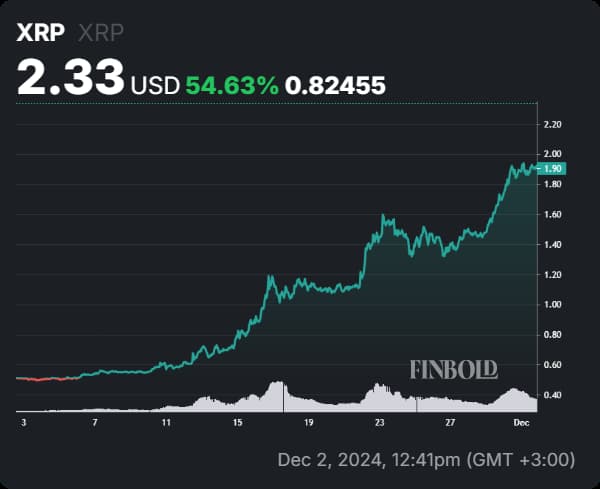

XRP is on an upward tear, with the cryptocurrency trading at its highest price level in about seven years while sustaining significant capital inflows.

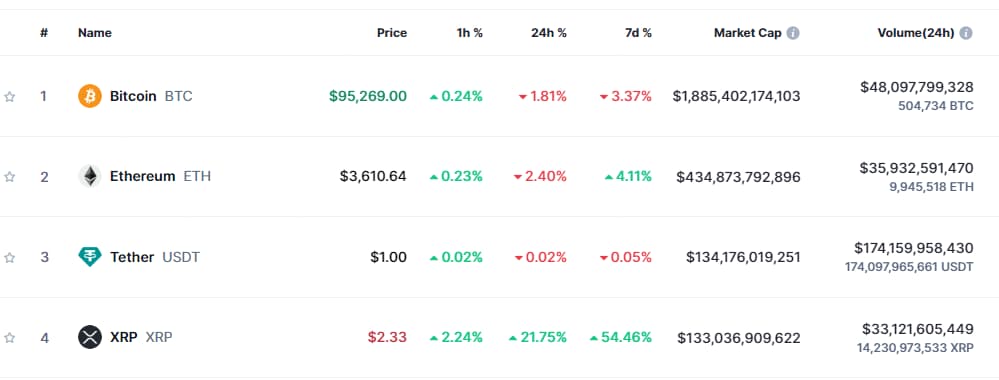

To put this momentum into perspective, in the last 24 hours, XRP has recorded an inflow of about $26 billion, bringing its market cap to $133 billion as of press time.

This inflow has elevated XRP to the world’s third-largest cryptocurrency by market capitalization.

Regarding price movement, the asset was valued at $2.33 at the time of writing, reflecting a 20% growth in the past 24 hours. Over the past week, the Ripple-affiliated digital currency has surged by over 50%, with gains exceeding 270% in the last month.

Investing in XRP

With XRP seemingly establishing a solid upward trajectory after years of consolidation, the question arises: Is it too late to invest in the asset?

At its current valuation, XRP is relatively cheap and shows potential for further growth. Now, a cryptocurrency trading expert, using the pseudonym Mags, offered insights in an X post on December 2 regarding whether to invest in XRP.

According to the analyst, XRP is trading significantly higher than its recent accumulation phase at $0.35. As such, it might not offer the same risk-to-reward ratio it once did.

While further gains are possible, the expert noted that the most profitable opportunities typically arise during low volatility and sideways price action.

To this end, he revealed plans to close 75% of his XRP holdings following the recent price surge, intending to rotate into projects with higher upside potential that have not yet experienced similar rallies.

Despite taking partial profits, the trader remained bullish on XRP, forecasting a potential price target of $4 during this market cycle.

The analyst suggested that XRP is currently in its parabolic phase, advising investors to wait for the asset to re-enter its accumulation phase before purchasing.

In his view, XRP follows four phases: the blow-off top, first bounce, accumulation, and parabolic phases. He emphasized that the first three phases offer the ideal opportunity to invest.

Drivers of XRP rally

XRP’s resurgence has been influenced by Donald Trump’s election victory and Gary Gensler’s announced departure as Chair of the Securities and Exchange Commission (SEC).

The rally also coincides with reports that the New York Department of Financial Services may approve Ripple’s RLUSD stablecoin, which is expected to launch on December 4.

Additionally, speculation surrounding a potential XRP exchange-traded fund (ETF) has fueled the asset’s rally. If such a product is approved, it could drive XRP to new highs.

As it stands, XRP is now targeting the $3 mark, with technical indicators supporting this potential move. For instance, the cryptocurrency is trading well above its 50-day ($0.82) and 200-day ($0.62) moving averages (MA), reflecting a solid uptrend.

However, the Relative Strength Index (RSI) at 92.51 indicates extreme overbought conditions, suggesting a potential correction ahead.

Featured image via Shutterstock

finbold.com

finbold.com