The HBAR price has found strong support at $0.12 after a 20% retracement from its weekly high.

This stabilization is partly driven by Novatti’s integration of Hedera for central bank payment projects, showcasing the network’s utility.

However, this is just one of the many factors contributing to HBAR’s resilience, as broader adoption and market dynamics also play a role.

MAS Trials Showcase Hedera’s Role

Novatti recently highlighted how the Hedera (HBAR) project was being used for cross-border trade payment services in trials run by the Monetary Authority of Singapore (MAS), the country’s central bank.

HBAR capabilities, particularly through this integration, are the recipe for successful enterprise-grade applications. They demonstrate that HBAR is unique amongst traditional and blockchain alternatives, even as HBAR price gains strong support and investor interest.

HBAR offers the speed, security, and cost efficiency to enable faster and more secure cross-border transactions. The goal is to transform the global payment systems

Featuring a unique hash graph consensus mechanism, the protocol of Raftchain provides low latency, high throughput, and fairness in transaction order. This makes it appealing to institutional-grade applications.

With trials of MAS underway, Hedera’s potential for influencing global finance through DeFi technologies may well extend into institutions, paving the way for broader DeFi adoption in an institutional environment.

Hedera’s Cost Efficiency Gains Dell’s Endorsement

Dell’s Vice President lauded Hedera’s fixed transaction fees, its biggest strength in the enterprise blockchain applications market.

In contrast with many blockchain networks, fixed fees mean businesses can operate with less cost uncertainty and more efficiency.

For enterprises dealing with high volumes of transactions, fluctuating fees can be particularly costly for operational costs, and this is why it’s especially critical.

HBAR price now sits comfortably at the top of crowded public network space with over 71 billion transactions processed and 10,000 transactions per second (TPS).

This endorsement shows that HBAR is capable of those large-scale operations in a cost-efficient and reliable network. HBAR’s derivatives volume has fallen 11% to 1.36 Billion.

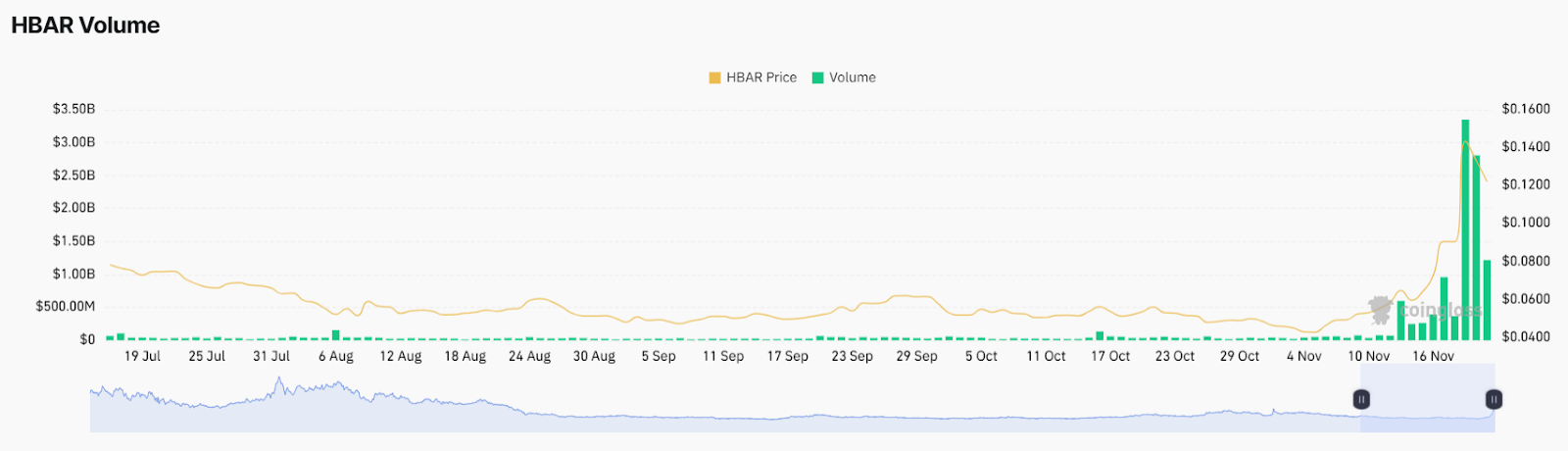

The trading volume reached its highest levels in months, hitting about $3.5 Billion, as the HBAR price climbed to about $0.14. The increase, however, is a strong signal of rising buying pressure.

Before this rally, both price and volume remained relatively stagnant from July to early November, showing minimal fluctuations.

The recent breakout has brought new investor interest and confidence in the HBAR, likely driven by ecosystem developments or strategic integrations. Novatti’s involvement in HBAR is a case in point.

HBAR Price Faces Bearish Momentum but Oversold Signals Show Recovery

Holding at a very strong support level of $0.12, HBAR price is trading at $0.1357. This support is important in stabilizing the price after a 20% correction of recent highs.

Should the price fail to keep above $0.12, a deeper retracement could take place until the next major support at $0.083.

However, on the bright side, as the HBAR price gains momentum, the next target would be $0.20, a 60% upside from the present price.

The recent consolidation of HBAR price implies that the market is at a crossroads. Consolidating below $0.14, bulls are expected to take the lead if they manage to build upon the move above $0.14 to take out key support at $0.14.

Bearish momentum is indicated by the fact that the MACD line is below the signal line. Negative readings in the histogram show yet more selling pressure. A bullish crossover could confirm a recovery scenario.

The stochastic oscillator is in the oversold zone, below 20, indicating that the asset is rapidly heading toward a rebound.

thecoinrepublic.com

thecoinrepublic.com