After most of the year was marked by choppy price action, November was the beginning of a strong bull run in the wider cryptocurrency market. At present, traders are eagerly waiting for leading digital asset Bitcoin (BTC) to cross the $100,000 threshold, although many are suggesting that it could first experience a flash crash.

In the meantime, altcoin season seems to have kicked off — driven by the allure of outsized returns, investors are flocking to cryptocurrencies with smaller market caps or even meme coins.

One of the most impressive rallies since the uptrend kicked off can be seen with Hedera (HBAR), the 19th largest cryptocurrency by market capitalization, which has made significant headway in the preceding period.

At press time, HBAR was trading at $0.23953 — after an 18.91% gain on the daily chart supplemented by weekly returns up to 65.76%. Looking at the last thirty days, Hedera prices have increased by a staggering 426.94%, bringing year-to-date (YTD) returns up to 178.17%.

While doubtlessly impressive, it’s still an open question as to whether or not this momentum can be sustained. For additional clarity, Finbold has consulted one of the most advanced publicly available large language models (LLMs) to shed light on where HBAR could be trading at by the end of 2024.

ChatGPT-4o outlines bullish and bearish factors affecting HBAR

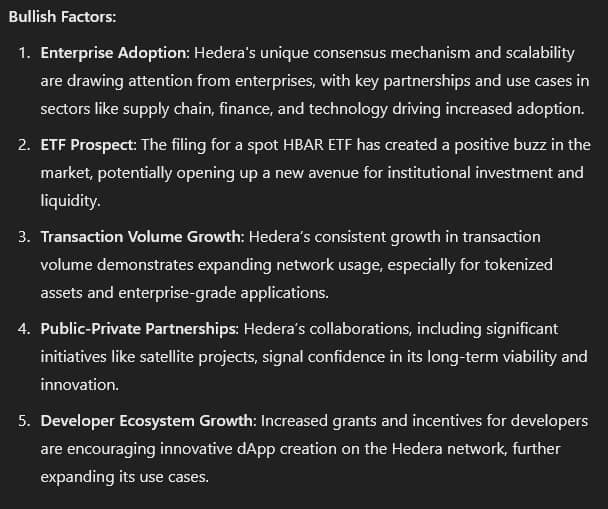

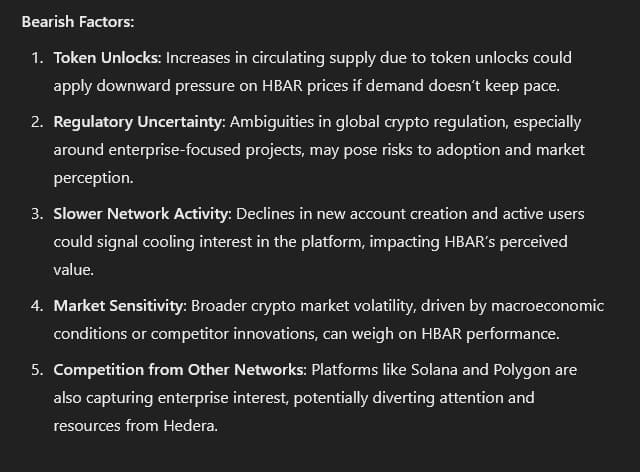

Several key factors were identified by OpenAI’s ChatGPT-4o as being relevant to HBAR’s performance in the closing month of the year. On the bullish side of the aisle, the model noted Hedera’s unique consensus mechanism and scalability, which is driving enterprise adoption, as well as Hedera’s numerous partnerships and collaborations.

Additionally, it highlighted the prospect of an HBAR exchange-traded fund (ETF) as a potential bullish catalyst — Canary Capital intends to open one such fund, per a November 12 SEC filing.

Lastly, increased grants for developers and consistent transaction volume growth, indicative of a robust ecosystem, were mentioned.

As for bearish factors, GPT-4o reflected on the usual regulatory uncertainty that surrounds cryptocurrencies, while also emphasizing worries surrounding the increase in circulating supply and decline in new account creation that could exert downward pressure on HBAR. To cap it off, the AI model mentioned that Hedera could potentially lose ground to networks like Solana (SOL) or Polygon (POL)

ChatGPT-4o sets Hedera (HBAR) price targets for the end of 2024

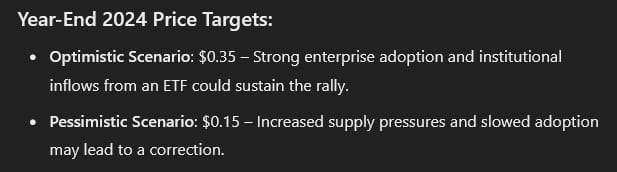

It’s impossible to state which of the many factors that were discussed will end up prevailing in the wider scheme of things — but the AI model did set two price targets, based on a broadly bullish and broadly bearish scenario.

In the first case, GPT-4o predicted that HBAR prices could reach as high as $0.35, if strong enterprise adoption is sustained and the asset experiences significant capital inflows from the aforementioned Canary Capital ETF.

Should Hedera reach that mark, prices will have surged by 46.1% from current levels.

On the flipside, if the expected level of adoption does not come to fruition and token unlocks increase circulating supply by a significant amount, Hedera could crash to as low as $0.15 — which would represent a 37.4% decline from current prices.

Featured image via Shutterstock

finbold.com

finbold.com