Litecoin network activity indicates that the network has an all-time high hash rate. 84 million transactions have been processed in 2024. This move sure puts Litecoin price in a good space.

Find out how $LTC is reaching these milestones and finding its future.

The number of $LTC holders making profit surged past 60%, its highest level in recent months, making over 60% of the Litecoin holder’s profit.

Over 60% of $LTC holders are now in profit—the highest since April.

— IntoTheBlock (@intotheblock) November 18, 2024

Many of the holders still at a loss bought in 2021 and may sell as they break even. Could this create resistance, or will Litecoin push past and set new highs this cycle? pic.twitter.com/EY4iKrKss8

As prices recover and give some relief to many investors, this shift shows real optimism and strength in the market. This increased profitability shows a positive trend in Litecoin.

Nevertheless, the situation holds the potential for a challenge. On the flip side, most of 2021’s $LTC holders are still at a loss.

Secondly, as the price gets closer to its break-even point, these investors could be tempted to sell, boosting Litecoin’s momentum.

So the key question is whether Litecoin can clear this potential seller’s line and create new cycle highs.

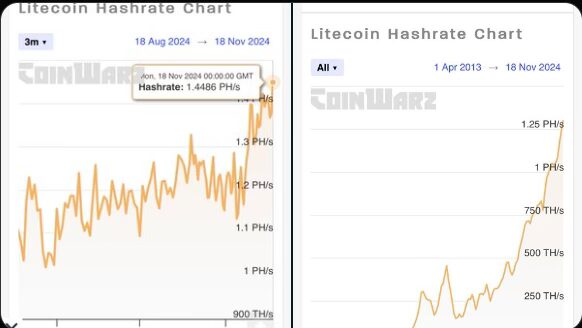

Steady Hash Rate Growth

Notably, Litecoin marked a new all-time high (ATH) in its hash rate — 1.4486 PetaHashes per second (PH/s) as of November 18, 2024.

Over recent months, steady growth has been recorded in mining activity along with a large increase in network security. The comparison chart above shows the long-term growth trajectory, that is, how the hash rate has skyrocketed over the years.

The compelling fact behind this announcement is that having a higher hash rate makes the Litecoin network less prone to attacks.

Growth of the miner confidence and the adoption of the Litecoin blockchain saw this milestone emerge. This is a good thing for $LTC.

Litecoin Hits Record 84 Million Transactions in 2024

In 2024, the Litecoin network did itself proud by hitting an impressive record high: the network moved a total of 84 million transactions in one year, which is the most ever. That’s a 17 million transaction increase over 2023, which indicates increased network activity and adoption.

NEW RECORD: The #Litecoin network has broken a new milestone, completing 84 million transactions in 2024! The most ever in a year & already 17 million more than in 2023. $LTC is more active than ever! #MondayMotivation pic.twitter.com/KvbS0aNPYW

— Litecoin Foundation ⚡️ (@LTCFoundation) November 18, 2024

The record-breaking amounts confirm that Litecoin is becoming a more important force in the cryptocurrency world. More users are turning to it for fast, cheap, and safe transactions, from small payments to larger-scale transfers.

This milestone demonstrates Litecoin as a scaling and efficient blockchain network that meets its large user base needs.

An average of about 230,000 transactions in a day so far in 2024 is a good sign of consistency and a busy life for its users. Increased transaction volume highlights rising interest in the platform. It also indicates increase in the network’s ability to pass higher throughput without hampering its performance.

Litecoin Price Technical Analysis

Litecoin price chart shows strong bullish trading within a rising channel with higher highs and higher lows. The day brings a 2.52% gain to the current price of $89.34. $87 is the support level, while $96 is functioning as the resistance.

If the price respects the channel boundaries, it forms a pattern that implies upward momentum. It also means that we are still in an upward trend with the volume levels remaining stable, supporting the trend. However, a breakout above $100 would suggest fast bullish momentum.

ADX at 29.50 indicates a moderately strong price trend direction. Though the current rally is based on market strength, it could begin to weaken on an ADX dip below 25.

The stochastic oscillator readings of 32.63 and 30.68 for Litecoin show that the crypto is coming up to oversold territory. On the other hand, if the lower boundary of the channel holds, the recent price consolidation may be preparing for a rebound.

thecoinrepublic.com

thecoinrepublic.com