FTX Token ($FTT) price has surged amid news of the impending reimbursement plan for clients and creditors.

$FTT is rallying as FTX Trading Ltd and its related debtors move towards executing their Chapter 11 Plan of Reorganization which was confirmed by the U.S. Bankruptcy Court on October 1st 2023.

FTX Reimbursement Plan Timeline and Key Requirements

FTX has disclosed that the preparations for the reimbursement process are currently in the final stages. The process is planned to start from January 2025.

As reported in the recent company update, the specialized distribution agents will be finalized by early December to allow global payouts to eligible creditors and customers.

Customers must sign up for accounts with these agents on the FTX customer portal, verify their identity, and fill in tax forms.

According to FTX, the customers who meet the mentioned criteria before the record date. This is expected to be the effective date in January, will be able to receive the first distribution.

The first distribution, for the most part, to the owners of claims allowed in Convenience Classes is projected to occur within sixty days after the plan becomes effective. John J. Ray III, FTX’s CEO and Chief Restructuring Officer, said,

“We are charging full speed ahead to get the money back to the creditors and customers as soon as possible.”

Challenges and Ongoing Litigation

However, the FTX bankruptcy estate is still not out of legal trouble. Creditors have attacked the creditors’ reimbursement plan. These critical creditors said the payouts determined with reference to asset values as of the bankruptcy filing in 2022 are inequitable.

For instance, at the time of filing this report, Bitcoin (BTC) was trading at around $16,000. It has since risen greatly in price and value.

Moreover, the FTX estate has also initiated several lawsuits. That’s in pursuit of regaining assets that are located in other crypto exchanges and companies.

In October, FTX sued KuCoin to reclaim $50 Million allegedly locked on its platform since the exchange’s collapse.

In November, similar complaints were filed against Crypto.com for $11 Million and Binance for $1.8 Billion in fraudulent transfers.

FTX has also initiated legal actions against SkyBridge Capital and Anthony Scaramucci. That is done to recover $100 Million in sponsorship and investment funds.

Impact of Recent Sentencings and Asset Recoveries

Gary Wang, the co-founder of FTX, was sentenced this month for his part in the $8 Billion fraud scheme that led to the exchange’s bankruptcy.

His cooperation is reported to have helped in the recovery of billions of dollars for the creditors. Wang was directed to surrender $11 Billion.

All the top management officers implicated in FTX’s activities have been brought to book. Former CEO Sam Bankman-Fried included.

However, FTX’s restructuring team has been able to retrieve billions of other assets. The retrieved assets will be shared according to the reorganization plan.

This has increased the market sentiment and this is evidenced by the increase in the value of the $FTT token.

$FTT Token’s Price Resurgence and Market Sentiment

The FTX Token ($FTT), which suffered a massive decline after the exchange’s collapse, experienced a dramatic 42% rally in the past day.

The price increase reflects growing investor optimism surrounding FTX ability to execute its reimbursement plan effectively and recover assets through ongoing litigation.

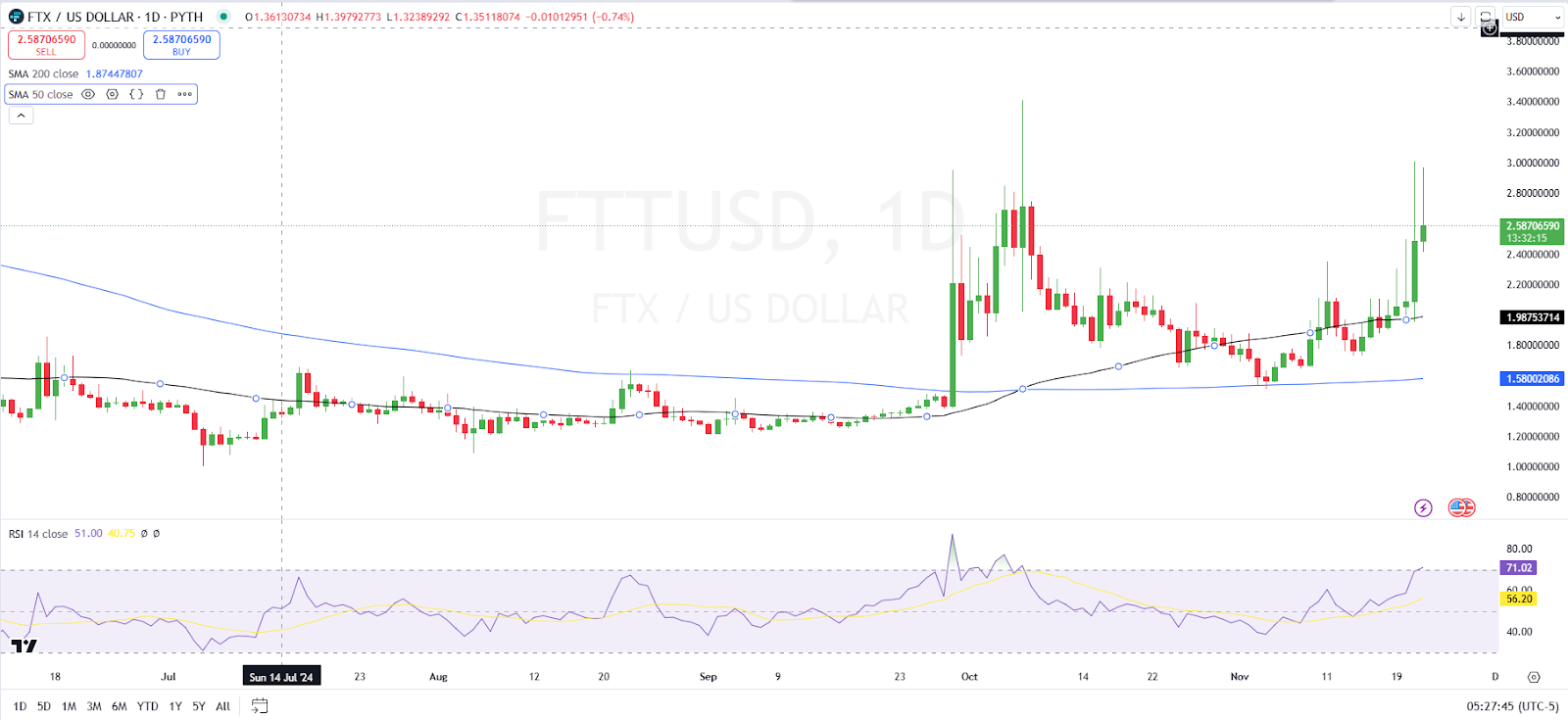

On the technical analysis, the 50-day Moving Average has shifted above the 200-day Moving Average. That reflects a “Golden Cross”, which is a bullish crossover.

This pattern suggests that the $FTT price is nearing a bullish breakout if they manage to breach the $3 resistance. However, the Relative Strength Index (RSI) rating of 70.87 suggests that the bull run maybe waning.

During the bull rally, $FTT’s market capitalization and 24-hour trading volume surged respectively by 20% and 267% to $854.33M and $211.17M.

thecoinrepublic.com

thecoinrepublic.com