Bittensor (TAO)’s price has risen 10% in the last 24 hours, solidifying its position as the largest artificial intelligence coin by market cap at $4.2 billion. The Ichimoku Cloud, RSI, and EMA lines all point to a strong uptrend.

The RSI at 65 suggests there’s still room for further gains before entering the overbought territory, while the EMA setup supports a potential climb to $625.

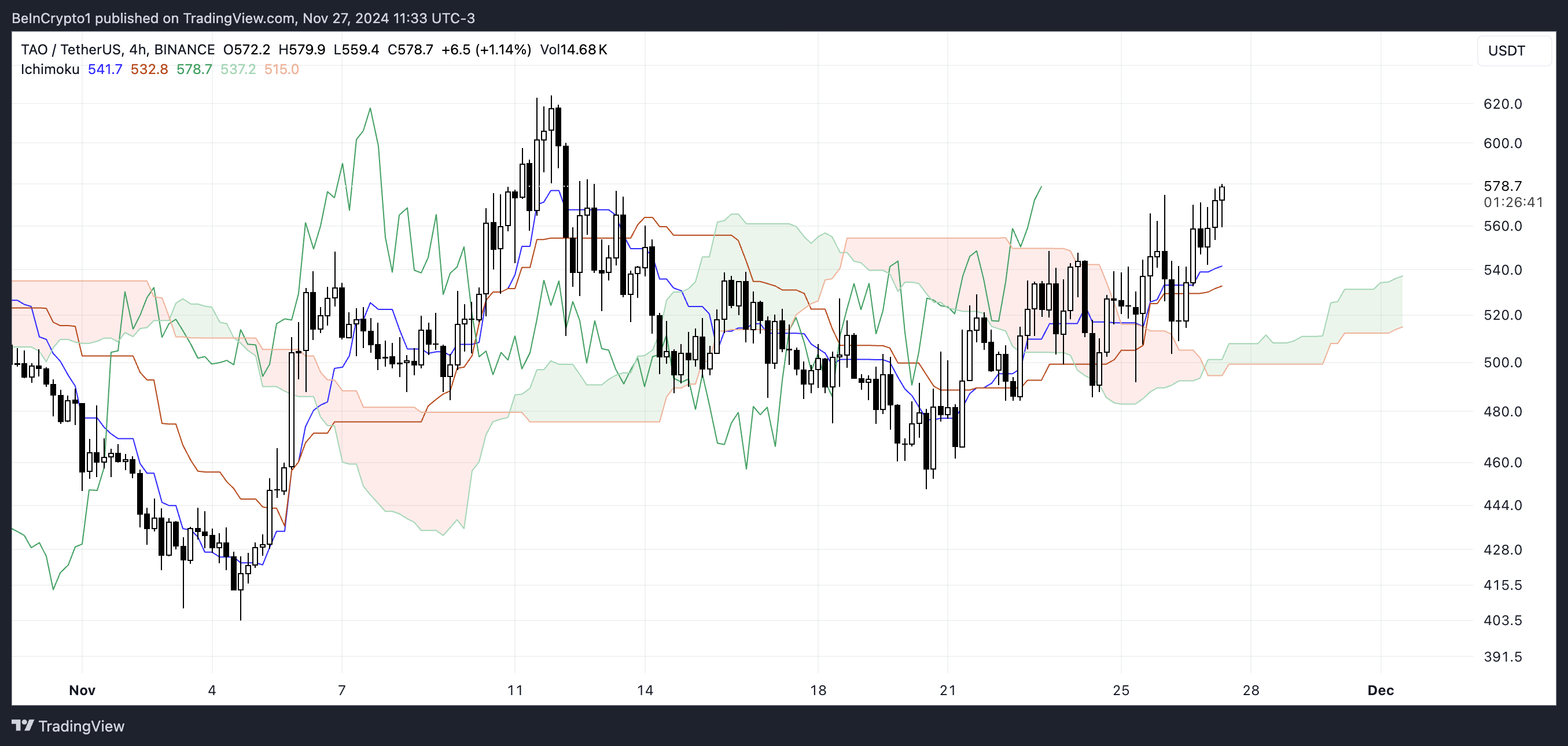

TAO Ichimoku Cloud Shows The Uptrend Is Strong

The Ichimoku Cloud chart for TAO shows a bullish trend. The price is trading above the cloud (Senkou Span A and B), indicating upward momentum. The Tenkan-Sen (blue line) and Kijun-Sen (orange line) are also positioned below the price, supporting the bullish sentiment.

The cloud itself has shifted to green, reinforcing mid-term support, while the upward slope suggests continued strength in the uptrend.

However, the price is approaching key resistance levels, and the narrowing gap between the Tenkan-Sen and Kijun-Sen indicates a possible slowdown in momentum. If TAO fails to maintain its position above the Tenkan-Sen, a pullback toward the cloud could occur.

Conversely, a breakout above current levels would confirm the continuation of the bullish trend, with the green cloud acting as a cushion for any potential retracement.

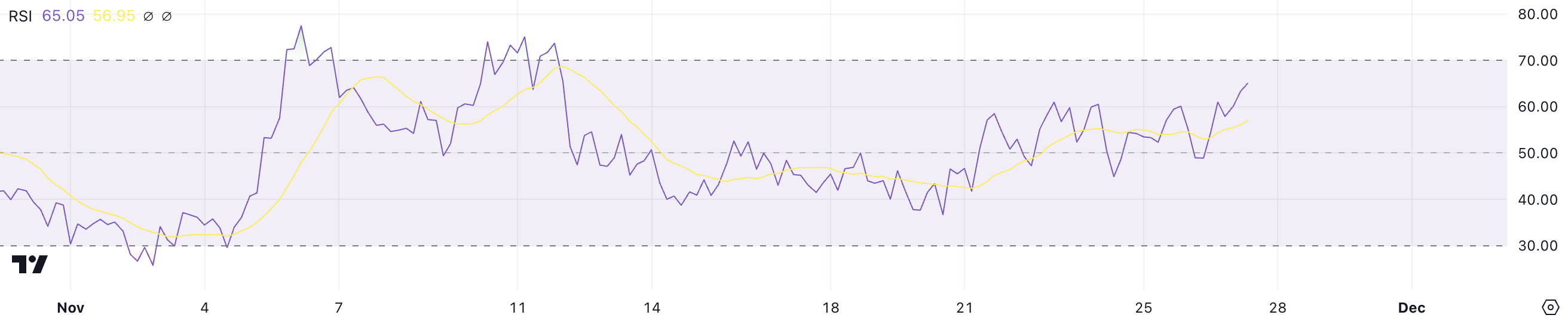

Bittensor Isn’t Overbought Yet

Bittensor RSI has risen to 65 from 49 in the last two days, reflecting strong bullish momentum as the price surges. The RSI, or Relative Strength Index, measures the speed and magnitude of price movements on a scale of 0 to 100.

Values above 70 indicate overbought conditions, suggesting a possible pullback, while values below 30 signal oversold levels, often leading to a recovery. The current RSI shows that while Bittensor is nearing overbought territory, it still has room for further gains before a correction.

Historically, TAO’s price has continued to climb until its RSI reaches 72 or 75, which suggests the current uptrend may have more room to run. If the RSI continues to rise, TAO could extend its rally in the short term.

TAO Price Prediction: Back to $600 Soon?

TAO’s EMA lines are currently very bullish, with short-term lines positioned above long-term ones and the price trading above all of them. This setup indicates strong upward momentum, supported by consistent buying pressure.

If this bullish sentiment continues, TAO price could climb another 8% to test resistance around $625, solidifying its uptrend and TAO’s dominance as the biggest artificial intelligence coin in the market.

However, if the current uptrend loses strength, TAO price may face a retest of key support levels at $510 and $487. Should these supports fail, the price could decline further to $449, marking a significant 22% correction.

beincrypto.com

beincrypto.com