Solana (SOL) has attracted the eyes of the crypto market with expectations that it may rise to $780.

Analysts and market participants are trying to figure out whether Solana’s impressive gains, network activity in the recent period, and other key market developments can continue to propel the token higher to achieve this goal.

Solana Network Growth and Market Activity Fuel Optimism

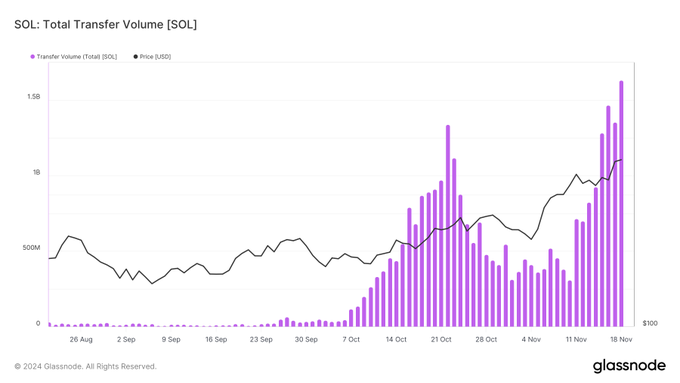

Solana has recorded significant achievements based on data from blockchain analytics firm Glassnode on network activity.

Daily trading volume soared to $318 Billion and the number of addresses involved in transactions stood at more than 22 million.

This growth shows increased awareness of the blockchain, especially due to the high speed of transactions and low costs.

Nevertheless, there are questions regarding the feasibility of this type of activity. Glassnode also pointed to shrinking average and median transaction sizes.

This would mean that some of the network activity may be coming from bots, not new users. Financial analysts are now observing if this increased usage will endure as a trend or will die out.

SOL Key Resistance Levels and Historical Price Patterns

Solana’s price soared to $248.52 and almost reached its previous record of $259, which was set in November 2021. Crypto analyst Miles Deutscher recently pointed out that Solana is mirroring the pattern it had in 2021.

At the time, Solana saw a sharp rise in its price, which led to speculation that it could do the same and hit $780.

Analysts pointed out that a SOL price close above the $250 level is critical for the currency pair to continue its upward trajectory.

Crypto trader Bonybean stated, “If Solana can break through $250, it may go even higher, possibly even to $291 in the short term.”

More hope can be drawn from the general cycle of the cryptocurrency market. Some individuals expect this “altseason” in 2025, when most altcoins rise in value in a big way, to be favorable for Solana.

Institutional Interest and ETF Speculation

The adoption of Solana has been on the rise as more institutions begin to include the asset in their portfolios. Moreover, the filing of the Solana spot ETF by VanEck has boosted the markets further.

Notably, this comes amid rumors surrounding the approval of such products following the potential departure of Gary Gensler as SEC Chair.

Open interest in Solana futures contracts surged by 96% this month, reaching $5.64 Billion, according to Coinglass data.

This increase indicates growing confidence among traders, as well as heightened capital inflows into the derivatives market.

Market participants view this trend as a positive signal for Solana’s price growth.

Market Catalysts and SOL Price Predictions

The surge in the price of Solana has also been boosted by other market factors such as the bullish run of memecoins and the increasing institutional investors’ interest.

The recent listings of Solana-based tokens on Binance and Robinhood have increased the asset’s exposure.

Also, the adoption of Solana in the recently launched Coinbase’s COIN50 index will boost adoption among institutional investors.

Price predictions for Solana remain divided. While some experts, such as Deutscher, maintain that Solana’s historical patterns could support a long-term target of $780, others suggest more cautious targets.

Analysts widely agree that breaking the $250 resistance is a critical step toward higher price levels, with near-term projections ranging between $350 and $500.

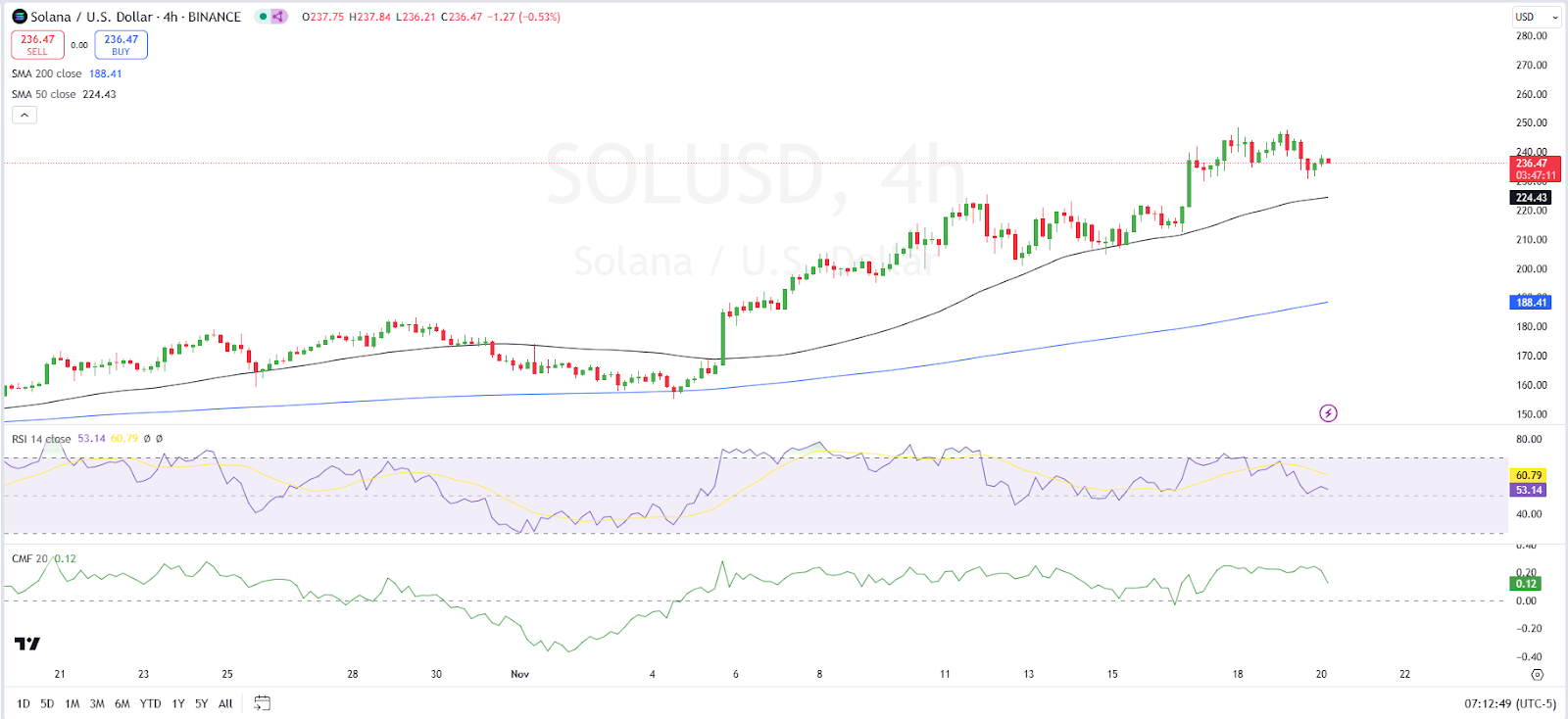

Adding to the bullish sentiment, the 50-day MA is moving above the 200-day MA suggesting that the bulls are still in control.

This move suggests that SOL price may head towards the $260 resistance level. However, with the RSI moving below its signal line, the bullish momentum may be dwindling.

In addition, the Chaikin Money Flow (CMF) trending southwards on the 4-hour price chart suggests that money is exiting the market as traders take profit. Should the CMF fall into the negative region, a bearish trend may be expected.

thecoinrepublic.com

thecoinrepublic.com