The competition among Layer-1 blockchains is fierce, with projects like $SOL, $SUI, and $OM dominating headlines. However, $OM is increasingly standing out, with its focus on real-world asset (RWA) tokenization—a sector set to redefine decentralized finance.

With a current price of $3.65 and a market cap of $3.3 billion, $OM has already delivered an incredible 198% rally over the past month. It remains one of the strongest performers among Layer-1s, signaling its potential to reach $10 and break into the top 20 cryptocurrencies by market cap in 2024.

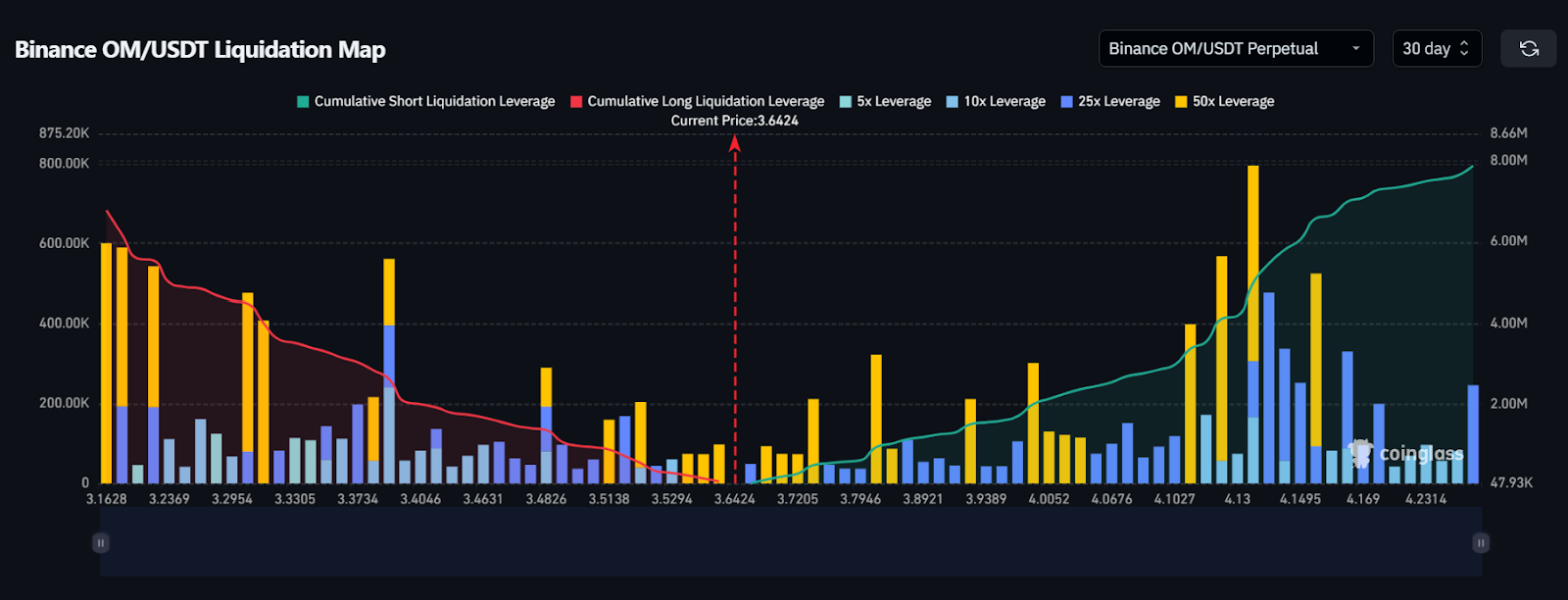

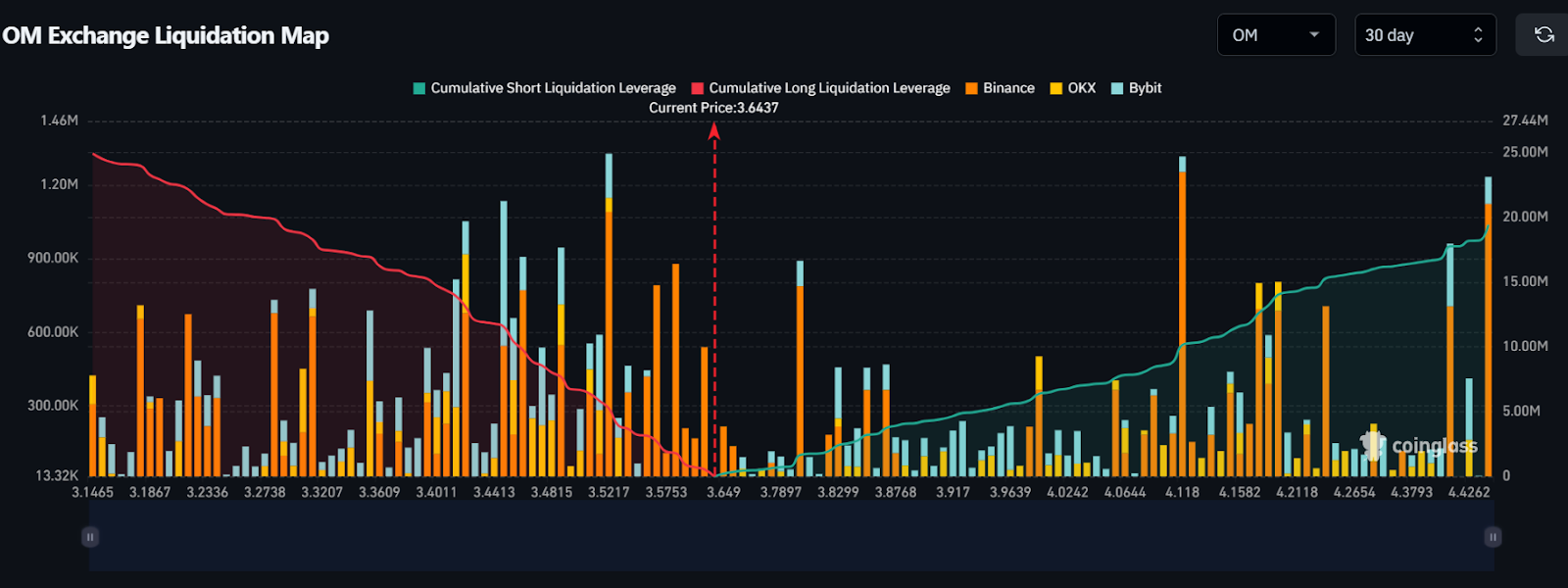

Liquidation Data Reflects Market Sentiment

Recent liquidation data highlights the bullish sentiment surrounding $OM. Short-sellers have faced a cascade of liquidations, further driving the price upward as bears cover positions.

- Over the last week: $OM recorded $45M in short liquidations, a clear indicator of strong bullish momentum.

- Key Support Levels: $3.60 has emerged as a solid support level, while resistance at $4.50 presents a short-term hurdle.

This dynamic highlights growing institutional and retail interest, creating a foundation for sustained growth.

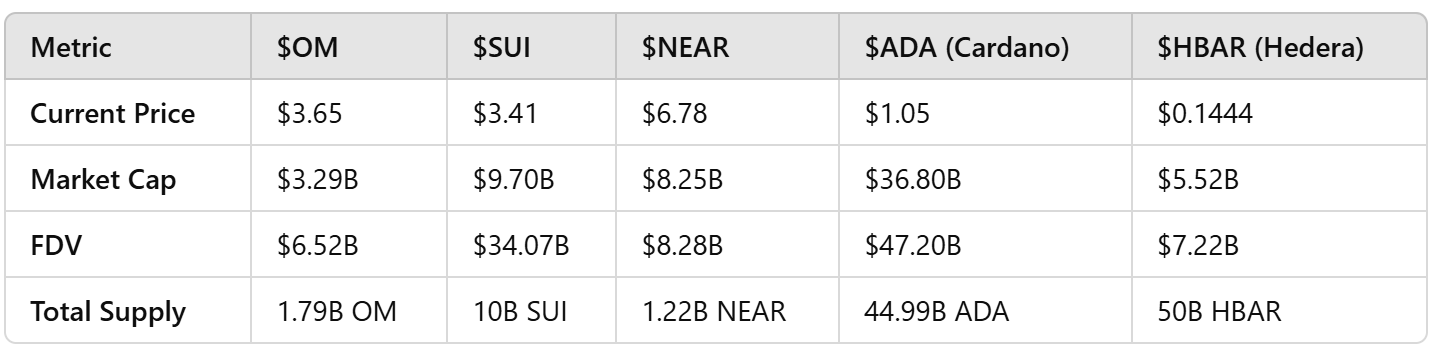

Comparative Analysis: Market Metrics

To illustrate $OM’s potential, let’s compare its key metrics to other Layer-1 blockchains:

What Sets $OM Apart?

$OM distinguishes itself through a combination of strong fundamentals and unique positioning:

1. Focused Narrative: Unlike general-purpose Layer-1s like $ADA and $NEAR, $OM focuses on RWA tokenization, a regulated and rapidly expanding market with immense potential.

2. Lean Tokenomics: With a total supply of 1.79B OM, $OM’s scarcity gives it an edge over peers like $ADA (44.99B) and $HBAR (50B). This scarcity positions $OM for greater value appreciation.

3. Real-World Utility: $OM enables tokenization of assets such as private equity, real estate, and funds, unlocking a $10 trillion market opportunity by 2030.

4. Institutional Adoption: $OM boasts collaborations with Libre Capital, ZAND Bank, and Google Cloud, ensuring strong backing for its ecosystem.

5. Attractive Staking APY: Offering an average APY of ~19%, $OM incentivizes long-term holding, appealing to both institutional and retail investors.

RWA: The $10 Trillion Opportunity

Real-world asset tokenization is the next frontier in blockchain adoption, with the market expected to reach $10 trillion by 2030. $OM’s early focus on RWAs gives it a first-mover advantage, setting it apart from generic Layer-1s.

Moreover, $OM’s infrastructure is designed for compliance and real-world utility, making it the ideal platform for regulated markets. Its partnerships in sectors like aviation finance and real estate further demonstrate its practical application.

In a highly competitive Layer-1 market, $OM’s focus on real-world utility, lean tokenomics, and institutional adoption makes it a standout contender.

Trading at $3.65 with a market cap of $3.29B, $OM has the fundamentals and momentum to target $10 in the near future and secure a spot in the top 20 cryptocurrencies by market cap.

Whether you’re an institutional player or a retail investor, $OM is the Layer-1 to watch as the RWA revolution takes center stage in blockchain technology.