$TON crypto’s price soared 35% following the Golden Cross on November 6, 2024, reaching $6.20. Increased volatility and rising trading volumes, especially on DEXs like STONfi and DeDust, suggest that the next rally could push the price toward $14.

$TON Crypto Price Soars 35% After Golden Cross: Will It Repeat?

On November 6, 2024, we witnessed the occurrence of the Golden Cross event on the $TON (The Open Network) chart. Traditionally, a short-term moving average that crosses above a long-term moving average is said to be a bullish pattern.

After the Golden Cross happened, volatility started to rise, indicating that the movements in price were becoming more volatile. $TON crypto’s price soared 35% in just 18 days, from $4.60 to $6.20. This jump in volatility has typically been followed by strong price action.

At this time, volatile periods occur with a significant increase in the realized volatility indicator. This means the market expects quite a bit more price movement and may further stimulate additional gains for $TON crypto.

If this pattern is repeated, $TON may go up, and the Golden Cross could take the price up to $14.

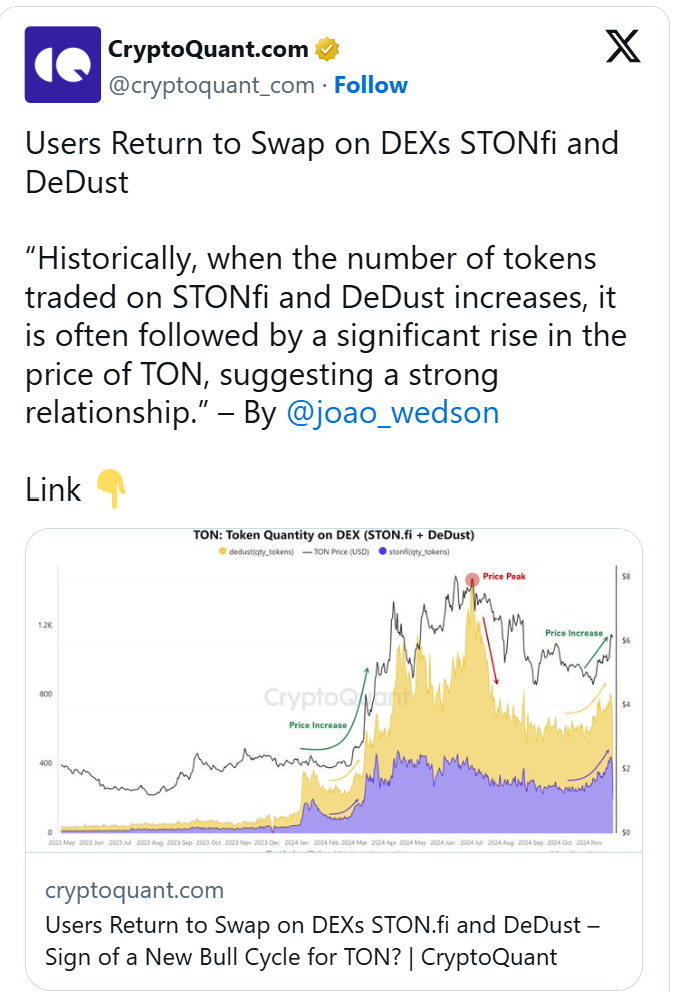

Higher Activity on STONfi and DeDust Predicts Bullish Trends

Wedson, a cryptoquant author, has done an analysis showing a clear relationship between how many $TON tokens were being traded and the price of the asset.

In this case, the number of tokens swapped is positively correlated to the price of $TON. Historically, when it gets ramped up, it tends to happen in tandem with $TON’s price rising.

The conclusion of this pattern is that user activity on these platforms, in terms of trading volume, could be an early sign for price rallies.

$TON crypto’s price climbs during increased trading volume peaking at specific intervals before slightly declining or staunchly consolidating.

Usually, the price surge happens when token volume grows drastically. The chart shows a high number of trades precedes price peaks. It is an indication of market sentiment and the demand for $TON.

Finally, this cyclical behavior indicates that as users come back to swap tokens on STONfi and DeDust, an increase in market activity could mean there’s the start of a bullish trend for the price of the $TON. The price could go higher.

The trend has continued recently, and analysts are waiting for token trading to continue increasing as a signal of the next bull cycle for $TON.

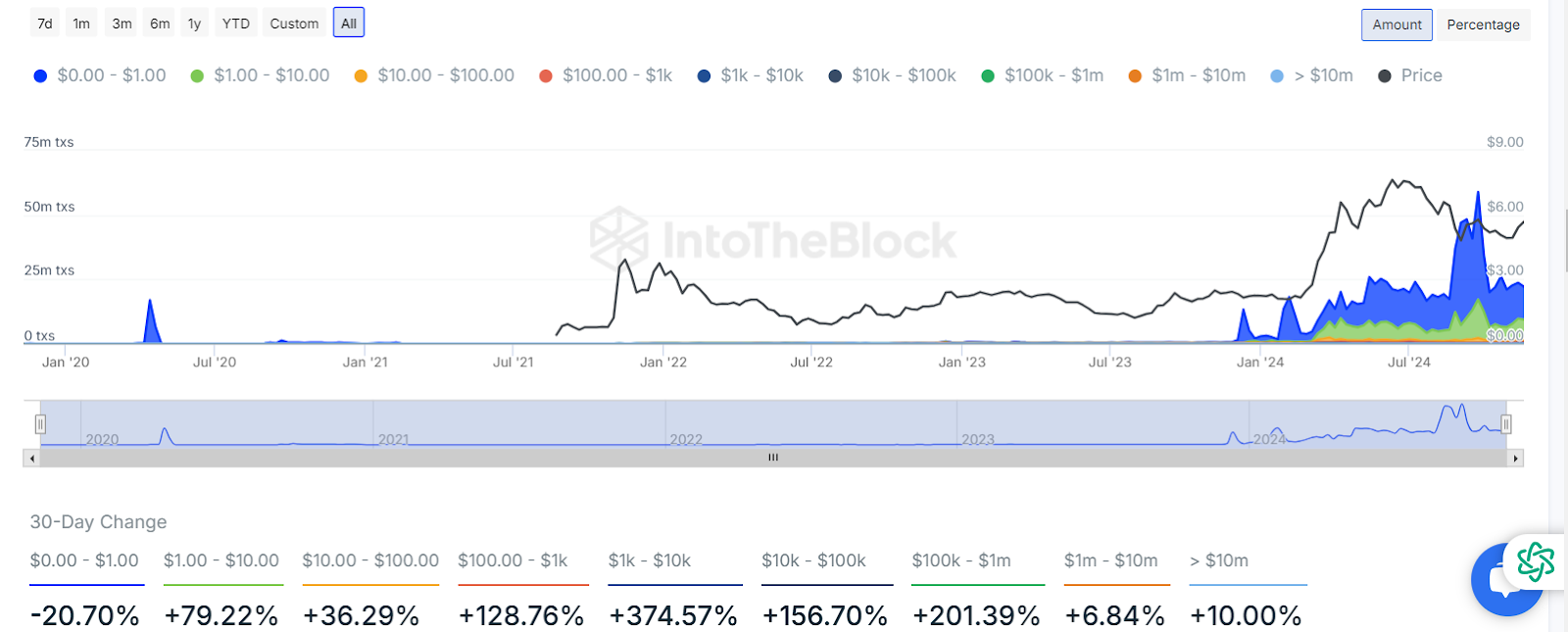

Transaction Volumes Align with $TON Price Growth

$TON crypto saw its transaction volumes increase markedly during late 2023. Transactions across all size buckets increased dramatically, with a whopping 374.57% increase in the $1k-$10k range over the last 30 days.

Coupled with impressive growth in the $10k-$100k of 156.7% and $100k-$1m of 201.39%. These numbers hint that $TON is becoming an increasingly popular destination for investors as well as a market for trading activity on multiple levels.

The huge jump in transaction sizes and general growth, in particular the past few months, correlates with $TON crypto’s price via a spike between $1.1 and $6.20 in early 2024, driven by increased trading volume.

That these increases indicate a high correlation between transaction activity and price movement suggests more users and institutions are in the $TON ecosystem.

Of the lower transaction ranges, specifically the $0–$1 range, there is a slight decrease, which could possibly mean a reduction in smaller transactions, which could be an indication of more big traders and more institutional membership.

thecoinrepublic.com

thecoinrepublic.com