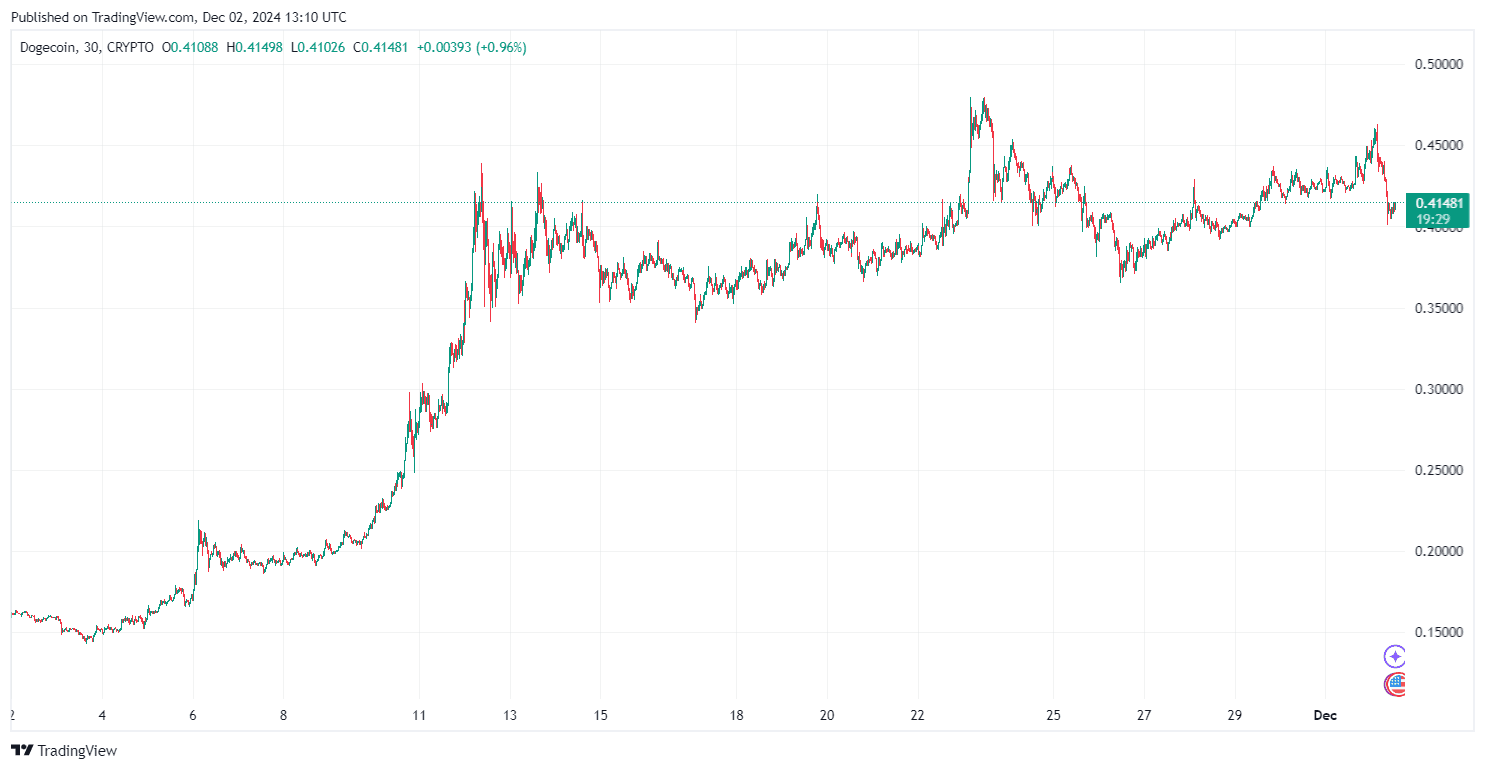

Dogecoin (DOGE) has captured significant attention as its price surges toward the critical $0.50 mark. While technical indicators suggest bullish momentum, warnings of a potential sell signal raise questions about its trajectory. This article explores the current market sentiment, price dynamics, and critical factors shaping Dogecoin’s potential to achieve new highs.

Dogecoin Price Analysis: Is DOGE Price Eyeing $0.50?

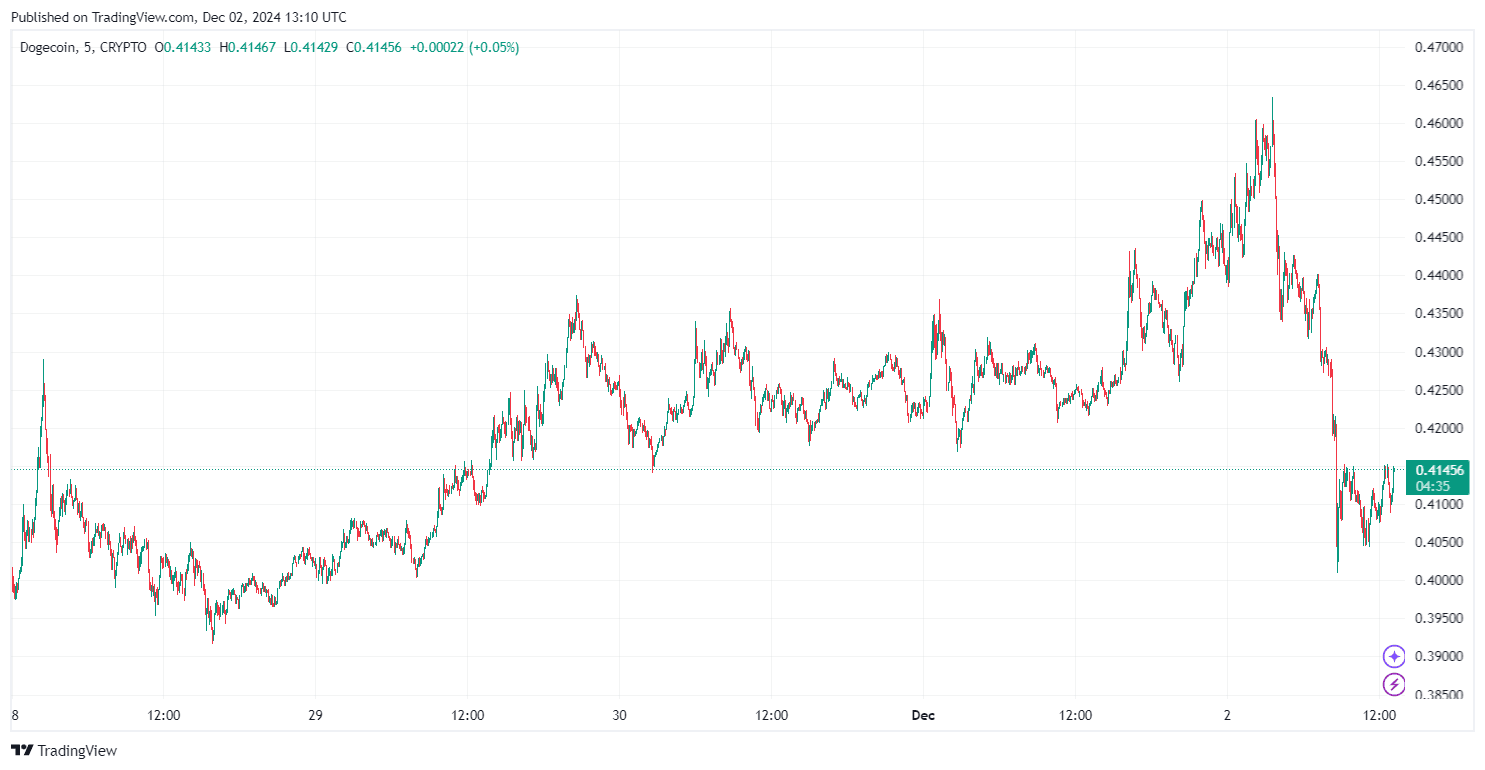

Dogecoin recently experienced a robust rally, climbing above the $0.4250 and $0.4400 levels, supported by a strong bullish trend line. Currently trading above the $0.4350 mark and the 100-hourly simple moving average, the price is consolidating near $0.450. Immediate resistance is seen at $0.4550 and $0.4640, with a close above $0.4720 potentially propelling DOGE toward the $0.50 milestone.

If bullish momentum holds, Dogecoin could test the $0.5200 level. However, failure to clear $0.4500 may lead to a downside correction, with support levels at $0.4400, $0.4300, and critical support at $0.4150. A drop below these levels could expose DOGE to declines near $0.4000 or $0.3800.

Dogecoin Price Prediction: Will $0.50 Be Reached or Is a Pullback Looming?

1- Crypto Analyst Insights: Bearish Signals on the Horizon?

Despite recent gains, some analysts remain cautious. Crypto expert Kevin (@Kev_Capital_TA) warns of a potential sell signal as Dogecoin exhibits bearish technical indicators, including a declining MACD and a Stoch RSI nearing a bear cross. Kevin notes that while the weekly chart shows bullish price action, downside risks persist.

He highlights $0.60 as a critical resistance level, asserting that breaking it would signify a significant bullish breakthrough. Meanwhile, macroeconomic trends, such as a potential altcoin season triggered by Bitcoin dominance dropping below 55%, could act as a catalyst for DOGE’s strength.

2- Pi Cycle Top Indicator: A Tool for Long-Term Decisions

Kevin also emphasizes the Pi Cycle Top Indicator—a tool typically used for Bitcoin—as a reliable predictor of DOGE market tops. This method, which tracks the crossing of the 111-day and 350-day moving averages, has accurately signaled Dogecoin's previous cycles. Kevin plans to reduce his holdings once these indicators align with an elevated Monthly RSI, signaling a likely market peak.

3- Short-Term Optimism vs. Long-Term Uncertainty

Despite looming bearish signals, Dogecoin remains in a favorable position in the short term, boasting its highest monthly close. However, the convergence of bearish indicators and resistance levels highlights the need for caution among traders. The $0.50 target remains plausible, but surpassing $0.60 is crucial for sustained bullish momentum.

Dogecoin’s price dynamics reveal a delicate balance between bullish aspirations and bearish risks. While immediate targets like $0.50 seem achievable, key resistance levels and macroeconomic factors will determine its long-term trajectory. Traders should closely monitor technical indicators, support levels, and broader market trends to navigate DOGE’s volatile landscape.

cryptoticker.io

cryptoticker.io