The Alameda Gap: Crypto Liquidity Normalizes After Two Years of Volatility

Two years after the collapse of Alameda Research, the liquidity gap in the cryptocurrency market, referred to as the “Alameda gap,” has officially closed, according to Kaiko, a leading crypto market data and analytics firm. This marks a significant milestone for the crypto industry, demonstrating resilience and recovery after one of its most tumultuous periods.

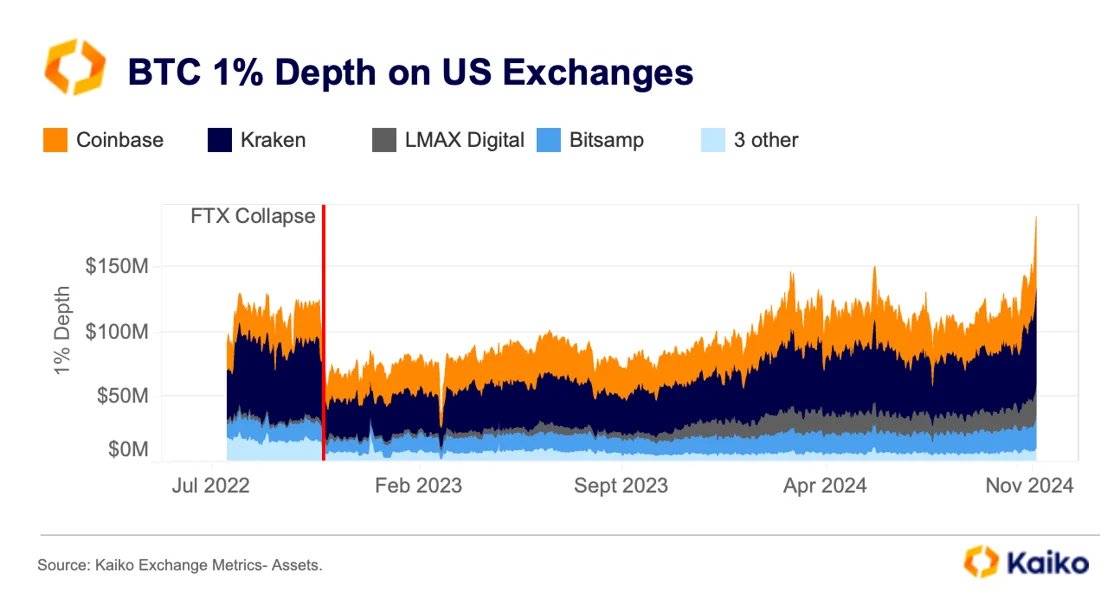

Kaiko revealed this recovery on X (formerly Twitter), highlighting that U.S.-based exchanges, including Coinbase, played a pivotal role in closing the liquidity gap. The firm cited the Bitcoin 1% Depth on U.S. Exchanges indicator as a measure of this achievement.

What Was the Alameda Gap?

The “Alameda gap” refers to the liquidity void that emerged following the collapse of Alameda Research, the trading arm and sister company of bankrupt crypto exchange FTX.

- Liquidity Impact: Alameda’s downfall left a significant hole in the market, particularly on U.S. exchanges, where its trading activity had provided substantial liquidity.

- Ripple Effects: The gap disrupted price stability, widened spreads, and reduced depth across order books, creating a challenging environment for traders and investors.

Alameda’s collapse was one of the most high-profile failures in crypto history, exposing vulnerabilities in centralized exchanges and trading firms.

Kaiko’s Analysis: Signs of Recovery

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

bitcoinworld.co.in

bitcoinworld.co.in