Toncoin (TON) appears to be moving sideways for now, but behind the scenes, its technical indicators quietly set the stage for a potential price pump. Let’s dive into the details to see why this might be an excellent opportunity for traders and investors.

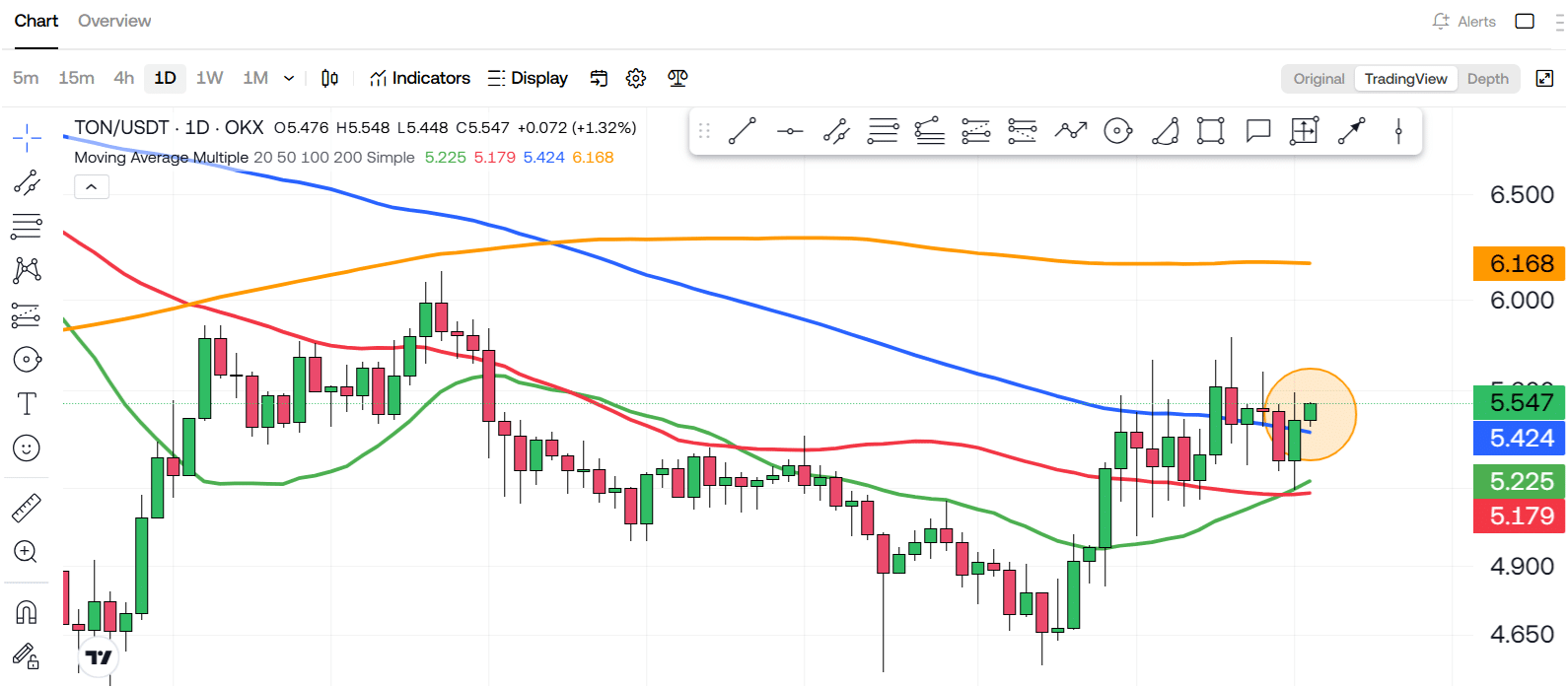

Trendline Breakout

When analyzing the trendlines, it becomes clear that Toncoin has broken out of its previous downtrend pattern. After this breakout, the price retraced slightly, settling near the top of the former trendline. This is often a bullish signal, indicating that the previous resistance level has now flipped into support. Currently, Toncoin is consolidating and forming a robust support zone. Consolidation at this level suggests that the coin is building a strong base, preparing for its next move upward.

Moving Averages

Next, let’s look at the moving averages. Toncoin is trading right at the 100-day moving average (100MA), a significant support level that often serves as a foundation for upward price movements. When an asset respects the 100MA during a consolidation phase, buyers step in, preventing the price from falling further. This setup strengthens the likelihood of a bullish breakout.

RSI Analysis

The Relative Strength Index (RSI) further supports this optimistic outlook. Toncoin’s RSI is currently above the median line (50), indicating healthy momentum. When the RSI holds above this level, it often suggests that the market is slowly shifting from bearish to bullish sentiment. This shift is critical, as it demonstrates increasing buying pressure, paving the way for higher prices.

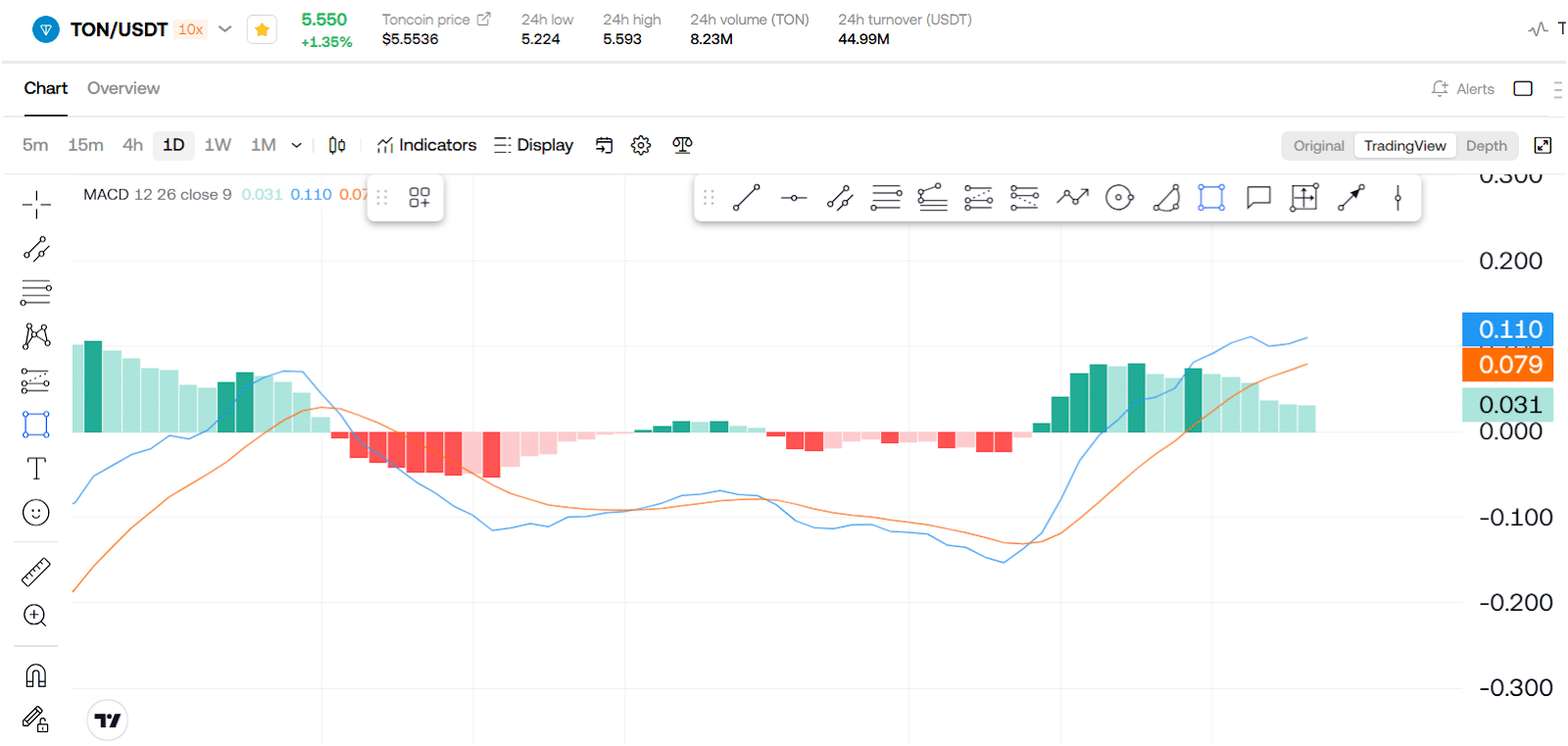

MACD Momentum

Another key indicator pointing to a potential uptrend is the Moving Average Convergence Divergence (MACD). Toncoin’s MACD is currently in positive territory, signaling the market is experiencing upward momentum. The green bars on the histogram are steadily forming, reflecting consistent buying activity. Additionally, the MACD line is hovering above the signal line, a classic sign that the asset is transitioning from a downtrend to an uptrend.

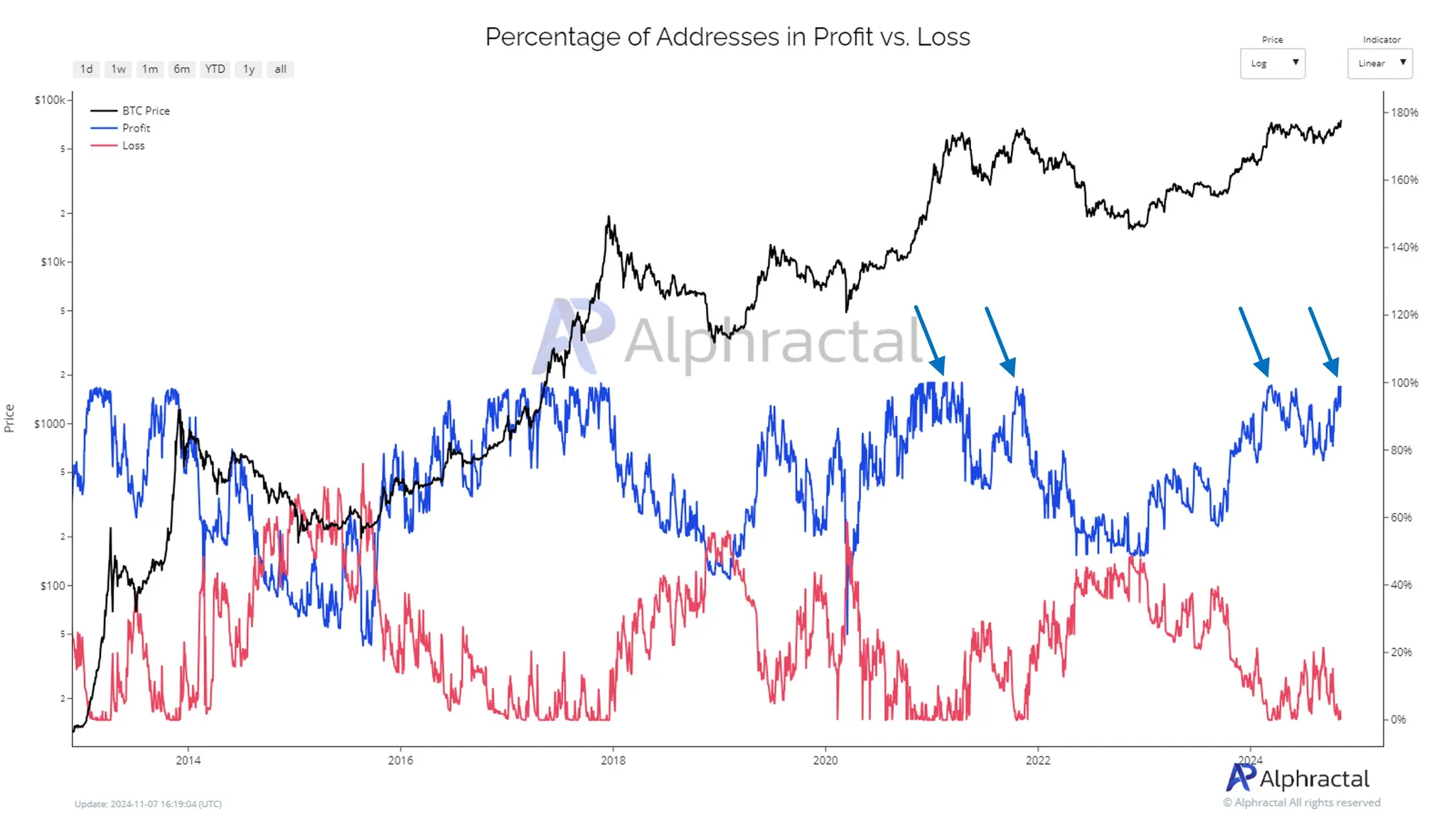

The Big Picture

While Toncoin’s sideways movement might seem unremarkable to some, it’s essential to view this period of consolidation as a strategic buying opportunity. When the market moves sideways, it often reflects a phase of accumulation where smart money enters before the next significant price movement. Buying during these quiet phases allows you to capitalize on lower prices before the market catches on.

Think of it this way: Toncoin is currently trading at a discount. Investing now while consolidating and building momentum could position you for significant gains once the next rally begins. The technical indicators all point in the same direction—upward. However, if you overlook these subtle signals, you might miss a substantial opportunity when the price starts to pump.

Final Thoughts

For more in-depth technical analysis like this one, make sure to subscribe and hit the notification bell on UseTheBitcoin’s YouTube channel. We post daily videos covering the crypto markets, so don’t miss out!

usethebitcoin.com

usethebitcoin.com