Tron price has gone parabolic, rising for two consecutive weeks and reaching its all-time high of $0.2067. It has soared by over 350% from its lowest point in 2022, bringing its market cap to over $17 billion, making it the eleventh-biggest cryptocurrency in the industry.

Tron has great fundamentals

Tron, the blockchain network established by Justin Sun, has some of the best fundamentals in the cryptocurrency industry.

Data by DeFi Llama show that it is the third-biggest player in the DeFi industry in terms of total value locked (TVL), which stands at over $7.7 billion. Ethereum and Solana have more than $63 billion and $8.8 billion, respectively. The biggest players in the Tron ecosystem are JustLend, Just Stables, Sun.io, and JustMoney.

Tron is also one of the top networks in the Decentralized Exchange (DEX) industry, through Sun.io. Data shows that it had a seven-week volume of $723 million, making it the 12th biggest player in the sector.

Its volume has done well despite the challenges in the SunPump ecosystem, which has lagged the market in the past few weeks.

Data by CoinGecko shows that the total market cap of all tokens in the Sun ecosystem stands at over $254 million, down from $600 million a few months ago. The biggest of these meme coins are the likes of Sundog, Tron Bull (BULL), Tron Bull Coin (TBULL), and Invest Zone.

The ongoing weakness in the Tron meme coin ecosystem could be a brief scenario, meaning that they may bounce back later this year.

Tron has other solid features. For one, it is a growing network with many users. Data shows that the network has over 273 million accounts, an increase of 220k in the last 24 hours. The number of transactions in the network crossed the 9 billion mark this week.

Tron is also highly deflationary as the number of TRX tokens has continued falling over time. It started the year with over 88.5 billion coins, a figure that has dropped to 86.3 billion. This trend has happened because of the rising TRX token burns in the past few months.

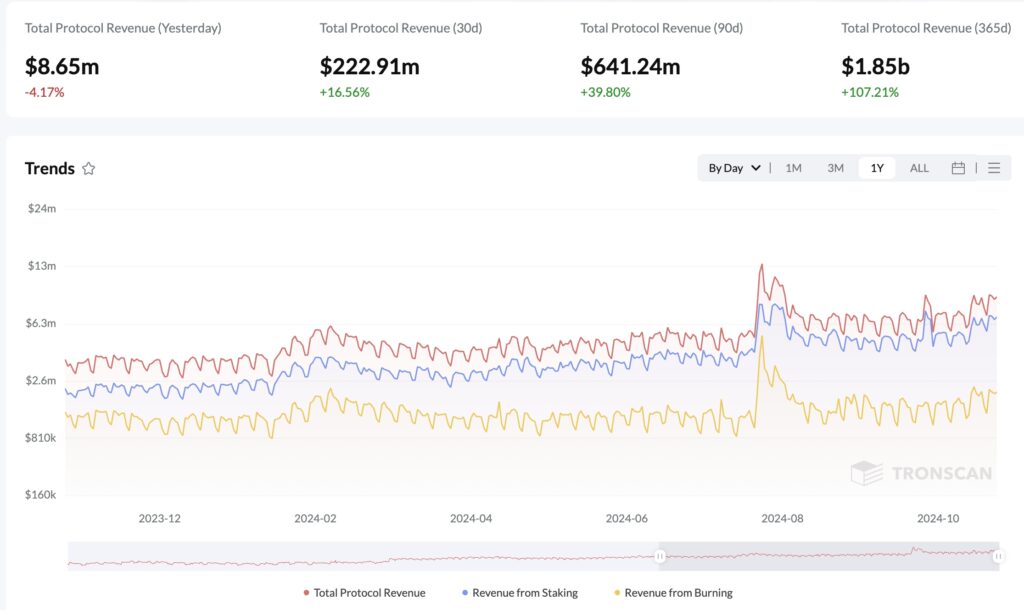

More data shows that Tron is one of the most profitable network in the crypto industry. Its total protocol revenue in the last 30 days jumped by 16% to over $222.9 million. It has made over $1.8 billion in the last 12 months.

Tron revenue | Source: Tronscan

Tron is also a big player in the stablecoin industry. The total volume of USDT traded in Tron on Thursday jumped by 23% to over $196 billion. This is notable since Tether has become the most popular stablecoin in the payment industry.

Tron price analysis

TRX chart by TradingView

The weekly chart shows that the TRX token has done well in the past few months. It has jumped above the key resistance at $0.1845, its highest swing in April 2021. The coin has moved above the 50-week and 25-week Exponential Moving Averages (EMA).

The MACD and the Relative Strength Index (RSI) have continued soaring in the past few months. That is a sign that the coin has a bullish momentum. Tron has also formed a cup and handle pattern, a popular continuation sign.

Tron token has also moved to the ultimate resistance of the Murrey Math Lines. It has jumped above the Ichimoku cloud indicator.

Therefore, the TRX token will likely continue rising, with the next point to watch being the extreme overshoot level at $0.24, which is about 23% above the current level. The stop-loss of this trade is at $0.1845, its highest swing in April.

The post Tron price analysis as revenues jump, TRX supply crashes appeared first on Invezz

invezz.com

invezz.com