Stellar Lumens continued its strong comeback, rising for three consecutive weeks and reaching its highest level since 2021.

Stellar (XLM) price jumped to $0.3052, driven by the ongoing cryptocurrency bull run and the fear of missing out.

Its surge has coincided with the ongoing Ripple price rallywhich saw Ripple jump to $1.5, its highest level since May 31. This rally is attributed to investor anticipation that the Securities and Exchange Commission will end its litigation on Ripple Labs.

Ripple and Stellar have two important similarities. Both were designed to disrupt the payment industry. Ripple aims to help institutions send money globally in an easier way, while Stellar’s goal is to facilitate peer-to-peer payments.

Additionally, Gavin Wood, who founded Stellar, was one of the co-founders of Ripple. Historically, XLM and Ripple (XRP) have moved in sync with each other. Investors also anticipate that some companies will apply for a Stellar and XRP ETF in 2025.

Technicals point to a Stellar Lumens reversal

The outlook for XLM price is bullish during the ongoing crypto rally. However, there is a risk of a harsh reversal in the next few days.

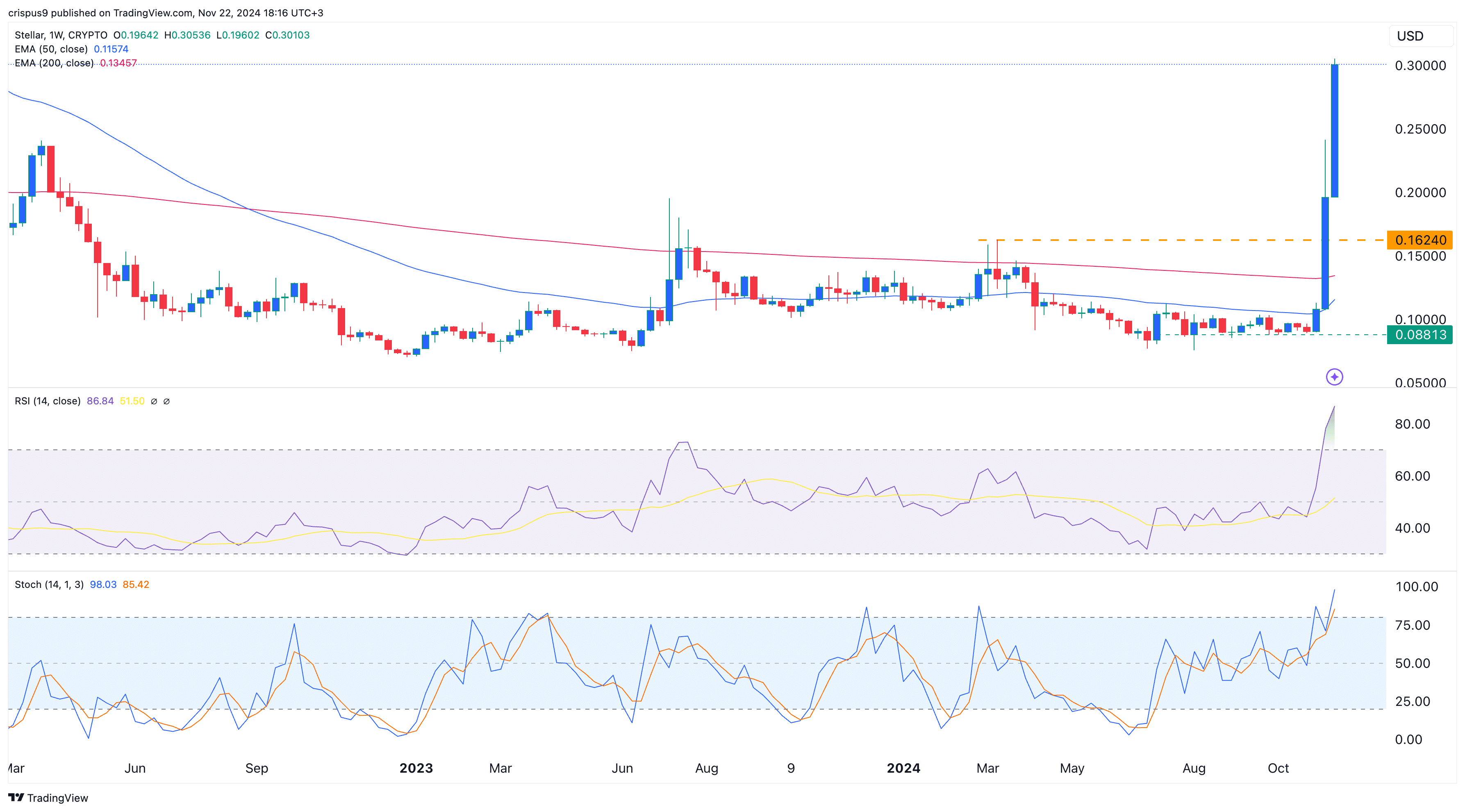

First, Stellar price could drop due to mean reversion, a concept where assets often return to their historical averages. In XLM’s case, the price has jumped 142% above the 50-week and 200-week Exponential Moving Averages during the rally.

Therefore, if mean reversion occurs, there is a risk that the coin will drop closer to these averages.

Second, XLM price could reverse sharply because it has become extremely overbought. The Relative Strength Index has jumped to 83, while the two lines of the Stochastic Oscillator are approaching 100. Rising oscillators indicate momentum, but such moves often precede sharp declines.

Third, Stellar price may reverse to form a break-and-retest pattern. It rallied above the key resistance level at $0.1624—its July 2023 high—last week. In most cases, financial assets retest key support levels before resuming a bullish trend. Therefore, XLM will likely drop to $0.1624 before resuming its upward movement.