NanoGPT is an artificial intelligence (AI) hub that exclusively takes crypto for payments to pay-per-use dozens of premium AI models. Finbold covered NanoGPT’s launch and growth while also reporting on its competitors like PayPerQ, a Bitcoin (BTC)-first platform.

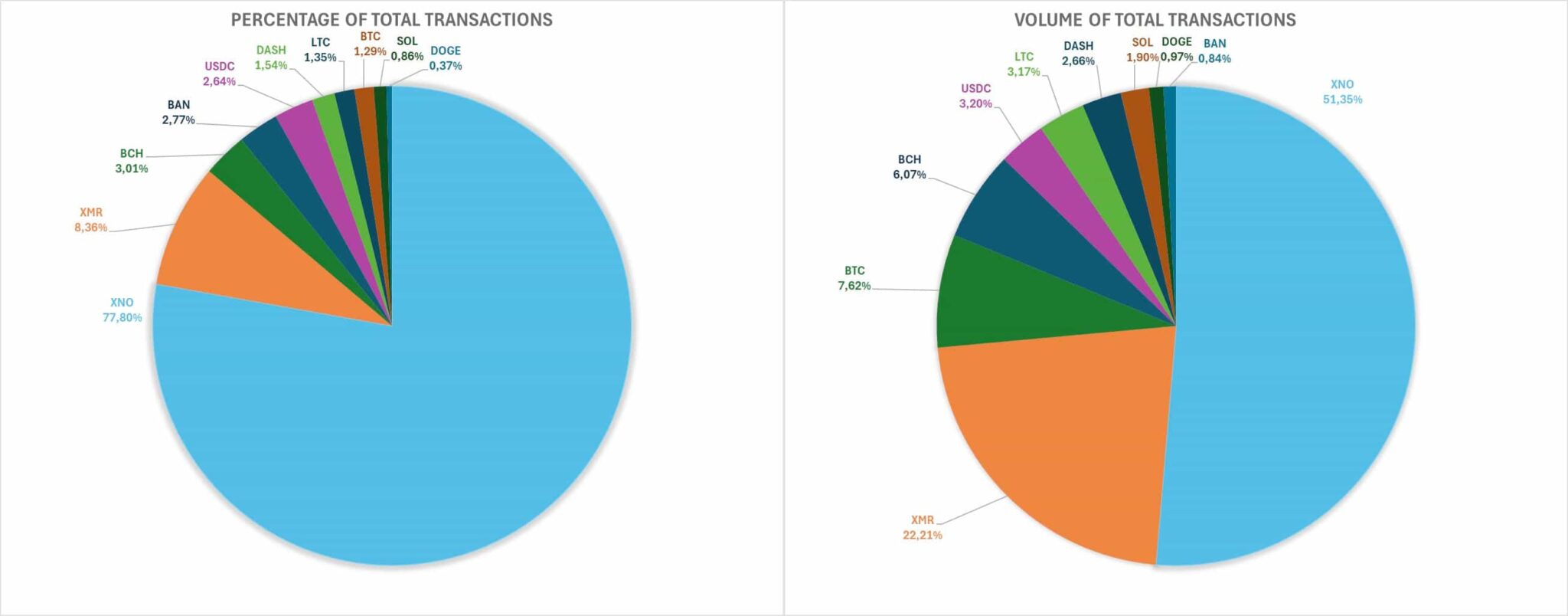

On December 1, NanoGPT published a data breakdown of all its crypto payments from November in the different accepted cryptocurrencies. The AI hub looked at the transaction count and volume of each coin, revealing its users’ preferences and customers’ behavior.

Why is Nano ($XNO) leading AI pay-per-use crypto payments?

It is notable that, despite having a far lower market capitalization and overall penetration than the other cryptocurrencies, $XNO dominates the users’ spending preferences in the AI pay-per-use platform.

Talking to Finbold, de Reede explained that, besides Nano’s efficiency for payments, the small-cap crypto also has other notable qualities. “It’s probably a combination of [$XNO] being the first coin that we supported, so it having spread widely in the Nano community,” he added.

“The reason we like Nano so much despite its low market cap is that it’s quite unrivaled as a medium of exchange with zero fees and instant confirmations, but also that we think it fundamentally might be the strongest possible store of value. That is not recognized in the market cap at all right now, but Nano is fixed supply and has a game theory that actively incentivizes decentralization. We feel more confident about it than any other crypto.”

– Milan de Reede, to Finbold

Right now, Nano trades at $1.45, up 33.5% year-to-date despite a local top of $1.85 in March. Moreover, $XNO surged by 97% from a local bottom of $0.736 in August, still below a $200 million capitalization.

As things develop, Finbold will continue to monitor crypto payment data from NanoGPT, competing AI pay-per-use platforms, and other services. Analysts like Alex Becker believe “utility altcoins” are the “easiest and surest” investment play into what experts believe will be “the mother of all bull markets” or “the biggest crypto bull run ever.”

Featured image from Shutterstock.

finbold.com

finbold.com