Amid the spotlight on Bitcoin’s (BTC) march toward $100,000 and the rising popularity of meme coins, Solana ($SOL) has quietly solidified its position as one of the top-performing digital assets in 2024.

Over the past week, $SOL has surged to $256, reflecting an impressive 45% weekly growth and reaching a record high of $264.50. This remarkable climb is not just riding on the broader market momentum but is also driven by Solana’s expanding ecosystem.

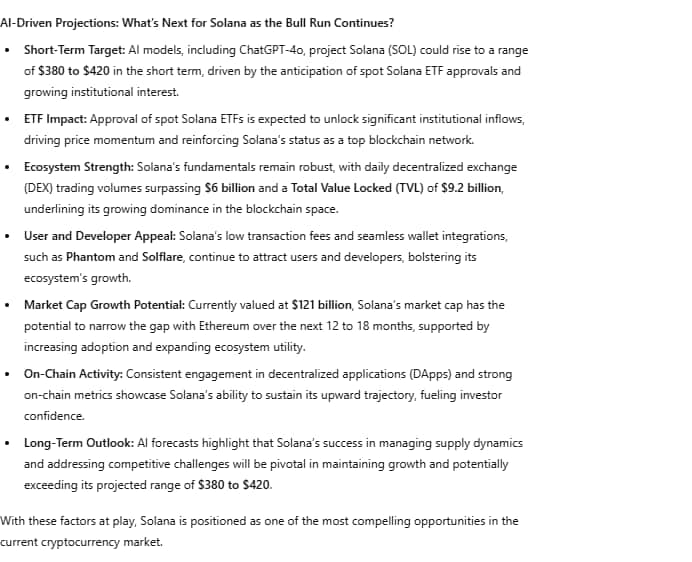

Adding to the momentum is the anticipation of spot Solana ETFs, which has ignited a wave of investor optimism, with AI-driven insights signaling the potential for even greater gains ahead.

For a detailed analysis of where Solana could head next, Finbold tapped into market data and sought insights from ChatGPT-4o to evaluate Solana’s prospects as it hits these new highs. The findings offer a deeper look into the key drivers behind $SOL’s surge and its future trajectory in the evolving crypto landscape.

ETF optimism ignites Solana’s rally

One of the primary drivers behind Solana’s recent performance has been the growing anticipation of spot Solana ETFs. Major players like VanEck, 21Shares, and Bitwise have filed to list these ETFs on the Cboe BZX Exchange, coinciding with the resignation of SEC Chair Gary Gensler.

However, certain challenges could influence its trajectory. By mid-2025, Solana’s total supply is expected to increase, introducing potential capital swings and affecting price dynamics based on market demand.

Large-scale sell-offs could create downward pressure on prices, whereas strategic reinvestments into the ecosystem could support long-term growth, enhancing Solana’s overall market strength.

In summary, Solana’s current momentum positions it for new highs, with an ETF approval potentially accelerating its growth. However, the ability to sustain $250 support level will be crucial to determine the next trajectory.

Featured image via Shutterstock

finbold.com

finbold.com