I am not against memes, but meme coins are getting “a little” weird now. Let’s build real applications using blockchain.

While altcoins plummeted following Bitcoin’s dip towards $90,000, former Binance CEO Changpeng Zhao dumped sentiments in themed tokens.

CZ urged developers to leverage blockchain to create real applications as “meme coins are getting a little weird.”

The remarks wiped billions in the meme token sector, with the overall market capitalization of all memes sliding to $115 billion from $128 billion before recovering to press-time levels of $120 billion (CoinGecko data).

Amidst the uncertainty, one Pepe holder grabbed the crypto community’s attention.

PEPE whale offloads billions of tokens

The last 24 hours saw large-scale meme token investors reducing their bags amidst price declines.

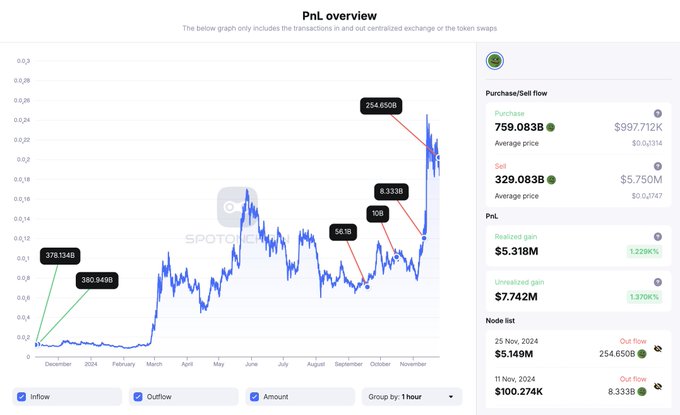

Spot On Chain revealed that a large-scale investor deposited 254.65 billion PEPE, worth approximately $5.15 million, to Binance, netting $4.81 million in profits.

Crypto whale @degentradingLSD deposited 254.65B $PEPE ($5.15M) to #Binance for a big $4.81M profit 13 hours ago! Currently, this whale holds: • 430B $PEPE ($8.13M) with another unrealized profit of $7.74M (13x return); • 3.96M $DOGE ($1.6M) with an unrealized profit of $1.5M…

Generally, whales deposit tokens into exchanges when planning to sell. Such trends lead to magnified selling pressure, triggering price dips.

Moreover, these players reduce their exposure amid looming prolonged price dips to book profits.

That could be the case for Pepe, as the whale’s transaction occurred during bearish price movements.

PEPE lost around 10% of its value over the past seven days and signals more downtrends before possible reversals. Spot On Chain added:

It seems like funds have been flowing from meme coins to other altcoins in the past few days.

PEPE price performance

The frog-themed digital coin painted its daily chart red after losing 5% to trade at $0.00001845.

Technical indicators and on-chain data indicate more dips for PEPE.

The Relative Strength Index has declined from 60 to 38 within 72 hours, confirming a weak bullish momentum.

The 7-day market value-to-realized value ratio, currently -6.2%, supports the bearish narrative.

While negative figures highlight reduced seller activity, PEPE has recovered when the MVRV hits -9.7.

That means the altcoin will likely plunge further before an upward move.

The Exponential Moving Average lines depict bearishness, with an emerging death cross.

PEPE could witness declines toward the support barrier at $0.0000139 (if the death cross is completed).

Intensified selling would breach this zone and welcome $0.0000108 before heading to $0.0000077.

That would translate to a 58% decline from PEPE’s current price.

However, PEPE will potentially mimic broad market performance.

Analysts remain bullish about the market, with many calling the latest crash an expected case after prolonged Trump-driven rallies.

Also, the anticipated altcoin season, forecasted in Q1 2025, will trigger explosive actions in the alt sector.

Improved sentiments in the altcoin space would reverse PEPE’s price trend. The meme token could soar towards the resistance zone at $0.0000228.

Overcoming this hurdle would propel the token to $0.000026 and an all-time high above $0.000030.

The post Whale dumps 254B PEPE tokens amid persistence bearishness; what’s next for PEPE price? appeared first on Invezz

invezz.com

invezz.com