JasmyCoin ($JASMY) has officially listed on Upbit, South Korea’s largest cryptocurrency exchange, significantly increasing its market visibility.

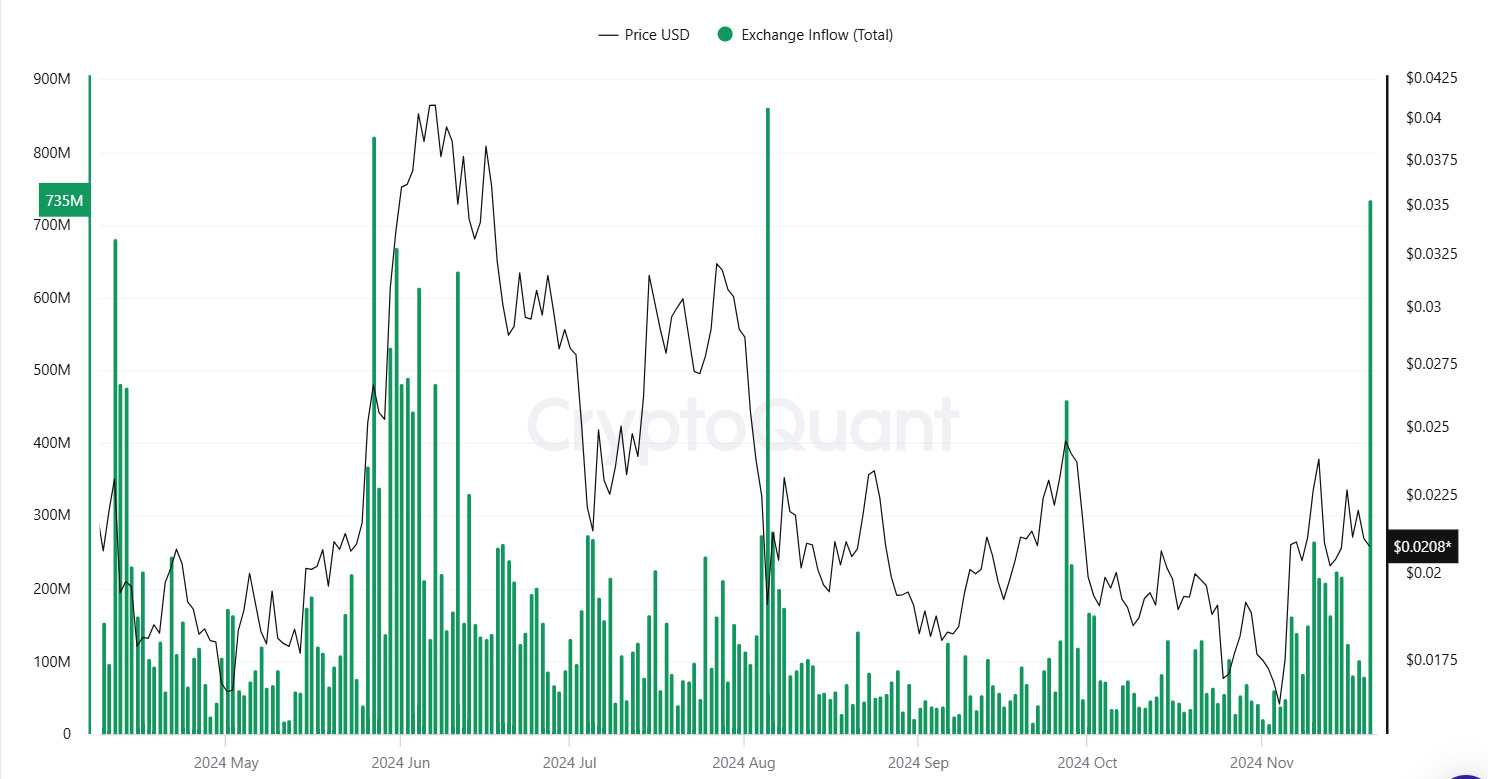

With exchange inflows for $JASMY reaching 735 Million, market participants are positioning for a potential price shift, making it a crucial moment for the token.

JasmyCoin Gains Traction With Upbit Listing

Recently, JasmyCoin ($JASMY) gained market attention when it got listed on Upbit, South Korea’s largest cryptocurrency exchange.

Listing has significantly amplified $JASMY’s visibility and prepared the token for growth in a market of high crypto adoption.

This resulted in new all-time highs in both; institutional interest volumes spiked 173.99% up to $226.94 Million.

With a jump in open interest of 4.38%, open interest increased to $42.96 Million, indicating trust in the token’s ability to move upwards in price.

The Upbit listing will expand the audiences of $JASMY. It will also expand the scope of the most active cryptocurrency market in the world.

Upbit is popular across South Korea, Singapore, and Indonesia. It’s known for its high liquidity and easy-to-use interface.

The range of the exchange with a good reputation makes it a good place to expand $JASMY in terms of trading volumes and market recognition.

The listing aligns with JasmyCoin’s mission to empower those with the rights to data and security in the Internet of Things (IoT) space.

JasmyCoin enables individuals to control their data while giving businesses a secure way to employ this data.

Consequently, JasmyCoin satisfies the increased demand for safe, privacy-oriented data management solutions.

This listing should spur further adoption of $JASMY’s platform as it establishes itself as a solid foothold in key markets that value blockchain ingenuity.

Discover What the $JASMY Charts Say

As of writing this, $JASMY sits at $0.02079, down 4.02% in the last 24 hours. The immediate support is at $0.02050, and the price is consolidating near the support zone at $0.02162.

Resistance lies at $0.02403, and the next big resistance is at $0.03000. If the support zone is broken, the price could fall to the subsequent key support level, which is $0.01600.

Price consolidation is near the lower band, which is signaled by the Bollinger Bands. This suggests reduced volatility and accumulation around the support zone.

If the middle band at $0.02162 is broken out on the upside, this could indicate willpower. If it is broken below the lower band at $0.02072, this could confirm bear pressure.

Market volatility is relatively low, as the ATR value is 0.00105. This indicates that $JASMY is forming within a consolidation phase and that there will be a sharp directional move if it breaks out or breaks down substantially.

However, the ATR increase should be watched to gauge the strength of any breakout. Bearish momentum is seen by the fact that both the MACD line (-0.00002) and signal line (-0.00011) are below the zero line.

The MACD and signal line are narrowing that gap, posing a potential bullish crossover on a histogram. A confirmed crossover means there’s a chance that an uptrend will begin.

Massive Exchange Inflows for JasmyCoin ($JASMY) Signal Key Market Movement Ahead

Exchange inflows to $JASMY have been on a significant uphill, from 735 Million today. The inflow surge is possibly from traders and investors getting set to make moves in the upcoming markets.

Large inflows to exchanges have been associated with elevated selling pressure or pre-trading.

Consolidation is apparent after earlier volatility, with sharp price fluctuations through the last few months.

Although the inflows are large, increases that are sustained but without the accompanying outflows would suggest that sales are outpacing buying pressure on the price.

The newly corrected inflow volume emerging now, together with recent price consolidation, is a precipitous moment for $JASMY.

Investors should see whether further inflows or price trend changes indicate that the asset will break out or tank further.

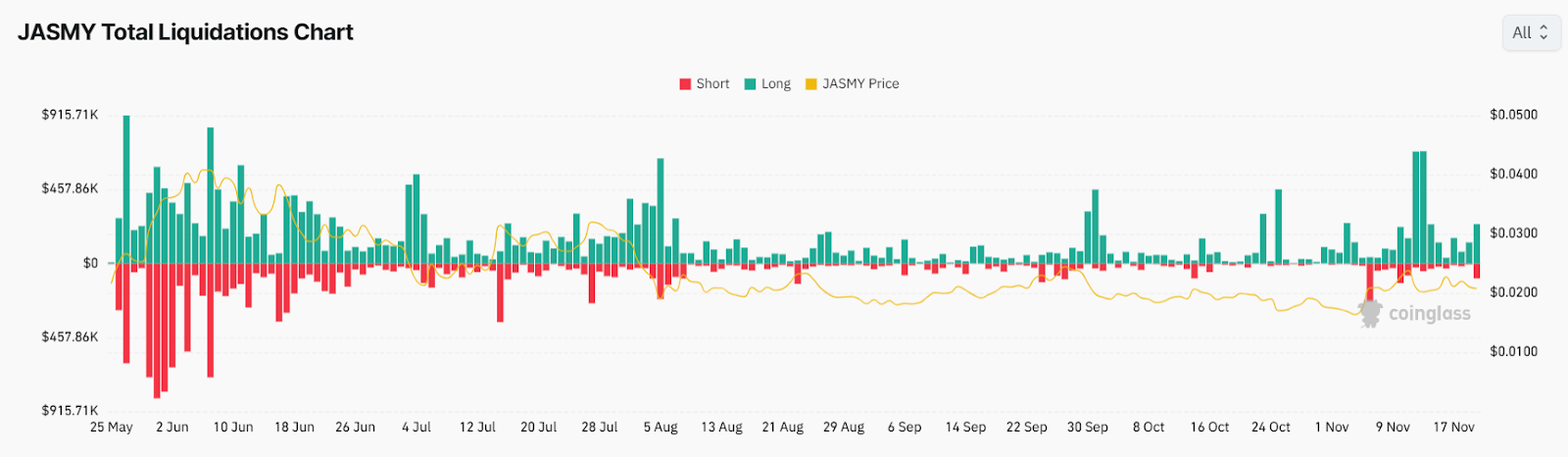

JasmyCoin ($JASMY) Sees Major Liquidation Spikes, Correlating with Price Swings

The liquidations data also show that both long and short positions demonstrate noticeable liquidations.

However, there were large liquidations around late June and early July, followed by relative stability before another spike of liquidations occurred around early November.

JasmyCoin ($JASMY) price volatility, however, is closely associated with this price movement. The price reaches higher levels on these liquidation spikes, which hints at relation to major market responses or traders’ positions.

The chart also indicates that short positions were more frequently closed at the top of major swings. This can be seen near the upward movement near the end of May and the beginning of November.

The liquidation activity was less due to speculative pressure on the market, and JasmyCoin consolidated around the $0.020 range.

thecoinrepublic.com

thecoinrepublic.com