.co