The crypto altseason is starting as some altcoins like $XRP and Cardano ($ADA) lead the way, printing significant gains. If history repeats this cycle, capital should rotate from large to small-caps, creating further opportunities for savvy investors and traders.

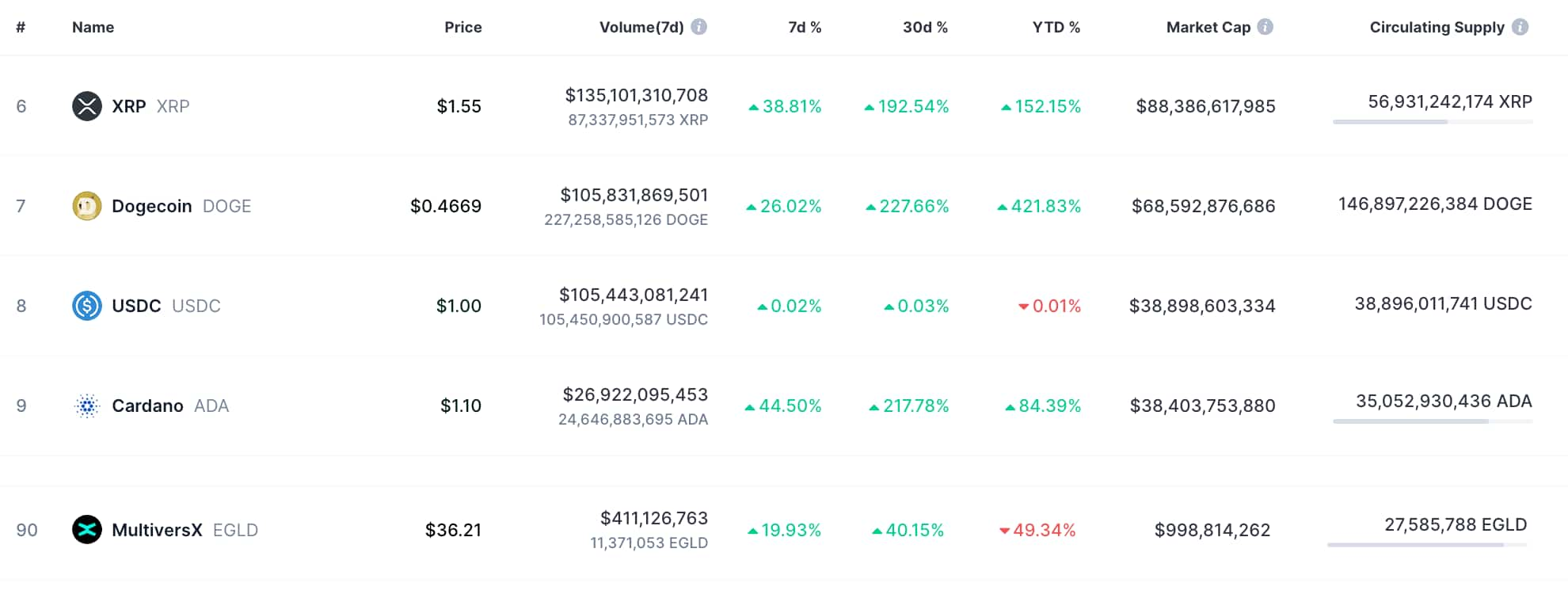

Looking at the two altcoins, $XRP and $ADA investors have amassed approximately 200% gain in the last 30 days. The former ($XRP) is up 190%, while the latter ($ADA) is up 211% in their one-month charts. Both also accumulate over 35% gains in the last seven days after a particularly positive week.

All things considered, Finbold is looking for a potential crypto opportunity – among dozens of them – for investors who missed this recent $XRP and $ADA rally. For that, we identified in MultiversX ($EGLD) a promising combination of sound fundamentals and potentially asymmetric market capitalization.

MultiversX ($EGLD) could follow the $XRP and $ADA price rally

Overall, MultiversX is a promising Ethereum rival, similar to $XRP and $ADA, with a growth potential recognized by different experts. On Finbold, we have covered analysts’ insights on $EGLD, highlighting its fundamentals, economics, and potential price action.

For example, Justin Bons, founder and CIO of Europe’s oldest cryptocurrency fund, deemed MultiversX’s sharding the “technological Holy Grail of crypto.” Andrei Sobolev sees a “30x” opportunity in $EGLD’s technical indicators as liquidity flows to altcoins. Meanwhile, Lucky (LLuciano_$BTC), a one-million followers analyst, agrees with Sobolev’s “bullish outlook” and praises $EGLD’s development ecosystem.

“Incredible team, supportive community $EGLD has really been building constantly!”

Lucky (LLuciano_$BTC)

As Finbold reported, Alibaba Cloud recently announced a partnership with MultiversX as the team started entering the Asian market. Startups have also leveraged the L1 blockchain’s infrastructure to build their businesses and innovative solutions.

Still, MultiversX has less than $1 billion in market cap, 88 and 33 times lower than $XRP and $ADA, respectively. The native token is almost fully distributed, with a 27.58 million $EGLD circulating supply out of 31.40 million.

By investing in $EGLD, investors also have the opportunity to earn passive income through over 6% staking rewards. Additionally, more experienced decentralized finance (DeFi) investors can find yield farming opportunities within the MultiversX ecosystem, like Hatom Protocol (HTM).

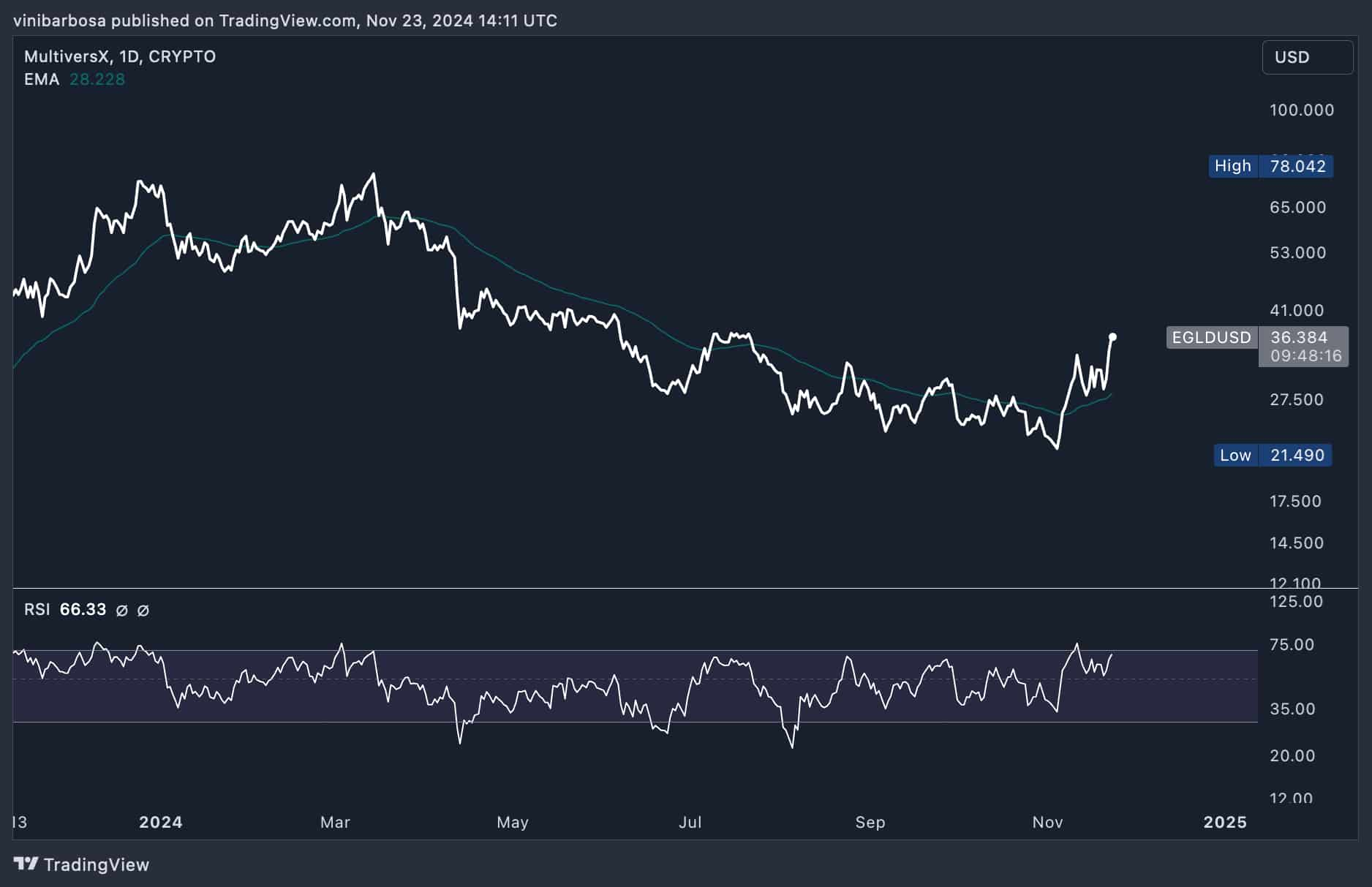

eGold ($EGLD) price analysis

$EGLD, which also reads as eGold, has broken out of an eight-month downtrend, trading at $36.38 by press time. $XRP and $ADA recently experienced a similar breakout from the same bearish outlook from March, igniting their respective price rallies.

In a first moment, $EGLD could surge up to $78, mirroring $XRP’s and $ADA’s 200% rally from the breakout price. This would mean an approximately two-fold return from investors buying at MultiversX’s current exchange rate.

Technical indicators like the 50-day exponential moving average’s cross ($28.22) and the relative strength index (RSI) show strong momentum. Nevertheless, the price may still pull back in the short term before any potential move upward.

As things develop, investors and traders must understand that each cryptocurrency may perform differently from its pairs. There is no guarantee that $EGLD will follow the $XRP and $ADA rally, and all crypto opportunities come with risks.

Featured image from Shutterstock.

finbold.com

finbold.com