Although the stock market has rallied recently, most equities exhibit significant volatility, with notable market cap swings, presenting opportunities to generate profits.

This volatility is highlighted by the fact that, since September, the S&P 500 has experienced weekly market cap fluctuations averaging $1 trillion. Notably, during U.S. election week alone, the index added $2.2 trillion in market cap, according to an analysis from The Kobeissi Letter on November 23.

The platform noted that such an environment can be rewarding for stock traders who adopt technical strategies, remain disciplined, and are ready to exploit opportunities in both directions of market swings.

“With more polarized market sentiment, the swings in both directions become much larger. Technical traders can capitalize on this,” The Kobeissi Letter stated.

Spotting market opportunities

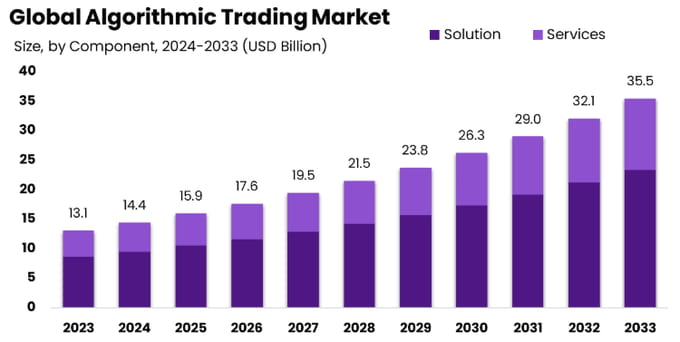

To highlight opportunities for capitalizing on the current stock market environment, The Kobeissi Letter pointed to the rapid growth of algorithmic trading, which is expanding at an annual rate of 10.5%.

These algorithms are highly reactive to technical supply and demand levels, making the market highly sensitive to key price zones.

A recent example is the gold miner ETF GDX, which experienced a sharp price collapse on November 8 after breaking a critical channel. Traders who anticipated this move profited from the drop, and the S&P 500 found support at forecasted levels after hitting 6,000.

Interestingly, one of these swings impacted Nvidia (NASDAQ: NVDA), one of the best-performing equities of 2024, a scenario that saw the equity being likened to a meme stock.

Retail investors have also surged into the market, now accounting for 20% of all options trades—a record high. Despite their increased participation, the average retail investor has gained only 3.7% year-to-date, significantly underperforming the broader market.

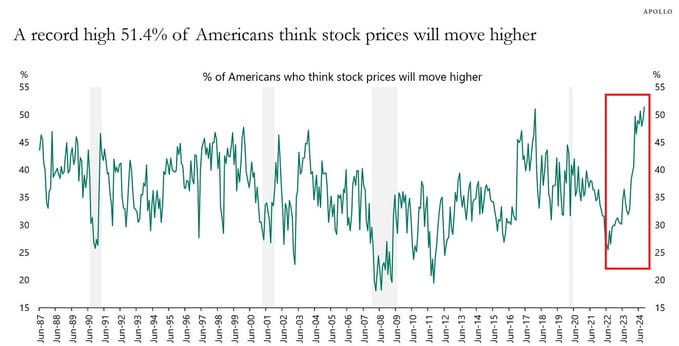

Many retail traders rely on technical levels, and with market sentiment polarized—51.4% of Americans are bullish on stocks—these opposing views further amplify price swings.

Focus on the U.S. market

Meanwhile, the American market continues to dominate globally, outperforming European stocks by 21% this year, the widest margin on record. This dominance, combined with liquidity and heightened activity, creates opportunities for traders to navigate the volatility.

“US markets have become the market of choice of global investors.In fact, European stocks have underperformed the S&P 500 by 21% this year, the most on record. As a result, the US stock market is now 4 TIMES larger than Europe. There has never been a better time to trade,” the platform noted.

The price swings persist even as the market trades at record levels. Donald Trump’s election has buoyed the S&P 500 to a historic high above 6,000.

However, these record highs come with caution, as analysts anticipate they could signal a possible market crash. Nevertheless, investors may find opportunities to buy the dip in such a crash.

Featured image via Shutterstock

finbold.com

finbold.com