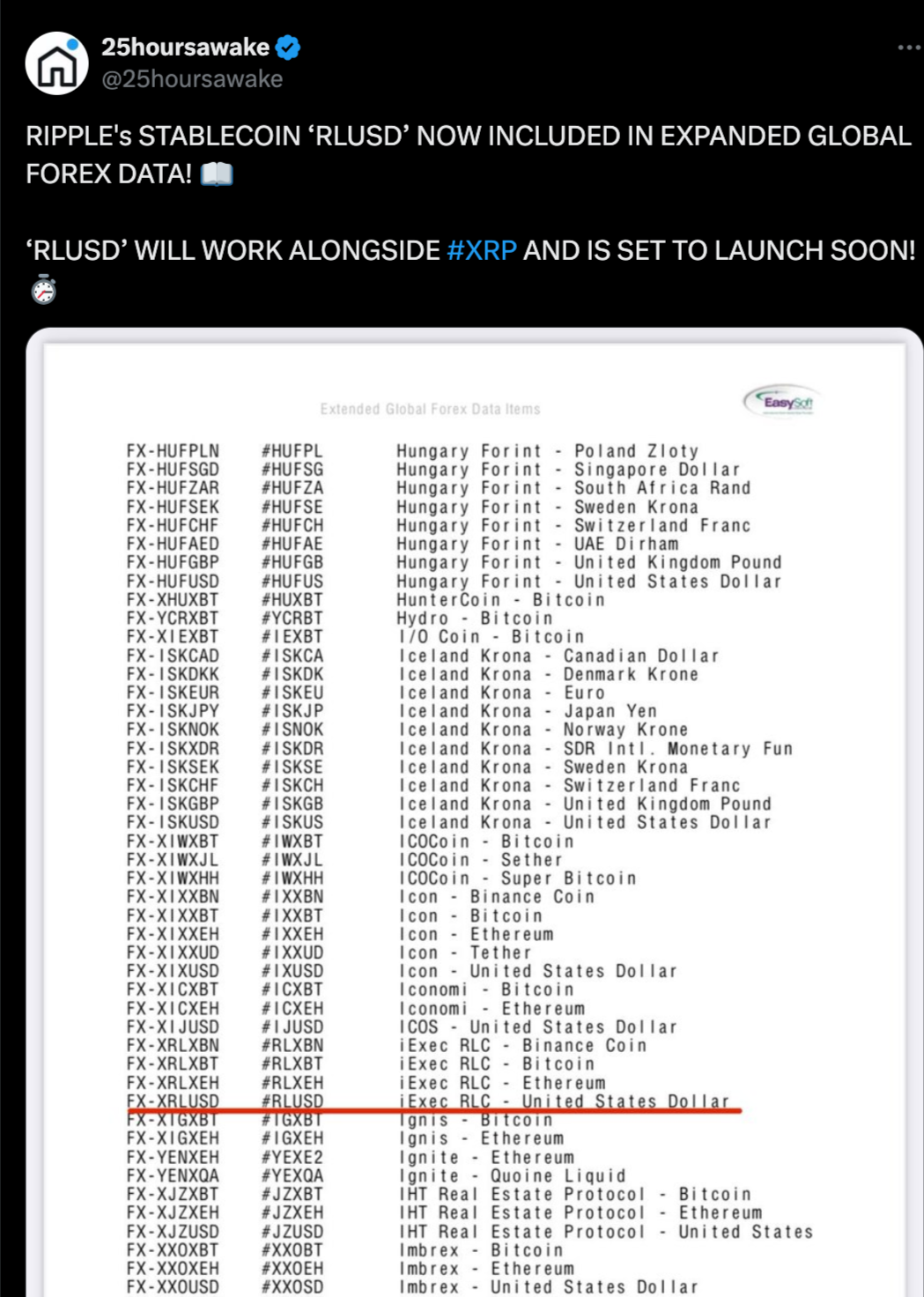

Ripple (XRP) has seen an 11% gain in the past 24 hours. This comes in anticipation of new developments in the token’s community. Recently, Ripple has been exciting not just because of their upcoming stable coin, their RLUSD.

Its inclusion in expanded global forex data highlighted news and made it a big milestone for Ripple’s ecosystem. The stablecoin, RLUSD, works alongside XRP to act as a stable transactional currency in a volatile cryptocurrency market.

According to recent sources, Ripple soon hopes to introduce RLUSD, the stablecoin, that will enhance its transaction abilities. It’s seen as a strategic move by Ripple to strengthen the service, expand its utility.

This might have hence increased the appeal among a broader base of financial institutions and individuals.

Market Response and Speculations

The announcement of the RLUSD has sparked massive speculation about how it will affect the Ripple network. They believe the stablecoin could become the key foundational asset in the Ripple network as use cases and adoption grow.

Furthermore, the addition of RLUSD to the forex data items indicates practical acknowledgment of Ripple’s stablecoin in the financial system and opens potential corridors for a bunch of new partnerships and integrations.

This recognition is important in that it provides essential validation of Ripple’s technology and that XRP acts as a reliable medium of exchange which complements Ripple’s system.

Technical Analysis and Market Outlook

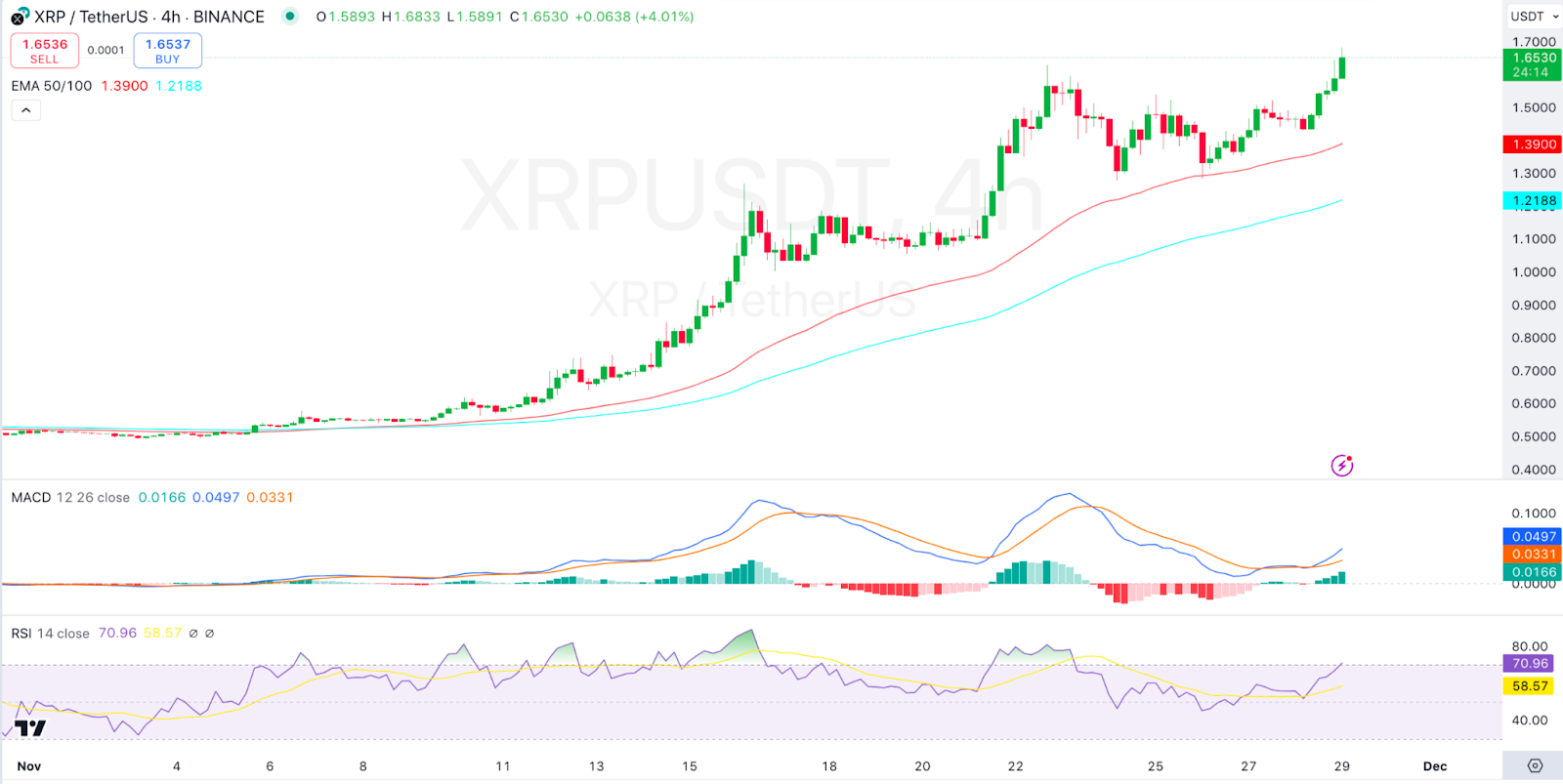

Other than this, the recent price action of XRP is noteworthy, considering that significant price action could be found on the trading chart. XRP’s latest price route, according to data from Binance, saw a day in which the cryptocurrency went from $1.4494 to a high of $1.661 in just a single day.

In the short term this rise in price is accompanied by a strong trading volume. This suggests a very strong investor interest which may keep sending the price upward in the near term.

The graph will show that EMA, 50 and EMA, 100 are on an upward trend indicating continuous bullish market sentiment. Relative Strength Index (RSI) has now crossed above 70. This is usually a signal that there are overbought conditions, but it also suggests that there is strong buying pressure.

At the same time, a bull’s case is bolstered by the Moving Average Convergence Divergence (MACD) which shows the MACD line is above the signal line and has histogram values rising. This indicates more upward progress.

The market reaction has been overwhelmingly positive, but there are a couple of things that come with the introduction of RLUSD.

Ripple’s ability to integrate this stablecoin into its current infrastructure will also be closely watched by investors and analysts as a test case indicating what influence that could have on the liquidity and volatility of XRP.

Additionally, Australia, a country with a comparatively progressive financial market, can also help guide Ripple’s future.

The news that Ripple might soon announce its stablecoin, RLUSD has led it to surge in price. This sparks a new wave of interest in the project’s potential to reshape the world of finance. With the impending launch of RLUSD, it will empower Ripple to exercise its transaction capabilities in a proven stable medium of exchange and increase the takeup of XRP.

thecoinrepublic.com

thecoinrepublic.com